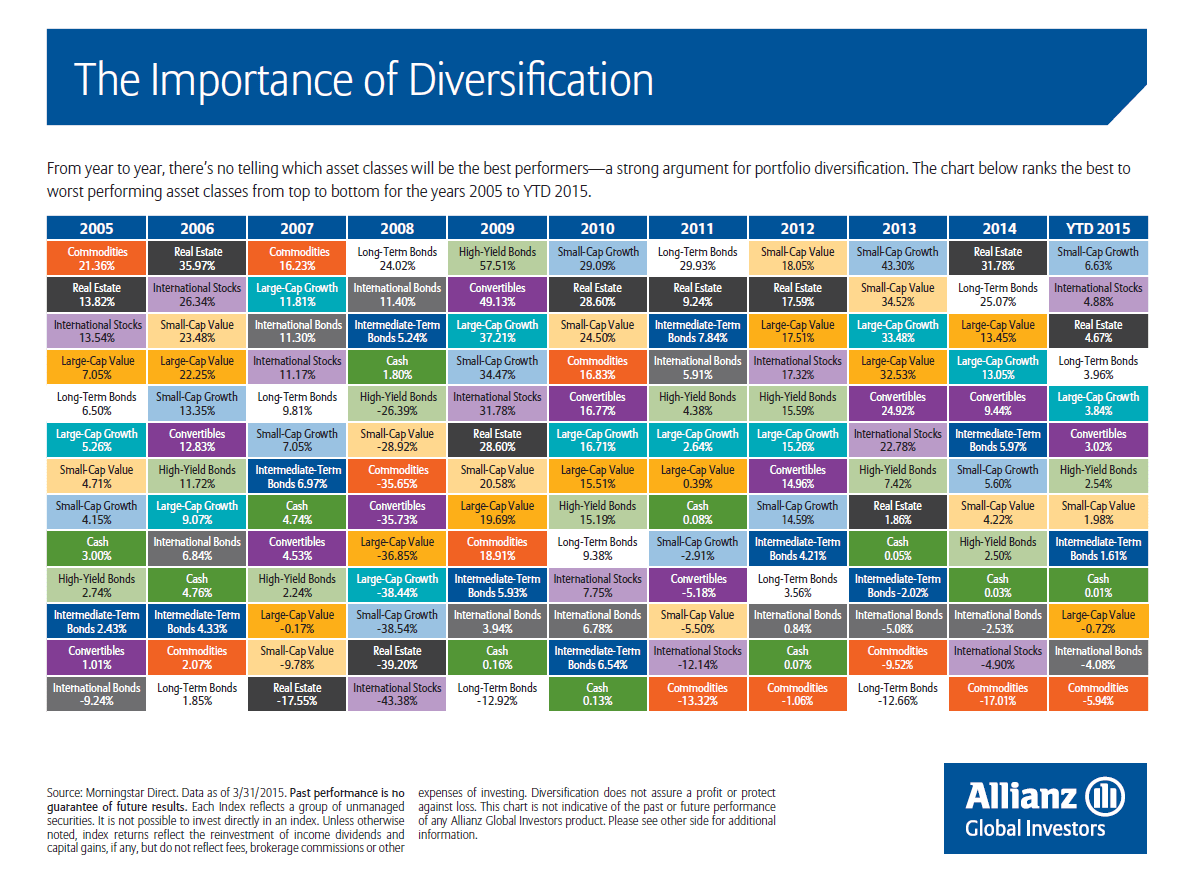

The following Periodic Table of Investment Returns shows why diversification in a portfolio is very important. Regardless of how big one’s portfolio is it is wise to spread the asset among various asset classes and not put everything in a single basket.

Click to enlarge

KEY:

◼ Cash represented by the Citigroup 3-Month T-Bill Index, an index of three-month Treasury bills.

◼ Commodities represented by the Bloomberg Commodity Total Return Index, which is composed of futures contracts on physical commodities.

◼ Convertibles represented by the BofA Merrill Lynch All Convertibles Index, which measures the performance of US dollar-denominated convertible securities not currently in bankruptcy

with a total market value greater than $50 million at issuance.

◼ High-Yield Bonds represented by the BofA Merrill Lynch US High Yield Master II Total Return Index, which tracks the performance of below investment grade (BBB), but not in default,

US dollar-denominated corporate bonds publicly issued in the domestic market.

◼ Intermediate-Term Bonds represented by the Barclays US Aggregate Index, which is composed of securities from the Barclays Government/Credit Bond Index,

Mortgage-Backed Securities Index and Asset-Backed Securities Index. It is representative of the domestic, investment-grade, fixed-rate, taxable bond market.

◼ International Bonds represented by the J.P. Morgan Global Aggregate Bond Index (ex-US), which is a US dollar denominated, investment-grade index spanning asset classes from developed to

emerging markets, excluding the US

◼ International Stocks represented by the MSCI EAFE Index. The MSCI Europe, Australasia, Far East Index (EAFE) is an index of over 900 companies,

and is a generally accepted benchmark for major overseas markets.

◼ Large-Cap Growth Stocks represented by the Russell 1000 Growth Index, which measures the performance of those Russell 1000 companies with higher price-to-book ratios and higher

forecasted growth values.

◼ Large-Cap Value Stocks represented by the Russell 1000 Value Index, which measures the performance of those Russell 1000 companies with lower price-to-book ratios and lower forecasted

growth values. ◽ Long-Term Bonds represented by the Barclays Long-Term Treasury Index, an index of US Treasury obligations with maturities greater than 10 years.

◼ Real Estate represented by the Wilshire REIT Index, which tracks publicly-traded Real Estate Investment Trusts in the US

◼ Small-Cap Growth Stocks represented by the Russell 2000 Growth Index, which measures the performance of those Russell 2000 companies with higher price-to-book ratios and higher

forecasted growth values.

◼ Small-Cap Value Stocks represented by the Russell 2000 Value Index, which measures the performance of those Russell 2000 companies with lower price-to-book ratios and lower

forecasted growth values.

Source: Allianz