As a emerging market superpower China is the largest consumer of many natural resource. China does not have huge crude oil resources and is a net importer of the black stuff.

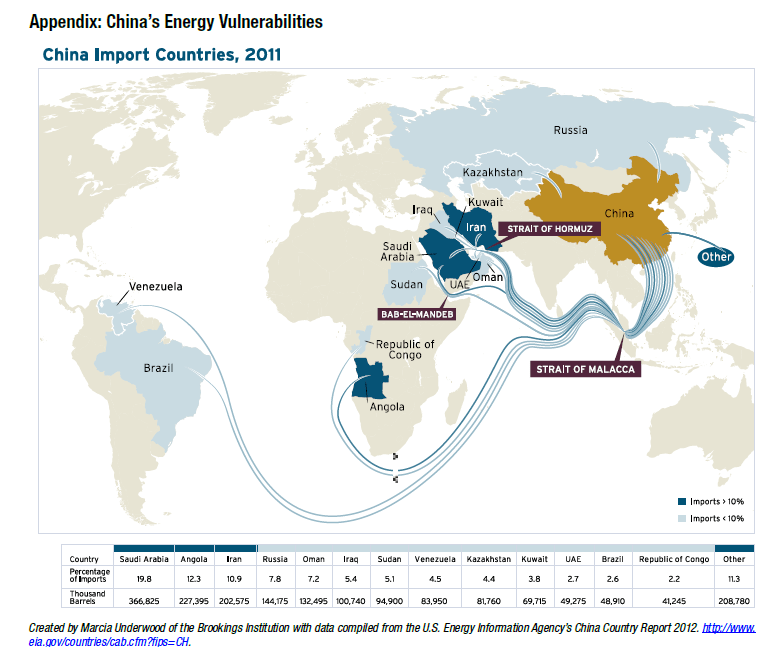

The following chart shows the list of countries which supply crude oil and natural gas to China:

Click to enlarge

Source: Fueling a New Order? The New Geopolitical and Security Consequences of Energy, April 15, 2014, The Brookings Institution

Saudi Arabia is the largest supplier of oil to China followed by Angola in Africa and Iran. Most of the crude oil and natural gas are shipped by sea to China.In the Western hemisphere Venezuela and Brazil are major source countries for China’s energy imports but not Canada.Since the U.S. and Canadian economies are highly integrated, Canada sends much of its crude oil to the U.S. via pipelines and rail making it the largest trading partner of the U.S. The U.S. does export oil to other countries due to a ban on exports.