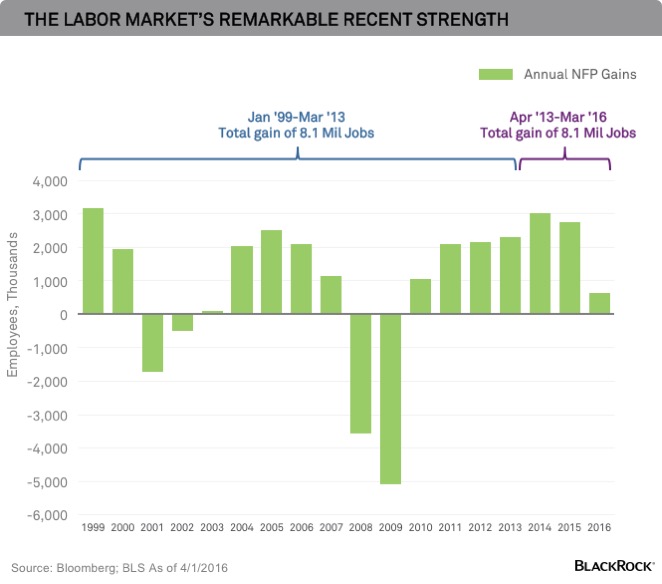

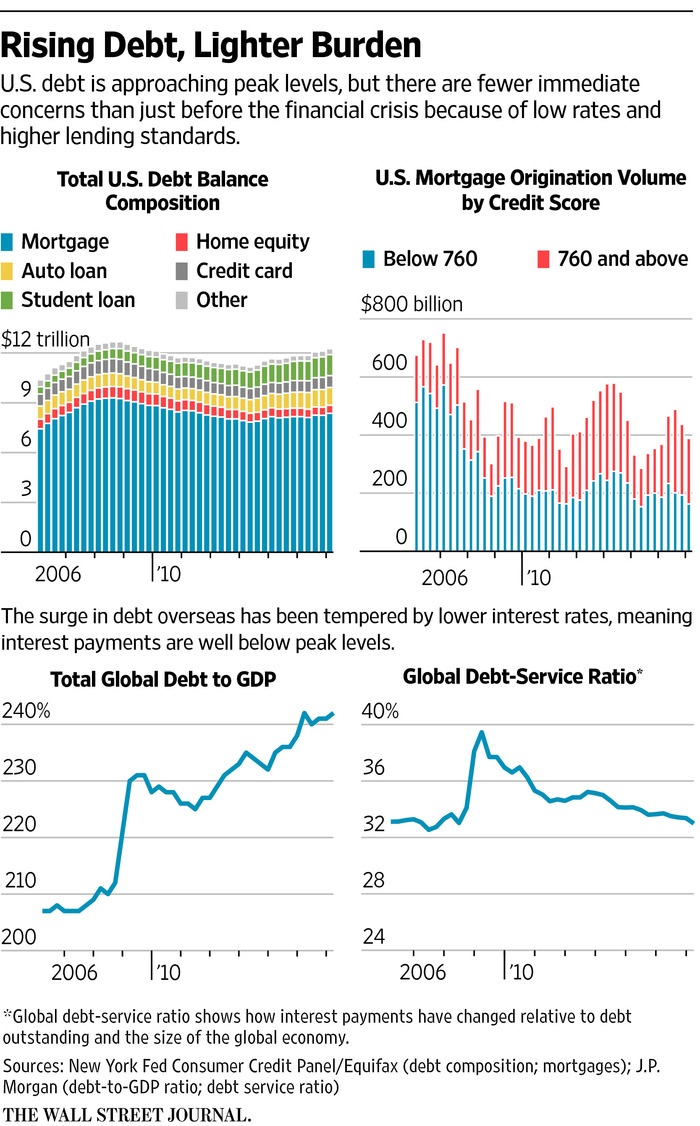

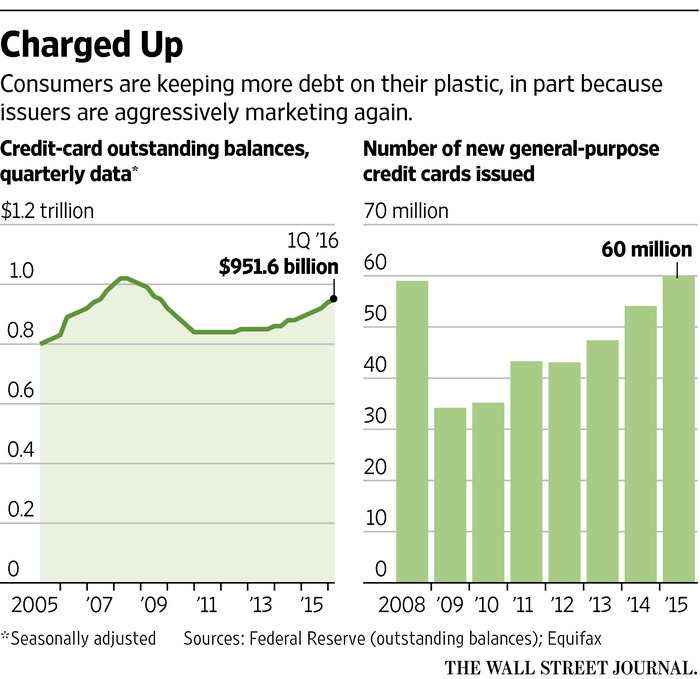

Earlier this week in an article on rising consumer debt I wrote that as a consumption-driven economy, the US economy needs consumers to do the heavy-lifting. So far consumer are doing their part and the economy is recovering. But the question is: How big is consumption spending in terms of the total economic output? Or put another way, how important is consumption to the overall US economy?

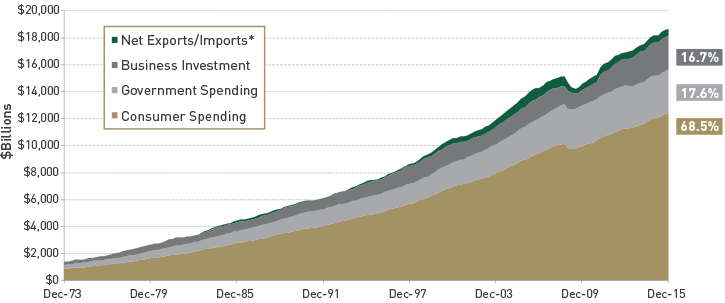

The following chart from Lord Abbett shows the components of the US GDP:

Click to enlarge

Source: U.S. Stocks: Small- and Mid-Caps’ Home-Court Advantage, Lord Abbett, May 31, 2016

According to the article, the US economy is uniquely dependent on the consumer. In fact, consumption accounts for about two-thirds(or 68.5%) of the US GDP as shown above.

Unlike the US, Germany and China are export-driven economies. So total US exports account for only 13% of US GDP. Germany’s export sector comprises about 46% of the German GDP and China’s exports constitutes about 23% of the economic output.

From an investment standpoint, the important point to remember is as long as the American consumer is able to have a job and access cheap credit, housing values remain stable and the consumer feels confident about the future, US economy will continue to remain strong.