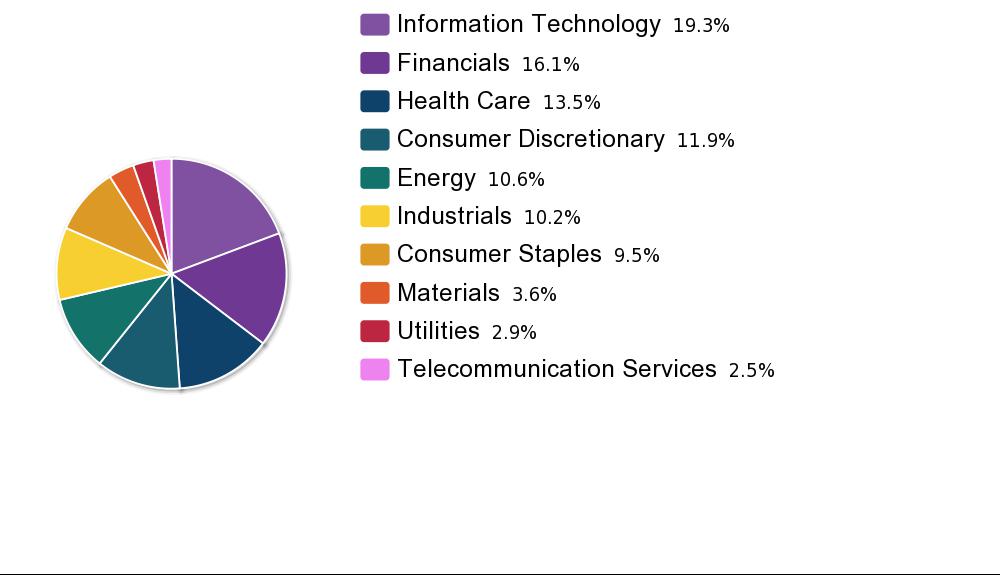

U.S. stocks, as measured by the S&P 500 index outperformed Canadian stocks last year. This was because the S&P 500 has a heavy concentration of IT stocks. This sector accounted for some 40% of the out-performance of the index last year against Canada’s benchmark S&P/TSX Composite index according to a research report by CIBC World Markets. As IT stocks, especially the social media stocks soared last year the S&P 500 boomed as well. The IT sector has a weighting of 19.3% as of today in the index.

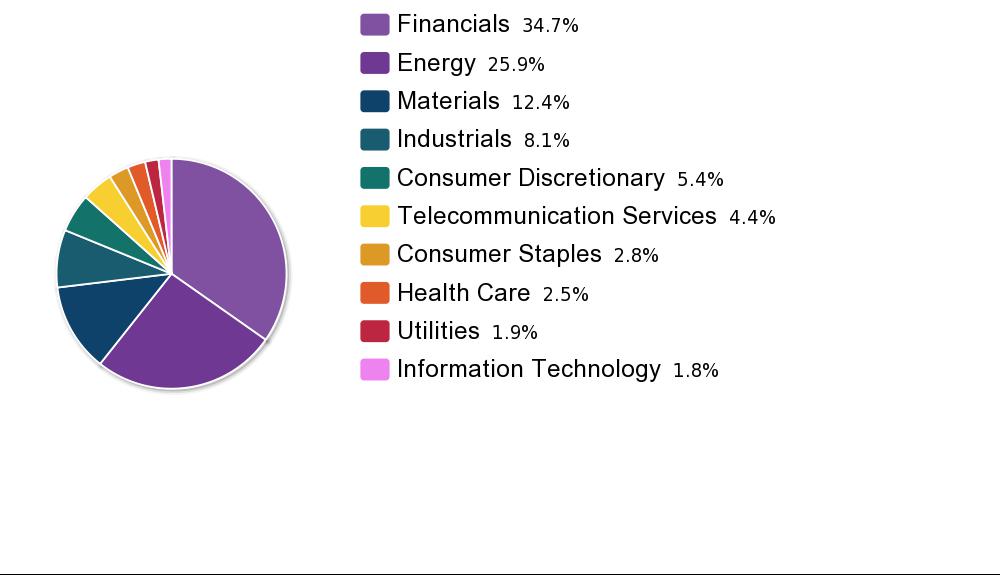

The S&P/TSX Composite index lagged the S&P 500 due to the low weightage of tech stocks in the index. The tech sector accounts for only 1.80% of the index now.Energy and materials are two of the largest sectors in the index after financials. As these two sectors perform well this year, the TSX Composite may outperform the S&P 500 whose tech sector is not having a great run this year.

The following chart shows the sector breakdown of the S&P 500 index:

Click to enlarge

The following chart shows the sector breakdown of the S&P/TSX Composite index:

Source: Standard & Poor’s

The Canadian economy is mainly a resource-based economy. Basically Canada digs up stuff from the ground like oil & natural gas, minerals and exports them to other countries in addition to other products like lumber, finished products like automobiles, etc. Hence the heavy concentration of these and financial sectors in the benchmark index.

Related ETF:

Disclosure: No Positions

Update:

As of August 6, 2014 the S&P/TSX Composite is up by 11.6%% year-to-date while the S&P 500 has increased by only 3.9% in price terms (excluding dividends).