The British equity market as represented by the FTSE 100 Index has outperformed other major stock indices of this world so far this year. For instance, the S&P 500 is up 6% year-to-date. The main European indices have performed as follows:

UK’s FTSE 100: 9.4%

France’s CAC 40: -2.3%

Germany’s DAX Index:-1.1%

Spain’s IBEX35 Index: -8.3%

Note: Figures noted above are as of Nov 11, 2016

Compared to other developed indices of Europe the FTSE 100 has had an excellent run. So why did the FTSE perform so well relative to other major markets?

Two main reasons stand out in the answer to the above question. They are exposure to emerging markets and currency.

The FTSE 100 is the most exposed to emerging markets of all the major global indices. Multinational firms in the FTSE-100 generate about 27% of their revenues from emerging countries. The S&P 500 on the other hand earns only 10% from those markets. So as emerging markets have done well this year the FTSE has done well also.

One of the main impacts of the Brexit vote a few months ago was on the British pound. The pound has depreciated in value against other currencies. As a result a weaker pound makes the earnings of British companies from foreign countries look bigger to investors who bid up shares.

So the key point to remember is that a bet on the FTSE-100 is actually more of a bet on the performance of emerging markets. I have noted many times before on this blog that big British companies have substantial operations in many emerging markets due to their deep roots there from the colonial periods.

Five FTSE-100 components are listed below with their current dividend yields:

1.Company:Diageo PLC (DEO)

Current Dividend Yield:3.06%

Sector: Alcoholic Beverages

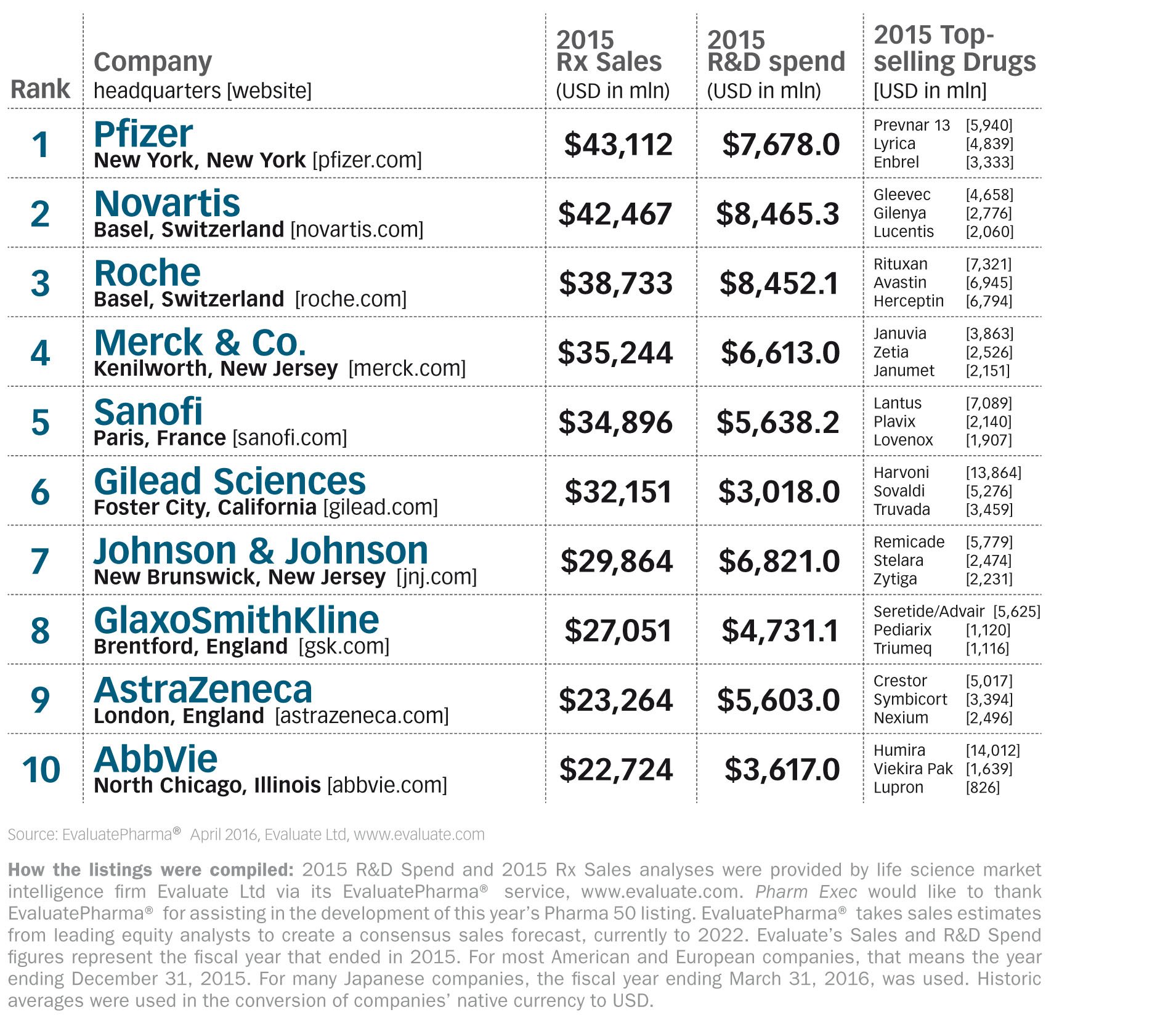

2. Company: AstraZeneca PLC (AZN)

Current Dividend Yield: 4.94%

Sector: Pharmaceuticals

3..Company: Vodafone Group PLC (VOD)

Current Dividend Yield: 5.65%

Sector: Wireless Telecom

4.Company: British American Tobacco PLC (BTI)

Current Dividend Yield: 4.12%

Sector:Tobacco

5.Company: GlaxoSmithKline (GSK)

Current Dividend Yield: 4.95%

Sector: Pharmaceuticals

Note: Dividend yields noted above are as of Nov 11, 2016. Data is known to be accurate from sources used.Please use your own due diligence before making any investment decisions.

Disclosure: No Positions