In this post lets take a quick look at the Ten Largest Indian Companies by Market Capitalization in the domestic market. Before we get to that here is a note on the Sensex.

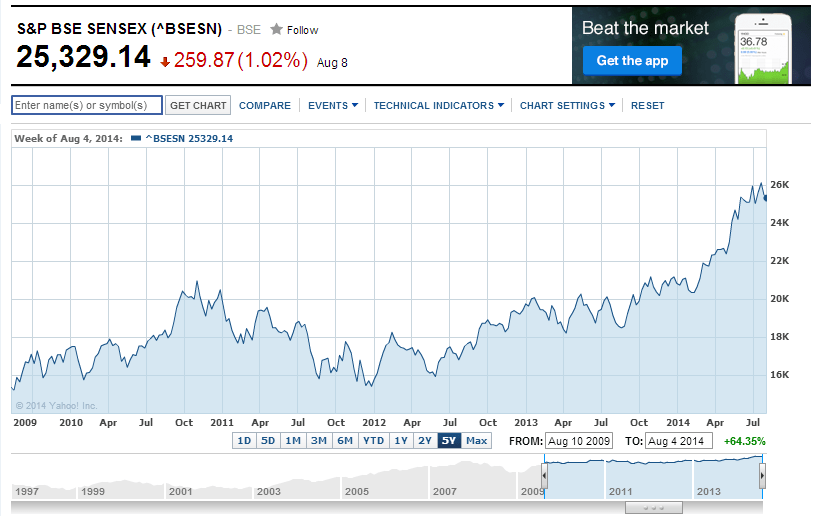

India’s benchmark S&P BSE Sensex index is up 21.25% year-to-date. After reaching an all-time record of over 26,300 the Sensex closed at 25,329 yesterday.

The five year chart of the Sensex is shown in the chart below:

Click to enlarge

Source: Yahoo Finance

With the euphoria over elections over it would be interesting to watch if the Sensex can recover from its recent fall and rise further.

The Ten Largest Indian Companies by Market Capitalization are listed below:

| S.No. | Company | Market Capitalization (in Millions of Indian Rupees) |

|---|---|---|

| 1 | TATA CONSULTANCY SERVICES LTD. | 4,849,810.50 |

| 2 | OIL AND NATURAL GAS CORPORATION LTD. | 3,372,146.40 |

| 3 | RELIANCE INDUSTRIES LTD. | 3,170,526.00 |

| 4 | ITC LTD. | 2,774,202.20 |

| 5 | COAL INDIA LTD. | 2,241,677.70 |

| 6 | INFOSYS LTD. | 1,998,542.80 |

| 7 | HDFC BANK LTD. | 1,919,843.10 |

| 8 | STATE BANK OF INDIA | 1,803,160.70 |

| 9 | ICICI BANK LTD. | 1,662,177.80 |

| 10 | HOUSING DEVELOPMENT FINANCE CORP.LTD. | 1,608,075.50 |

Source: Bombay Stock Exchange

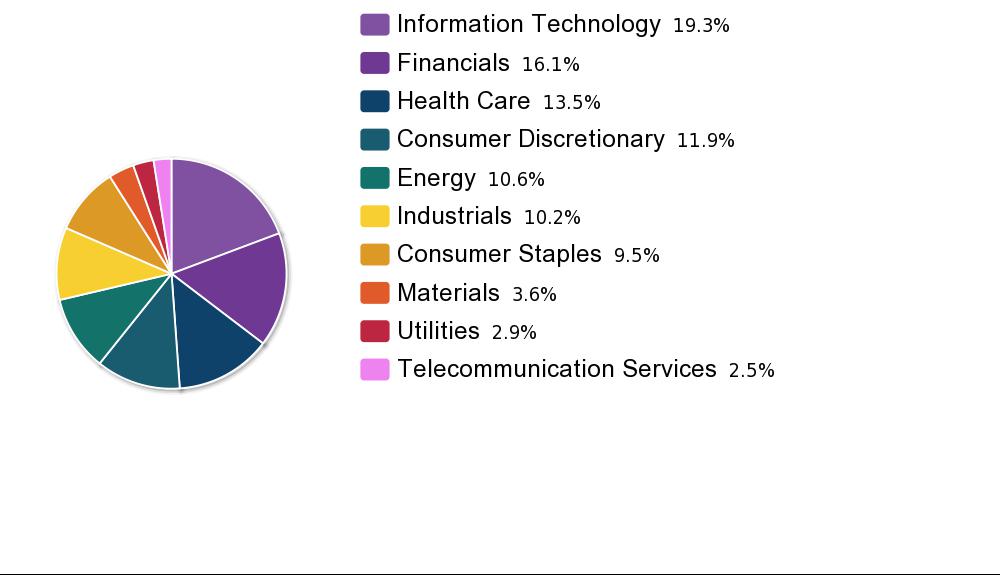

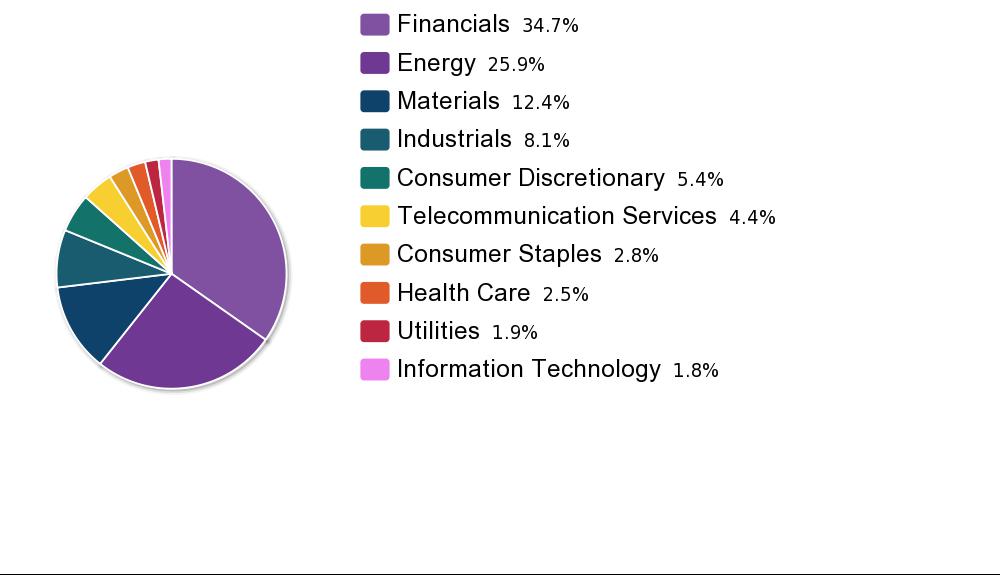

Tata Consultancy Services (TCS) became the most valuable Indian company on July 23rd reaching a market capitalization of about $84.0 and became the second largest IT company in the world after IBM. It is not surprising to see TCS rise to such astronomical levels since outsourcing of IT services continues as multinationals try to reduce expenses further. The second most valuable company is the state-owned petroleum company Oil and Natural Gas Corporation Ltd (ONGC). Infosys (INFY) another major IT services provider is also in the list underscoring the growth of offshoring and investors’ attraction towards this sector.

Two of the banks in the above ranking – HDFC Bank Ltd (HDB) and ICICI Bank Ltd (IBN) – trade on the New York Stock Exchange. HDFC Bank is an arm of the Housing Development Finance Corp Ltd. In addition to ONGC, State Bank of India and Coal India are two other state-owned companies that are considered most valuable.

ETFs: The Complete List of India ETFs and ETNs Trading on the US Markets

Disclosure: No Positions