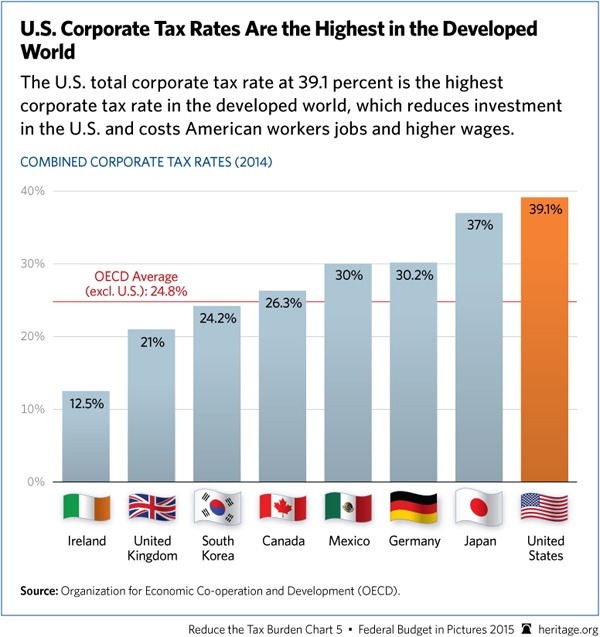

- How the cult of shareholder value is cannibalizing corporate North America, Financial Post

- Why you may need more international stock, Fidelity

- How easyJet revolutionised European air travel, This is Money

- Fixed Income – What’s the Difference Between Duration and Maturity?, Blackrock Blog

- Cyclical vs. Defensive Stocks, SocGen

- Going Global: Selecting ADRs or Foreign Stocks, Schwab Note: Old article but worth checking out

- Can You Pick the Guys Who Pick the Guys Who Pick the Best Stocks?, Jason Zweig @ WSJ Moneybeat

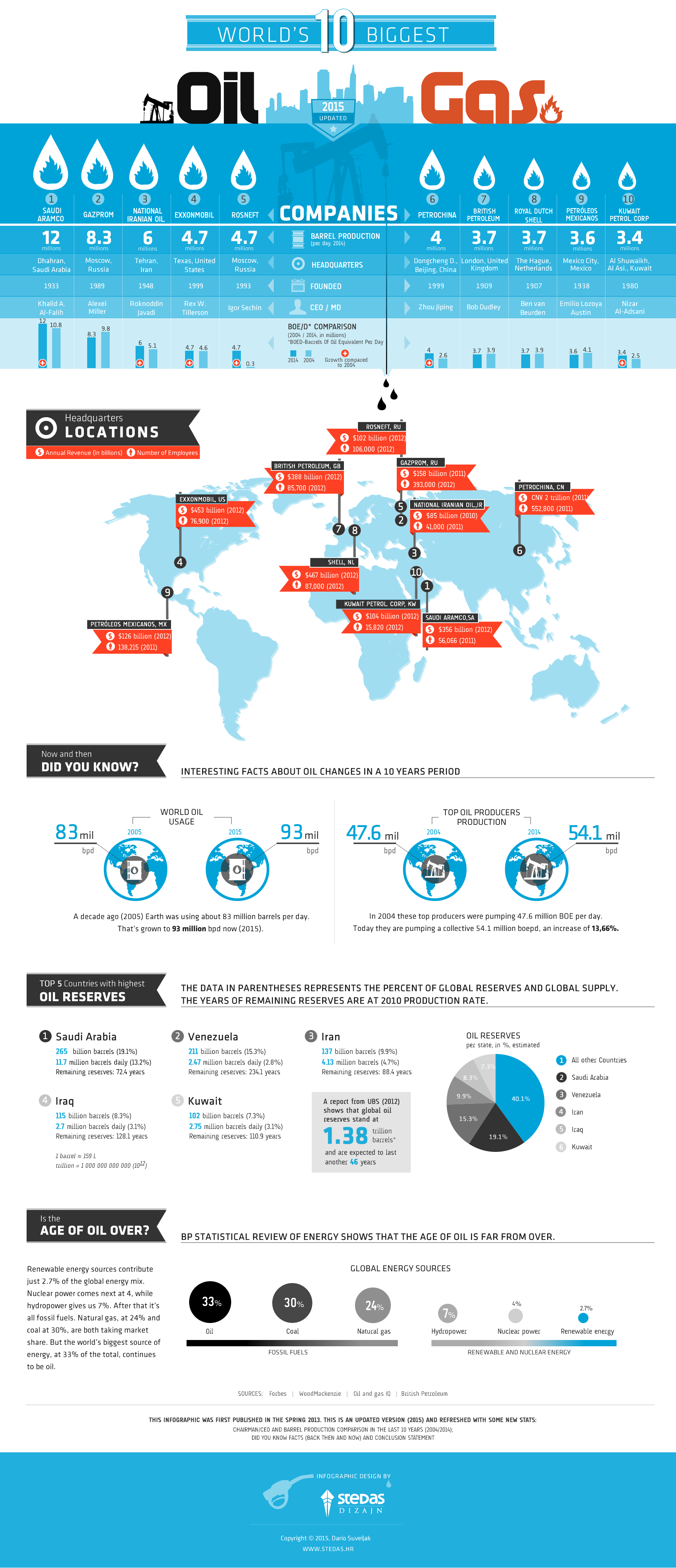

- Rockefeller Fund: ‘The oil age is coming to an end’, Deutsche Welle

Ground Crew in Action at Atlanta Airport