Germany-based Continental AG (CTTAY) is one of the world’s largest tire and auto-parts makers. Due to the strong growth of the global auto industry the ADR is up over 80% year-to-date and closed at $210.93 today.

Germany-based Continental AG (CTTAY) is one of the world’s largest tire and auto-parts makers. Due to the strong growth of the global auto industry the ADR is up over 80% year-to-date and closed at $210.93 today.

Continental announced a stock split in the ratio 5:1 recently. The ADR Record Date is Dec 20, 2013 and the ADR Payable Date is is Dec 23, 2013. Currently 1 ADR represent 1 ordinary share. As a result of this stock split, the ratio will change to 5 ADRs representing 1 ordinary share. ADR holders will receive 4 additional shares for each ADR held.

From a recent Bloomberg article:

Continental, based in Hannover, Germany, has a price-earnings ratio of 12, even after it rallied 72 percent this year, more than five times the Stoxx 600. Europe’s second-largest auto-parts maker has beaten analyst earnings estimates the last four quarters and raised its profit forecast for 2013 on growth in China and North America.

Tricky Market

The manufacturer has sidestepped the effects of the region’s car-market contraction by adding sales to customers including Volkswagen AG and Bayerische Motoren Werke AG in growing markets such as China and the U.S. Continental gets 27 percent of its revenue from Europe outside Germany, 16 percent from North America and 14 percent from Asia, data compiled by Bloomberg show.

“They have a good balance of exposure, so in essence you’re not betting on any one company or area,”James Moffett, who oversees $10 billion in international assets at Scout Investments in Kansas City, Missouri, said in a Dec. 4 phone interview. “It’s both the earnings and the market pricing, which helps with the question of how do you try to play with what can be a tricky market next year.”

Source: Bargains Beckon Funds to Europe With S&P 500 Past Prime, Bloomberg

Some facts from the company’s website:

Today, Continental ranks among the top 5 automotive suppliers worldwide.

As a supplier of brake systems, systems and components for powertrains and chassis, instrumentation, infotainment solutions, vehicle electronics, tires and technical elastomers, Continental contributes to enhanced driving safety and global climate protection. Continental is also a competent partner in networked automobile communication.

With around 170,000 employees (Status: December 31, 2012) in 46 countries, the Continental Corporation is divided into the Automotive Group and the Rubber Group, and consists of five divisions:

- Chassis & Safety embraces the company’s core competence in networked driving safety, brakes, driver assistance, passive safety and chassis components.

- Powertrain represents innovative and efficient system solutions for vehicle powertrains.

- Interior combines all activities relating to the presentation and management of information in the vehicle.

- Tires offers the right tires for every application – from passenger cars through trucks, buses and construction site vehicles to special vehicles, bicycles and motorcycles. Continental tires stand for excellent transmission of forces, exceptionally reliable tracking in all weather conditions and high cost effectiveness.

- ContiTech develops and produces functional parts, components, and systems for the automotive industry and for other key industries.

More information can be found on their Investor Relations site.

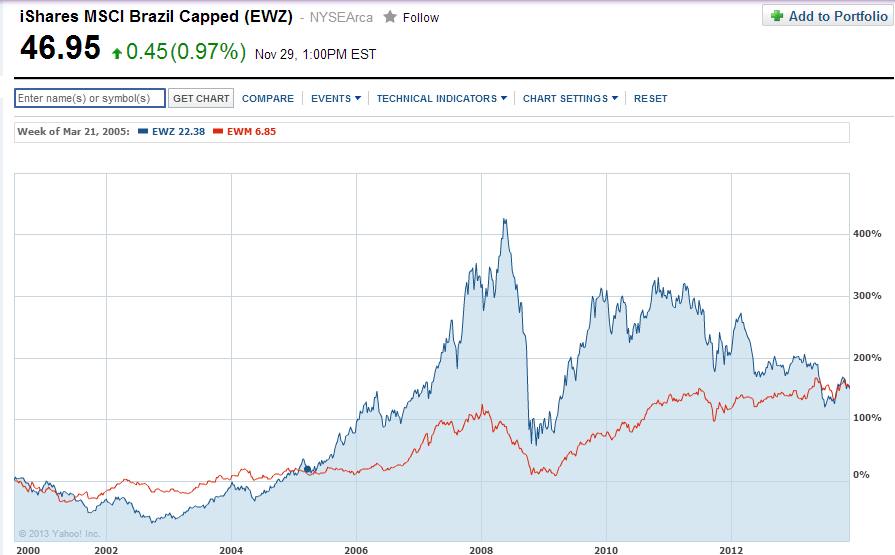

In 5 years CTTAY is up about 264%.

Disclosure: No Positions