The world of equity investing has changed in the past few decades. The invention of mutual funds decades ago allowed many retail investors to participate in the market by pooling resources together and reducing risks. More recently the advent of ETFs have changed the investment landscape even more as investors have a wide range of funds to choose from focused on specific strategy, sector, region, etc.

Due to explosion in the number of available funds and cost factor, some investors may prefer to invest in equities primarily via index funds such as ETFs and not bother with individual stocks. SPDR S&P 500 ETF (SPY), SPDR Dow Jones Industrial Average ETF (DIA), Vanguard Emerging Markets Stock Index ETF (VWO) are few of the large ETFs that track a certain index such the S&P 500 by the SPY ETF. There are many advantages for going with just index funds as opposed to equities directly. Some of the pros of investing with funds include less risk, easy diversification, low costs, ability to trade all day, etc. While these are valid benefits that one cannot deny, there are many advantages that only stocks can offer. In this post, let’s review some of the pros of investing in equities over funds.

1.Dividends

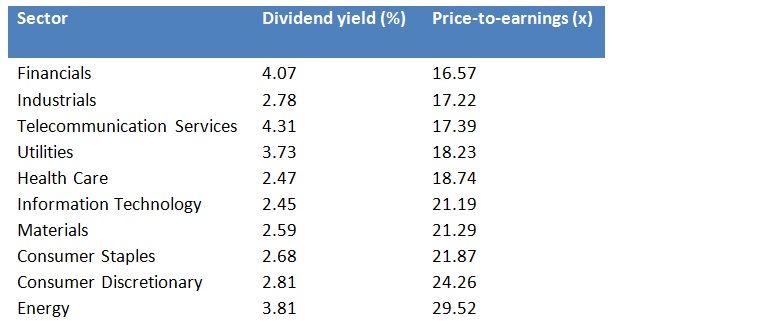

When investing in individual company stocks, an investor receives the full amount of the dividends paid. There is no leakage of the dividends due to management fees and other fees. Due to the effect of compounding when full dividends are reinvested returns will be much higher especially over many years. When firms increase dividends, then adds another boost to returns as well. With index such benefits cannot be fully attained.

2. Special Dividends

Some companies offer special dividends to attract and keep loyal shareholders. Usually such dividends can be annual. Equity investors are able to enjoy such dividends. This may not be the case with index fund investors. For example, Glacier Bancorp, Inc (GBCI) pays a special dividend of $0.30 at the end of the year.

3. Spinoffs

By holding individual companies, investors will get additional shares in a new company or cash when a firm has a spinoff. This is an additional advantage of holding stocks as opposed to funds. Many of the large-cap companies are big enough to carve out some of their units into separate entities. For instance, Reckitt Benckiser(RBGLY) spun off its pharma unit Indivior into a separate firm. As a result RBGLY shareholders ended up receiving some shares in Indivor(INVVY). Similarly US utility Duke Energy(DUK) spun off Spectra Energy(SE) a few years ago.

4.Takeovers

In a takeover situation, shareholders of target firms can reap huge gains when the acquirer pays a steep premium. Though it is not possible to predict which firms are takeover targets, takeovers at huge premiums can lead to a big windfall for holders. Recent takeover of LinkedIn(LNKD) by Microsoft (MSFT) is one example. While fund investors also benefit from takeovers the reward of individual shareholders can be much higher.

5.Stock Splits

Many firms split their stock after the price reaches a certain level to maintain liquidity in the marketplace. Though stock splits do not increase the value of one’s holdings, usually splits tend tend to benefit shareholders in the form of higher returns over the long-term. So an investor starting with just 100 shares in a company can accumulate hundreds of shares over many years if the stock splits again and again. Index funds can also split but the probably of them splitting is less than individual stocks.

Disclosure: Long RBGLY, INVVY, GBCI