Investing in stocks of auto parts makers is a wise move for many reasons. For example, the demand for automobile parts is stable during economic expansions and contractions. In fact during recessions demand goes even higher as consumers try to repair their existing vehicles and use them instead of buying new ones. During good times, the demand for auto parts continue as consumers replace worn-out parts in their vehicles or add accessories to even newer vehicles. As cars are a necessity for most Americans living in places other than the world-class cities of Los Angeles, New York, Chicago, etc. there will always the need for replacement parts for automobiles. I written about the auto parts sectors many times such as here and here and here and here over the years.

Recently I came across an interesting piece at Alliance Bernstein that discussed how auto suppliers are more profitable than auto makers.From the article:

Suppliers Are Highly Profitable

Auto suppliers are already much better businesses than perceived. Many of these companies streamlined dramatically after the 2008 global financial crisis because they weren’t propped up by governments like the carmakers. There was a wave of mergers and acquisitions in Europe and the US, along with drastic cost cuts and consolidation of production.

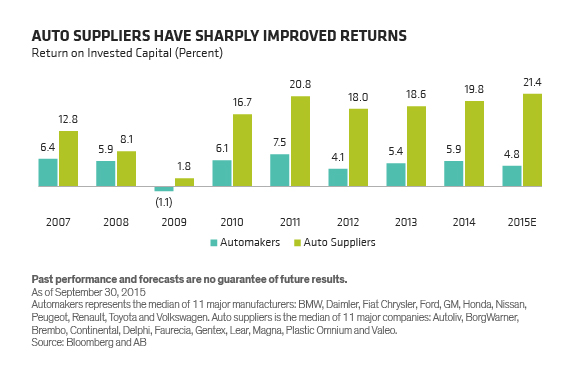

Today, the supply base is brimming with technology. This gives suppliers more pricing power than in the past because their products are more sophisticated. Combined with industry restructuring and investment in new products, suppliers have improved returns on invested capital to levels well above those of the automakers (Display)—which adds resilience to downturns.

Click to enlarge

Barriers to entry are high. Since quality standards for car parts are very stringent, it’s not easy for an upstart with a sharp product to challenge an incumbent and win support from big auto manufacturers.

From an investment perspective, the authors note that European suppliers are now trading at n attractive valuation and have stronger balance sheets. In addition, their organic growth rate is higher than US auto parts suppliers.

Source: Does Volkswagen Fallout Taint the Auto Industry? by

The above evidence validates my long-held theory that in order to profit from the rebound in the auto industry, it is a good idea to invest in auto parts makers instead of auto makers as part suppliers offer the “picks and shovels” to the auto manufacturers.

Some of the foreign auto parts makers to consider are: Continental (CTTAY), Michelin (MGDDY), Valeo (VLEEY), Autoliv Inc (ALV), Magna International Inc(MGA) and Bridgestone Corp. (BRDCY).

Major US-based car parts suppliers include Johnson Controls, Inc.(JCI), Genuine Parts Company (GPC), AutoZone, Inc.(AZO), Lear Corp (LEA), Visteon Corp (VC), etc.

Disclosure: Long MGA