- Small island nations – how much do you know? (The Guardian)

- U.S. unemployment rate falls to seven-year low (MarketWatch) but The road to recovery: furloughs, layoffs and job numbers that shade the truth (The Guardian)

- Fastfood not good for workers or suppliers – Frappuccino society (Le Monde)

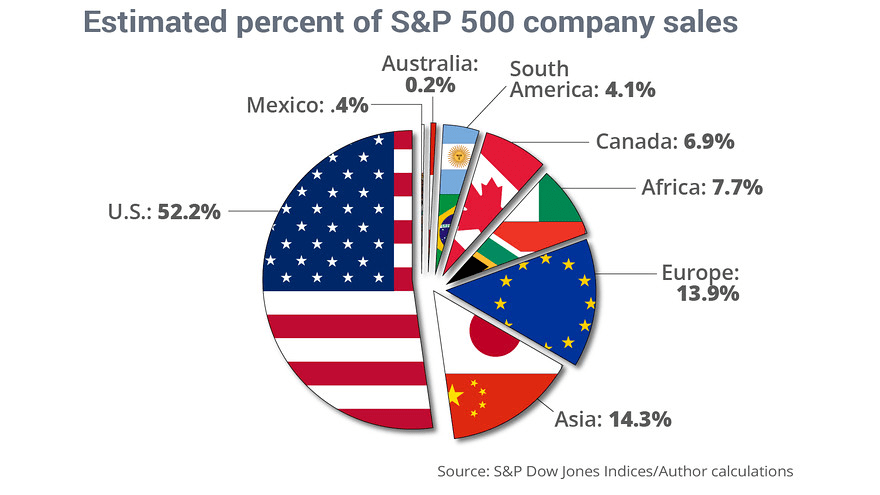

- Paul Krugman: Australia can weather the Chinese economic downturn (The Guardian)

- The West Spreads Intellectual Idiocy (Counterpunch)

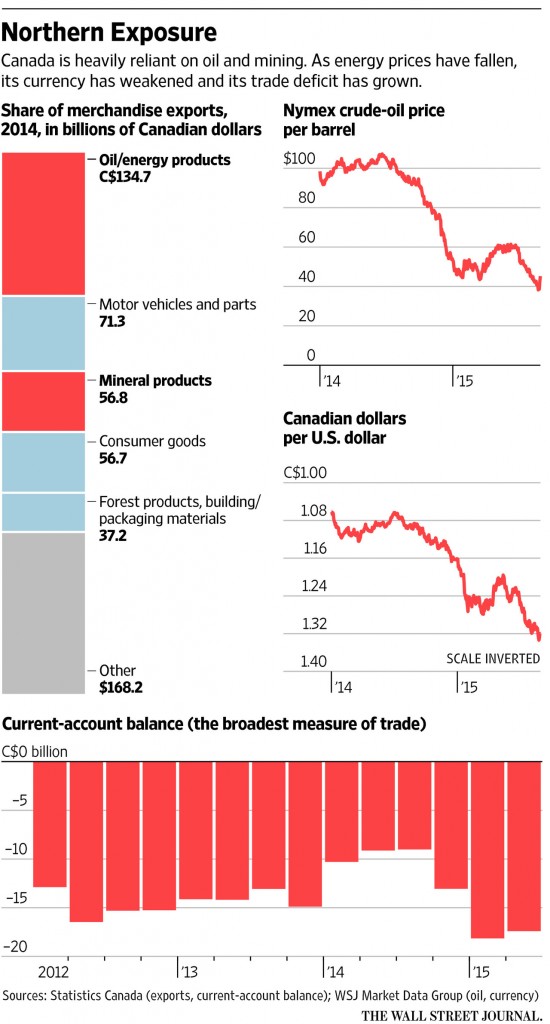

- Buy Canada! The bullish case for the Canadian economy (CBC)

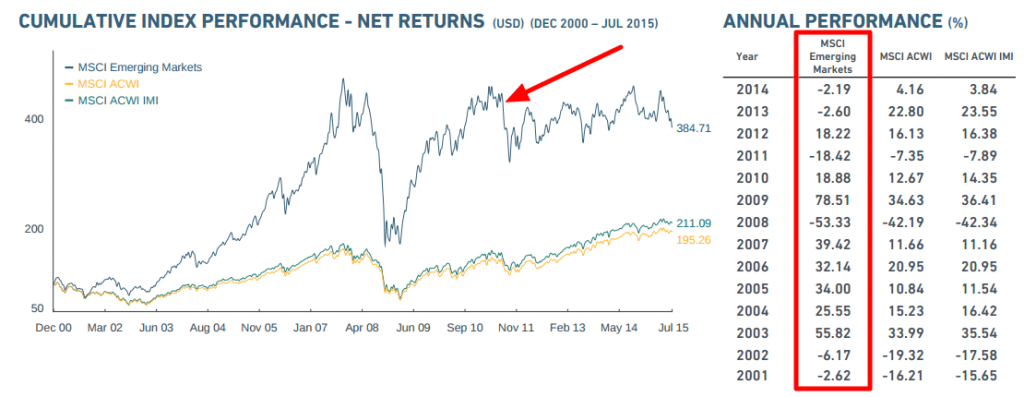

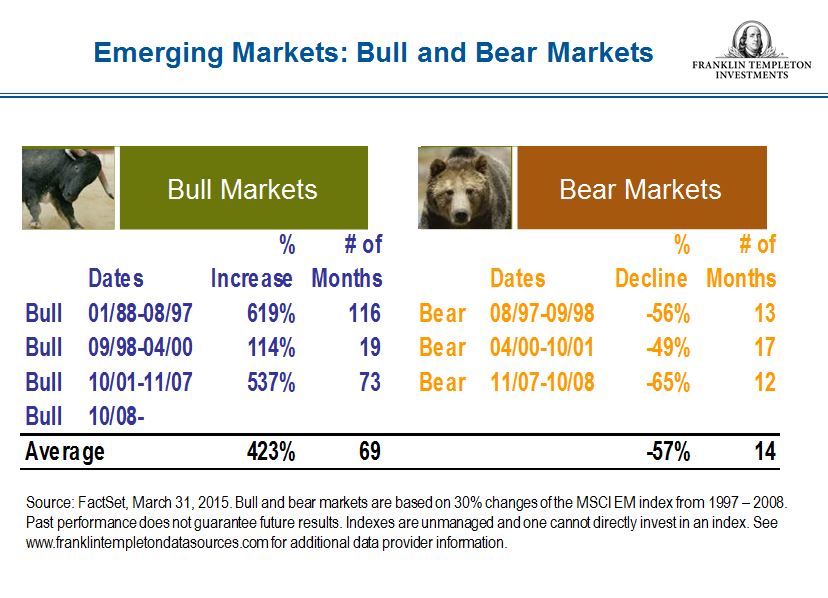

- China fooled the world, and now comes the Great Unwinding (FT Beyondbrics)

- When businesses are bad, who you gonna call? (OECD Observer)

- Q and A: Estimating Long-Term Market Returns (Schwab)

A Zoo in UK