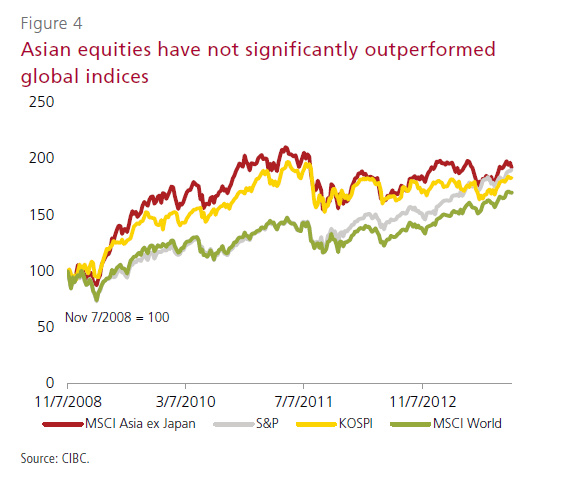

Asian stocks have not significantly outperformed other major global indices during the past three to four years. The MSCI Asia ex-Japan index has mostly went sideways during the period.

Click to enlarge

According to a report by CIBC World Markets, Asian equities are well positioned to post solid returns in 2014. Some of the reasons CIBC offers in support of this prediction are:

- Asian markets have generally positive fundamentals.

- The asset markets in Asia have not been excessively inflated by global easing.

- The Fed tapering may not affect these markets.

- Inter-regional trade is growing strongly in Asia with countries in the region trading more with one another than with developed countries. This has helped reduce the adverse effect of soft demand from the developed world. For example, China is the largest trade partner of both South Korea and Taiwan.

- Asia’s current account surplus has stabilized this year as shown in the chart below:

Click to enlarge

Some of the other factors noted by CIBC in favor of Asian economies include:

Solid economic fundamentals in the fashion of moderate growth, (mostly) low inflation, currencies that are by and large on the cheap side of fair value, and policymakers willing and ready to respond to.

Source: A Look to the Future – 2014 Edition, CIBC World Markets

In general, consumption of goods and services in many Asian countries is increasing faster as wages rise. For example, wages in China have increased so much in the past few years that some manufacturers are shifting their operations to cheaper countries such as Vietnam or Cambodia. Other than the developed Asian countries, poor infrastructure is a major impediment to growth in emerging Asian countries. So growing investments in infrastructure development should help drive economic growth in addition to rising private consumption.

Ten stocks from ten Asian economies trading on the US markets are listed below for consideration:

1.Company: China National Offshore Oil-CNOOC (CEO)

Current Dividend Yield: 3.60%

Sector:Oil & Gas Producers

Country: China

2.Company: Chunghwa Telecom (CHT)

Current Dividend Yield: 4.93%

Sector: Telecom

Country: Taiwan

3.Company: HDFC Bank (HDB)

Current Dividend Yield: 0.75%

Sector: Banking

Country: India

4.Company: Posco (PKX)

Current Dividend Yield: 1.89%

Sector: Metals & Mining

Country: South Korea

5.Company: Telekomunikasi Indonesia (TLK)

Current Dividend Yield: 3.47%

Sector: Telecom

Country: Indonesia

6.Company: Philippine Long Distance Telephone (PHI)

Current Dividend Yield: 4.81%

Sector: Telecom

Country: Philippines

7.Company:United Overseas Bank(UOVEY)

Current Dividend Yield: 3.31%

Sector: Banking

Country: Singapore

8.Company: Malayan Banking Berhad(MLYBY)

Current Dividend Yield: 5.78%

Sector: Banking

Country: Malaysia

9.Company:PTT Exploration & Production (PEXNY)

Current Dividend Yield: 3.81%

Sector: Oil & Gas Producers

Country: Thailand

10.Company:Hang Seng Bank (HSNGY)

Current Dividend Yield: 4.19%

Sector: Banking

Country: Hong Kong

Note: Dividend yields noted above are as of Dec 27, 2013. Data is known to be accurate from sources used.Please use your own due diligence before making any investment decisions.

Disclosure: No Positions