The greek debt drama continues to drag on with no end seem to be sight. Now that the Greeks have voted “no” to creditors’ demands in the referendum yesterday, the country faces a difficult future ahead.

Today the OECD released a report titled “Government at a Glance 2015” comparing the performance of public sector across countries.The following are key points about Greece from this report:

Budget Balance: Greece ran a budget surplus of 0.4% of GDP in 2014. This is a welcome development

since many countries ran a budget deficit last year.However if interest payments on public debt

are included, Greece ran a budget deficit of 3.5% of GDP in 2014.

Public Spending: Public expenditures dropped significantly since 2009 in per capita and as a percentage of

GDP in 2014. Greece spent US$12,942 per capita in 2014 compared to $16,643 in 2009.As a share of

GDP, government spending decreased from 54.0% in 2009 to 49.3% in 2014. This is also a step

in the right direction.

Public Debt: Public debt reached 181% of GDP in 2014. This figure is much higher than the

OECD average of 109%. So despite years of austerity, Greece’s public debt remains too high.

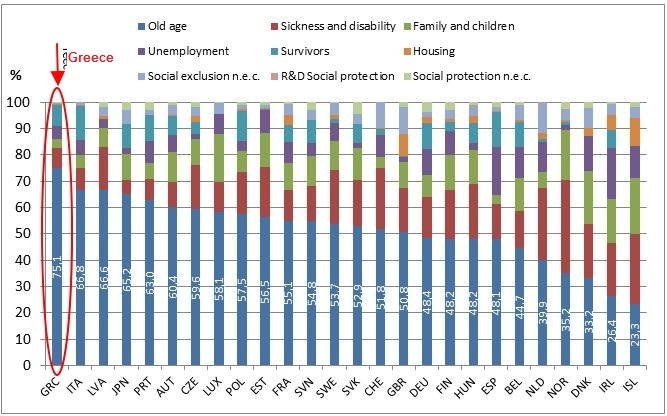

Old age pensions: This accounted for 14.4% of GDP in 2013 or about three quarters of social protection

as shown in the chart below. Spending on pensions is the highest share among OECD countries.

Click to enlarge

Sources: OECD National Accounts Statistics (database); Eurostat Government finance statistics (database). Data for the OECD non- European countries (apart from Japan) and for Turkey are not available. Iceland and Spain: 2012.

Public Sector Employment: Between 2009 and 2013, public sector employment decreased from

by 2.4% from 19.7% to 17.5% of the total work force. This is the highest decreased OECD countries.

Public Procurement: Greece has the lowest public procurement expenditure in relation to GDP (9.8%).

Source: The facts about Greece, OECD Insights Blog