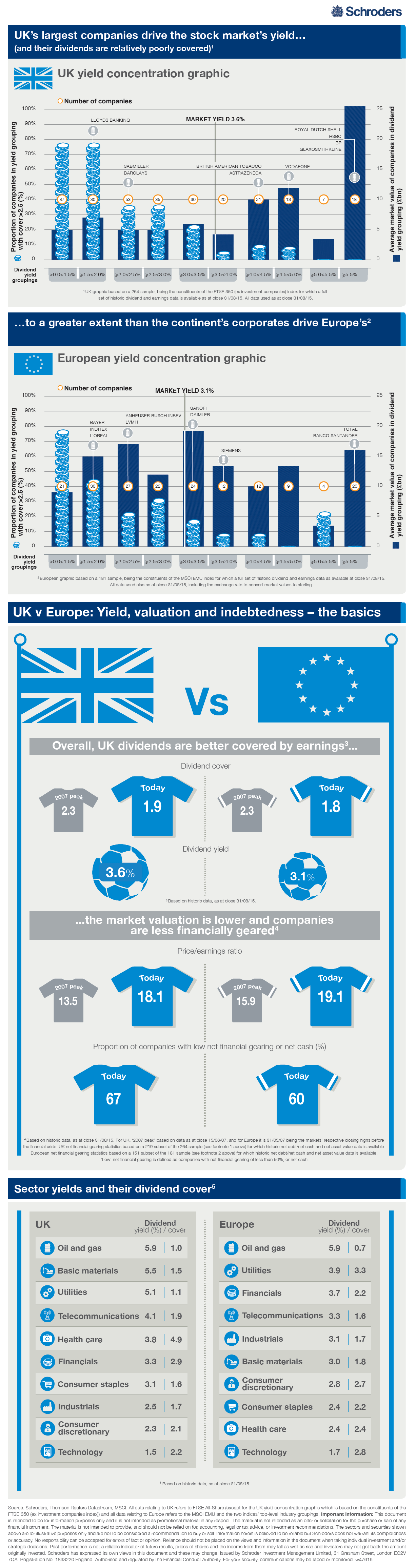

Dividends paid out by companies in the UK and Europe is concentrated among a few firms. In fact, only five large names generated 45% of all UK dividends in 2014 according to a report by Schroders. These companies were Royal Dutch Shell(RDS-A, RDS-B), HSBC(HBC), BP(BP), GlaxoSmithKline(GSK) and Vodafone(VOD).

A few of the European large companies drive the European dividends paid out to shareholders. The overall yield is lower than British yields but still the concentration is high.

The following infographic compares the dividend yields, concentration and sector yields of British and European firms:

Click to enlarge

Note: All data shown above are based on August end, 2015

Source: Europe v UK: How safe is your yield?, Schroders

Disclosure: No Positions