Labor wages vary across countries. For the same work, the wages in a developed country is traditionally much higher than in emerging countries. Hence it is no secret that companies looking to reduce labor costs tend to move their operations to the developing world. I recently came across an interesting article titled “Which country will be the next China?” by Jason Hsu of Rayliant Global Advisors in Australia. A small excerpt from the piece:

Between a rock and a hard place

China is great at what it does, and I don’t envy companies trying to diversify their supply chains. Consider Foxconn, the ‘gold standard’ for operating factories that manufacture high-end electronics. In response to increasing geopolitical pressure, the Taiwanese firm has made several efforts to expand beyond China.

In the United States, Foxconn reached agreements in both Wisconsin and Arizona to invest many billions of dollars in manufacturing plants. And recently, Foxconn signed a partnership with Vedanta Group to manufacture components in India. But as most of my readers know, these deals have all been scaled back or cancelled altogether, including some recent drama in which Foxconn said parts of the US lacked the skills and infrastructure to launch a plant.

I don’t want to speculate too wildly about specific cases like Foxconn’s. But it’s a simple business fact that the United States, United Kingdom, Germany, and other developed countries are simply too expensive and lack sufficient labor to replace Chinese manufacturing. In addition, cultural, employment, and labor norms have hampered Chinese manufacturing attempts in Western countries. (For those who haven’t seen it, American Factory is an excellent case study.)

At the other end of the spectrum, Africa offers inexpensive labor and investment opportunities. However, the infrastructure and labor force cannot currently support high-end and value-add manufacturing.

EM is the only viable option. But as Foxconn’s efforts in India demonstrate, there are challenges even within these markets.

Source: Which country will be the next China?, FirstLinks

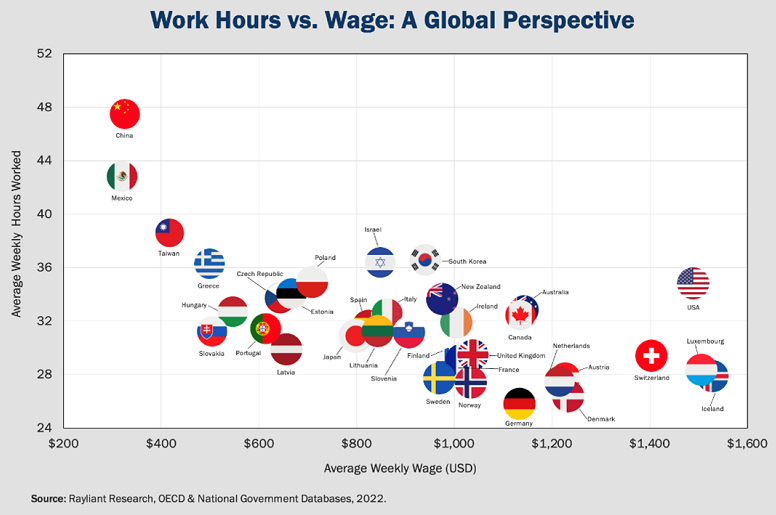

China has the highest hours worked per week and the lowest wages as shown in the char below. That is one major reason why China is the factory floor of the world. The second cheapest destination for labor wages is Mexico. Unions cutting deals directly with company managements and without worker representation have kept wages below.

The highest earners with lowest amount of hours worked are in Iceland, Luxembourg and Switzerland. Wages are higher in the US but the number of hours worked is also higher relative to most developed western European countries.