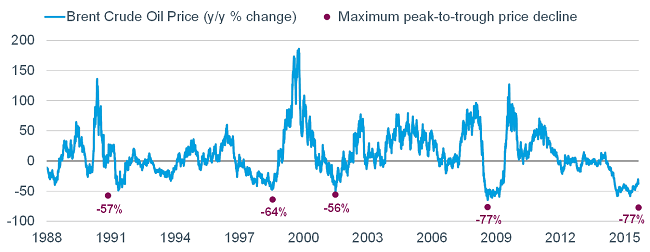

- Will Oil Prices and Energy Earnings Increase During 2016? (Factset)

- False beliefs and unhappy endings (OECD Observer)

- Investor psychology has turned: it’s time to look for opportunities (MoneyWeek) and see What should investors do in a market meltdown? Hold your nerve, rebalance your portfolio, and watch five key indicators for signs of recovery, say experts (This is Money, UK) and Never run from a bear and five other things you shouldn’t do in this market (The Financial Post)

- Help for investors unfamiliar with Zen-like calmness (Tom Stevenson, Fidelity UK)

- Fear of missing out (Tom Stevenson, Fidelity UK)

- The mega brands making no money (News Limited, Australia)

- What could turn the market around? (Fidelity)

- Market ‘Capitulation’ Is Nowhere in Sight (So Far) (Jason Zweig, WSJ)

- What is driving inequality in India?, Deutsche Welle

Rockefeller Center, New York