The average hourly wage for auto workers in Mexico is increasing according to a recent article in the journal. Major automakers expanding or opening factories there are offering higher wages, benefits and incentives to attract workers. The competition among auto makers to attract and retain auto workers is high.

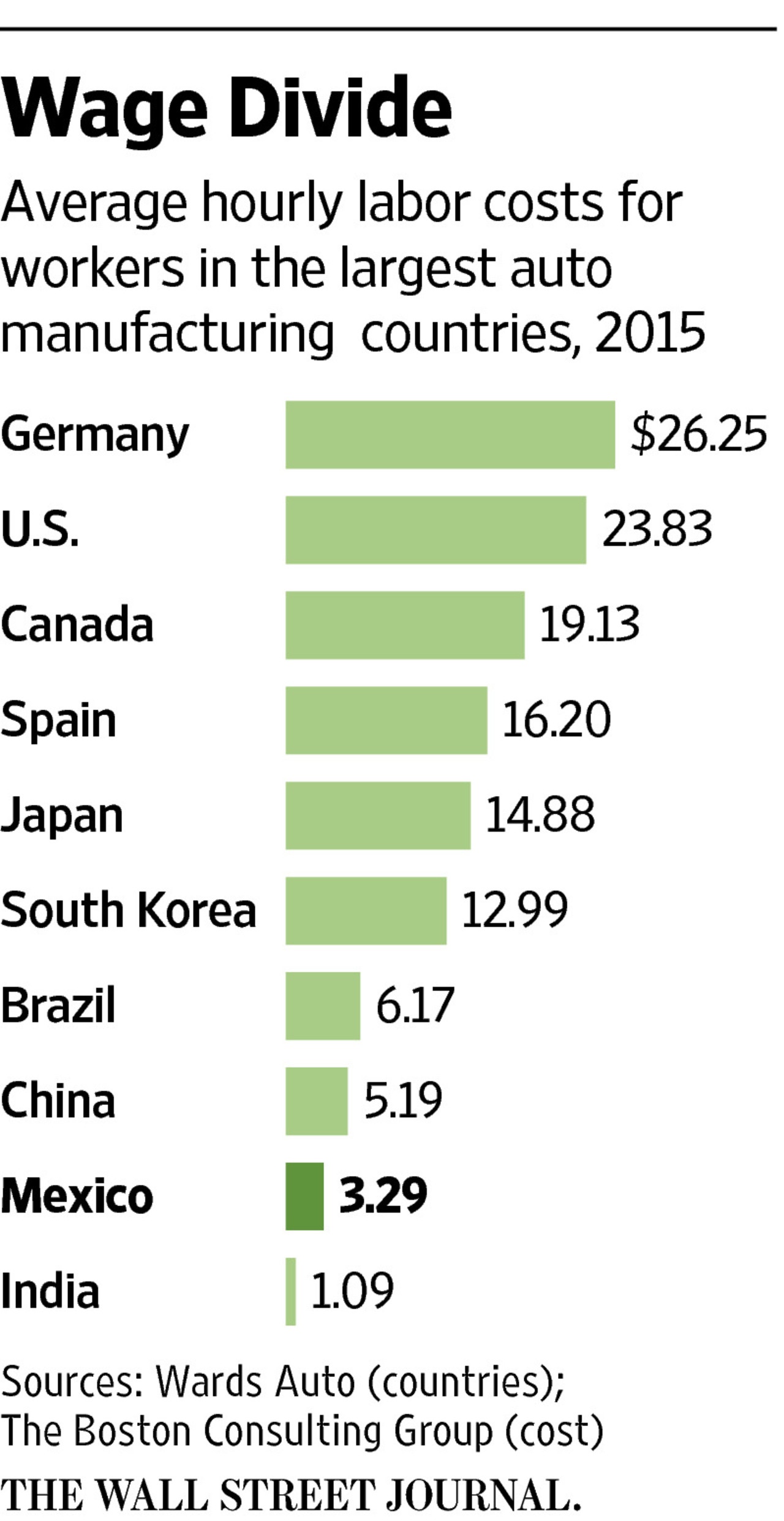

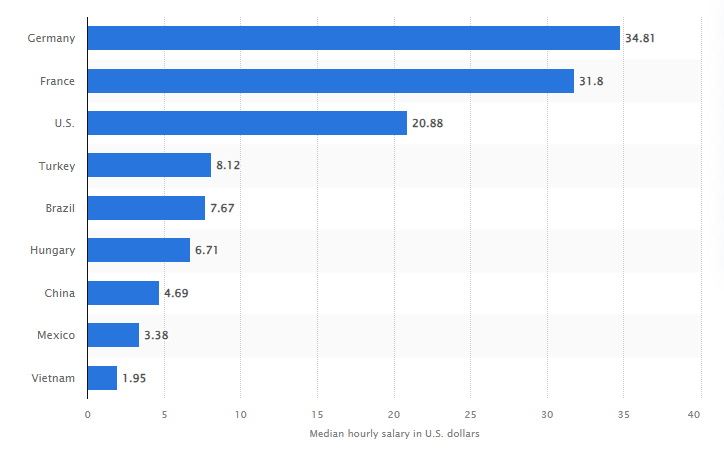

Global auto manufacturers flock to Mexico and other emerging countries due to their cost advantage. Hourly wages in Mexico, Brazil, China, India, etc. are much lower than in developed countries like shown in the graphic below:

Click to enlarge

Source: It’s Getting Harder and More Expensive to Make Cars in Mexico, WSJ, Aug 14, 2016

Mexicans working at the auto factories get between $1 an hour to $ 3 an hour. Mexico’s minimum wage is 73 pesos or $4 a day. Hence auto workers earn much more than the prevailing minimum wage. Despite this Mexican workers are far cheaper since in all the developed countries hourly wages run into double digits. Mexico has many advantages for auto manufacturing due to many factors including the cheap labor, railroad and road transportation links and close proximity to the US.

As long as wages are cheap in emerging countries auto makers will exploit that.It is interesting to note that though auto makers have shifted manufacturing to lower cost countries prices of autos have not come down. In fact an average car costs around $20,000 these days. Pickups, SUVs and other types of vehicles cost double that if not more and have much higher profit margin for auto makers.

Updates (9/27/23):

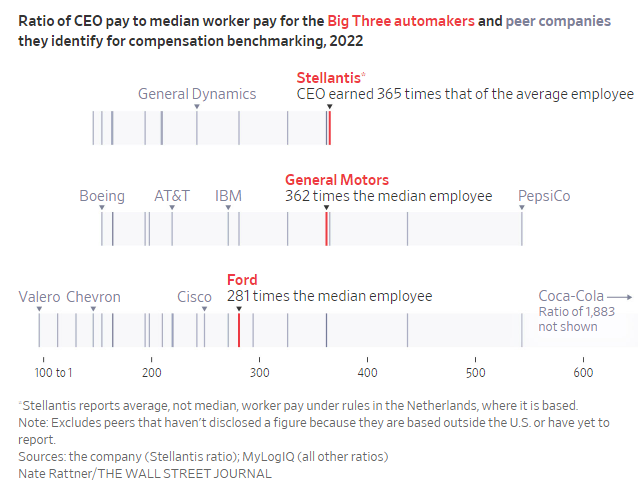

- Ratio of CEO Pay to Median Worker Pay at Big 3 Auto Firms:

Click to enlarge

Source: Auto CEOs Make 300 Times What Workers Make. How That Stacks Up, WSJ, Sept 25, 2023

- The global car manufacturing wage gap: what do car factory workers earn?, Auto Express

- Auto Workers’ Median Hourly Salary for select countries (in 2015):

Source: Statista

- Growing Pressure on Automotive Industry Wage Growth in Central and Southern Europe, Paylab

- Major Car Manufacturers Ranked by Number of Employees, Alan’s Factory Outlet

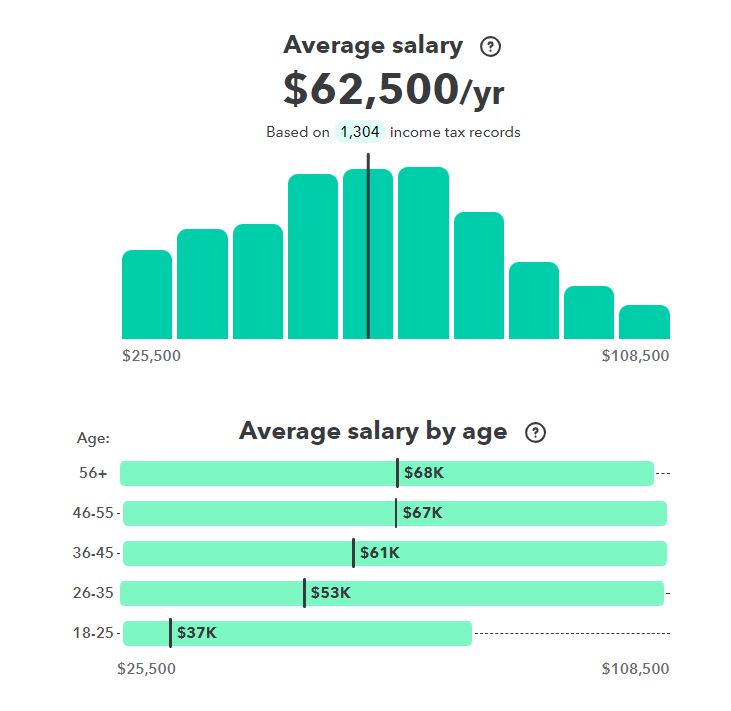

- Average Auto Worker Salary in the United States:

Source: Intuit

- Low Cost Manufacturing Labor in Mexico’s Automotive Industry, Tecma

- Average Auto Worker salary is is 568 pesos or US $33 a day , WSWS

- UAW auto strike: Why US Automotive CEOs make more than global competition, The BBC

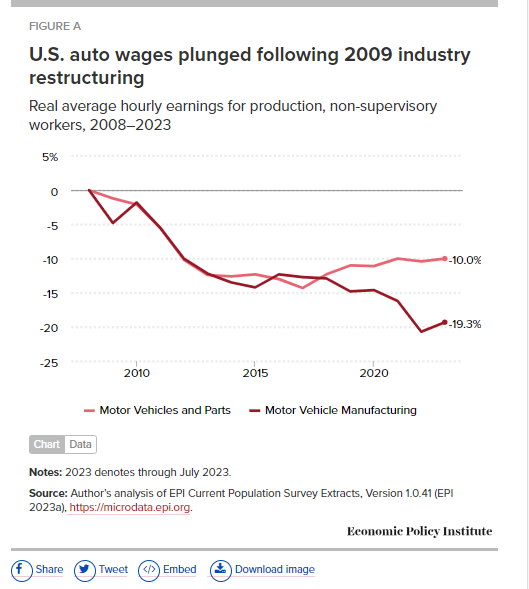

- US Auto Workers Wages plunged since 2009 restructuring: Chart

Click to enlarge

Source: UAW-automakers negotiations pit falling wages against skyrocketing CEO pay, EPI

Related Posts: