The Dow Jones Industrial Average (or) Dow Jones Index is oldest benchmark in the world. Dow Jones is also the most popular index that tracks the US equity markets though the S&P 500 is a better representation of the US market.

Similar to the Dow Jones, the EURO STOXX 50 Index, is Europe’s leading Blue-chip index for the Eurozone countries. The 12 countries represented in this index are Austria, Belgium, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg, the Netherlands, Portugal and Spain. UK is not included in this index since it has its own currency.The index is comprised of 50 companies which can be found here.

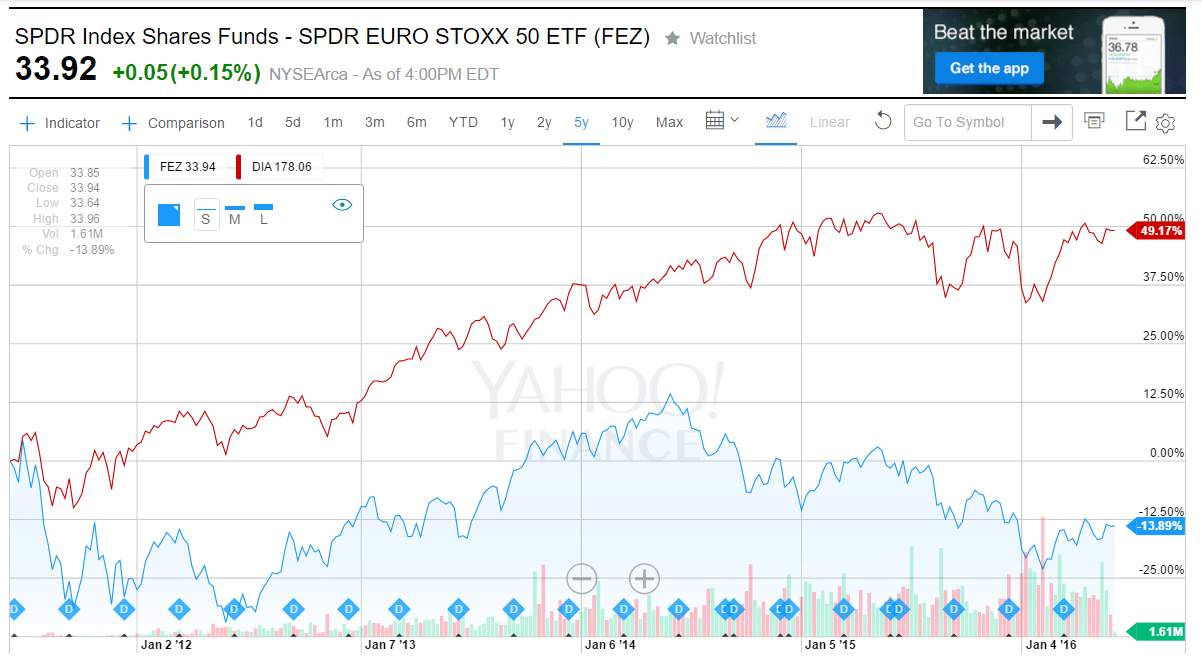

In order to compare the performance of the Dow Jones Index and the Euro Stoxx 50 Index I used the ETFs (DIA and FEZ) that track the respective indices. The 5-year return chart shows the wide gap in performance between Eurozone stocks and their American peers. Unlike the US, European countries never fully recovered from the crisis of 2008-09 and continued to suffer many other sovereign debt crises including the perennial Greek debt drama. Political infighting between member nations of the EU and general dithering in taking effective and quick actions by regulators and policy makers alike have left Eurozone firms under-perform relative to US firms.

Click to enlarge

While the US stocks as represented by the Dow Jones ETF has soared by nearly 50%, Eurozone stocks have declined by about 14%.So the actual difference in returns 64%.

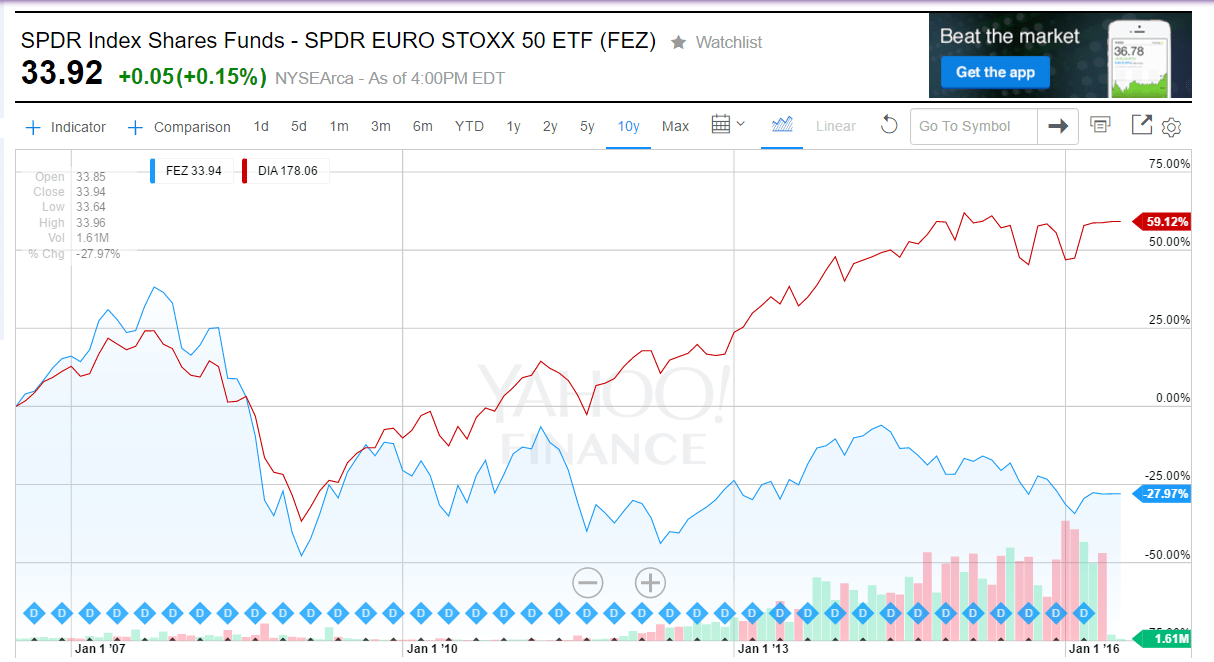

The following is a long-term chart showing the 10-year price returns:

Click to enlarge

** NOTE: Returns shown above are as of June 3, 2016.

Source: Yahoo Finance

The long-term return does not look good either for the Euro Stoxx 50 ETF as it has plunged by about 28% while the Dow Jones ETF has sailed smoothly all along for a gain of 59%.

It remains to be seen if this divergence will continue to widen or European stocks will beat US stocks for a change. After so long being poor performers it is about time that European firms show their strength in earnings growth and consequently higher valuation for their equity prices by investors.

Related ETFs:

Disclosure: No Positions