Emerging markets have been laggards in the past few years compared to their developed world peers. Among the developed stocks, U.S. stocks especially had a superb run last year compared to European stocks. However this year, the tables seem to have turned with European stocks outperforming American stocks so far.

With the poor performance of emerging stocks recently some investors may be tempted to dump them altogether now and move their assets to developed stocks. This strategy is not a wise for many reasons. Before we get to those, lets take a quick look at the annual return of emerging market stocks as represented by the MSCI Emerging Markets Index:

| Year | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 |

|---|---|---|---|---|---|---|---|

| Return | -2.19% | -2.60% | 18.22% | -18.42% | 18.88% | 78.51% | -53.33% |

Source: MSCI

Since the Global Financial Crisis, emerging stocks returned double digit growth in 2009, 2010 and 2012. But more recently in 2013 and 2014, they performed poorly with negative returns of 2.60% and 2.19% respectively.

Despite losing money in the past two years, emerging stocks still have a place in equity portfolios. The following are a few reasons to hold emerging stocks now:

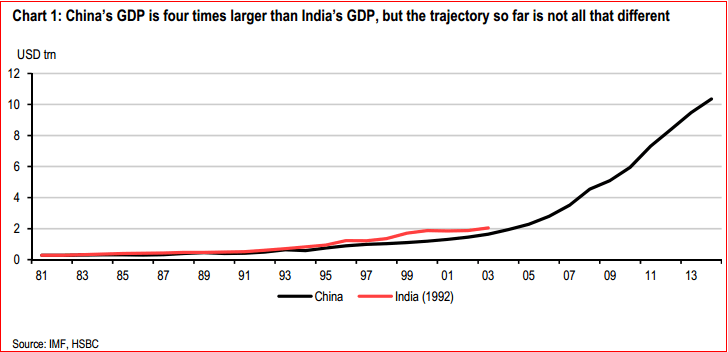

1. Some emerging markets have strong and growing economies and their equity markets would soar accordingly. For example, last year India was one of the top performing markets in the world while Brazil was not. So one way to profit from growing emerging economies is have to some investments in those countries.

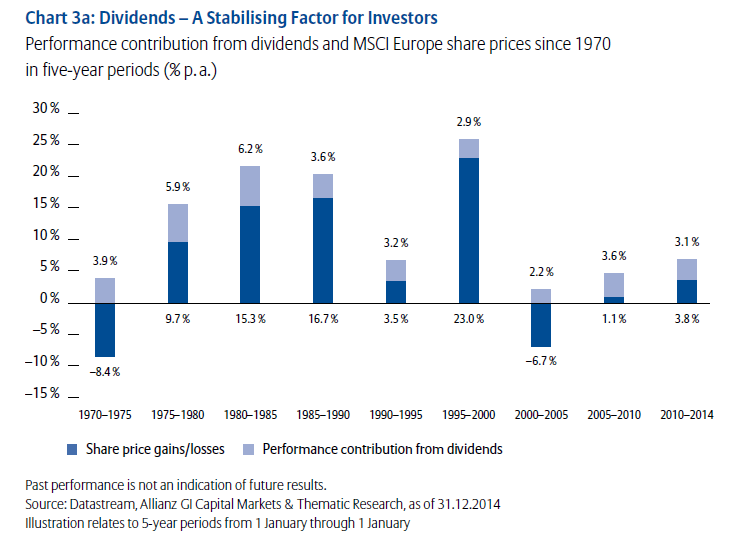

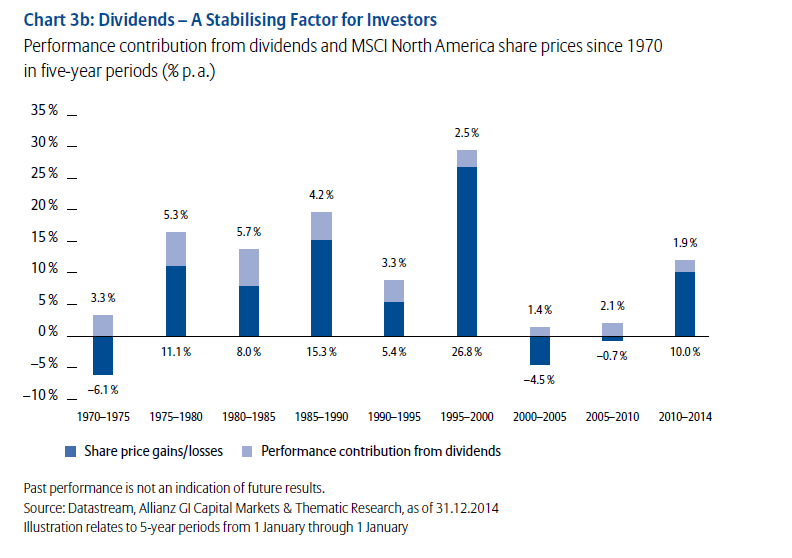

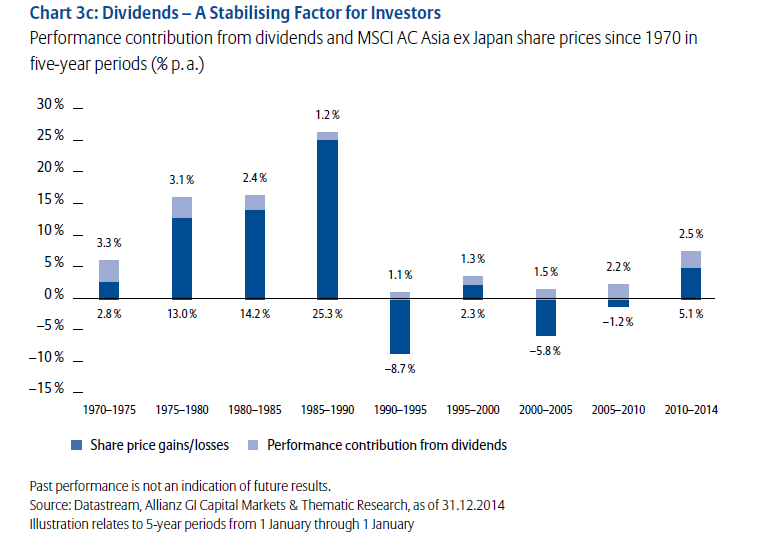

2. Emerging companies have decent dividend yields. More importantly, many are raising their payouts to shareholders as they try to attract domestic and international investors. Even in South Korea, where companies are not known for shareholder-friendly dividend policies recent tax policy changes may make them share more earnings with investors. In terms of emerging dividend yields, the MSCI Emerging Markets Index has a yield of 2.60% as of Feb, 2015. This is better than say the average yield on the S&P 500 which is about 2%. But this does not mean emerging stocks are better than stocks. It simply means that certain developing countries such as those included the MSCI index have firms that pay good dividends. The key is to do research and identify them.

3. One important reason to hold emerging stocks is the concept of diversification means owning laggards. From an article I wrote in December last year quoting Seth J. Masters,Chief Investment Officer of Bernstein Global Wealth Management:

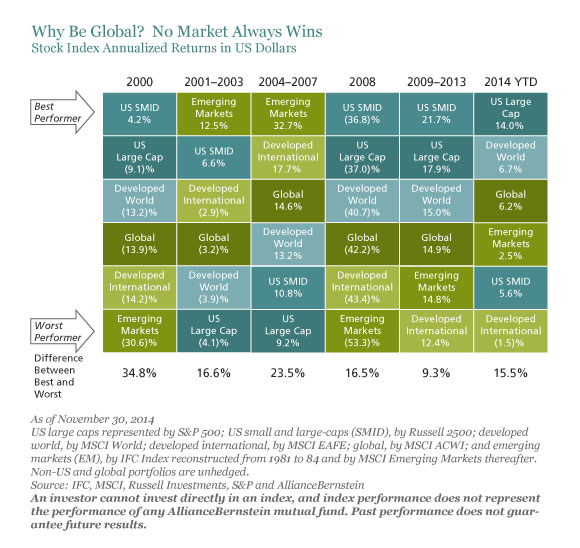

After leading globally in 2013, in 2014 through November the US stock market beat developed international stock markets by 15.5 percentage points in US dollar terms; it beat emerging markets by 11.5 percentage points, as shown in the first Display, below. This outperformance by US stocks has some investors ready to throw in the towel on global investing.

Click to enlarge

We think selling an asset after a stretch of lagging performance is a bad decision. Often, the lagging asset may be more attractive looking ahead. And that’s what we’re seeing in developed international stocks markets, where valuations are more attractive than in the US stock market.

Since 1990, non-US stock markets have outperformed the US market more than half the time. Since no one can be certain just when this will occur, we think it’s wise to own stocks in all regions.

Investors not already having exposure to emerging market equities can consider adding the following stocks in a phased manner:

1.Company:Taiwan Semiconductor Manufacturing Co Ltd (TSM)

Current Dividend Yield: 2.02%

Sector: Semiconductors & Semiconductor Equipment

Country:Taiwan

2.Company:Empresa Nacional de Electricidad SA (EOC)

Current Dividend Yield: 2.53%

Sector:Electric Utilities

Country:Chile

3.Company: HDFC Bank Ltd (HDB)

Current Dividend Yield: 0.56%

Sector: Banking

Country: India

4.Company:Banco Santander- Chile (BSAC)

Current Dividend Yield: 4.65%

Sector: Banking

Country: Chile

5.Company:Bancolombia (CIB)

Current Dividend Yield: 3.76%

Sector: Banking

Country: Colombia

6.Company: Standard Bank Group Limited (SGBLY)

Current Dividend Yield: 3.84%

Sector: Banking

Country: South Africa

7.Company: Embraer SA (ERJ)

Current Dividend Yield: 1.65%

Sector: Aerospace & Defense

Country: Brazil

8.Company: PetroChina Co Ltd (PTR)

Current Dividend Yield: 4.84%

Sector: Oil

Country: China

9.Company: Malayan Banking Berhad (MLYBY)

Current Dividend Yield: 6.64%

Sector: Banking

Country:Malaysia

10.Company:Philippine Long Distance Telephone Co (PHI)

Current Dividend Yield: 5.59%

Sector: Telecom

Country: Philippines

Note: Dividend yields noted above are as of Feb 20, 2015. Data is known to be accurate from sources used.Please use your own due diligence before making any investment decisions.

Disclosure: Long BSAC

You may also want to check out:

Emerging Market Equities in 2015 – the ugly, the bad and the good, March 15, 2015, Fidelity UK