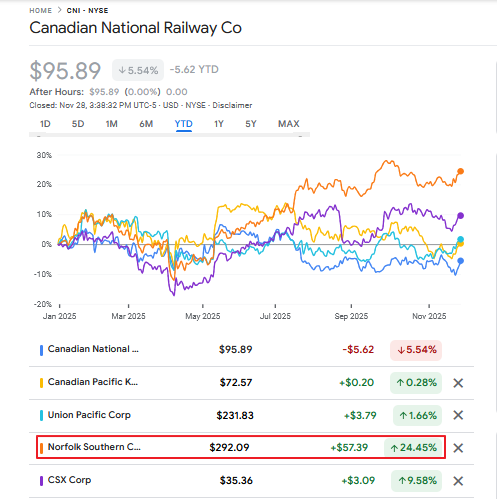

The S&P 500 is up by 16.45% YTD on price basis. Many sectors have performed extremely well this year. Let’s take a look at the returns of the Class I railroad stocks in this post. The best performing railroad so this year is Norfolk Southern(NSC) which has soared by about 25% based on just price appreciation. This amazing growth came on the heels of its merger proposal with competitor Union Pacific(UNP). The deal has still get all the approvals by the relevant regulators. The worst performing railroad is Canadian National Railway Co (CNI) with a loss of 5.50% YTD.

The following chart shows the YTD price returns of major railroads:

Click to enlarge

Source: Google Finance

Note: Returns noted are as of Nov end, 2025.

Related Stocks:

- Canadian National Railway Co (CNI)

- Canadian Pacific Railway Ltd(CP)

- CSX Corp (CSX)

- Union Pacific(UNP)

- Norfolk Southern Corp(NSC)

Disclosure: Long CSX, CNI, NSC and UNP