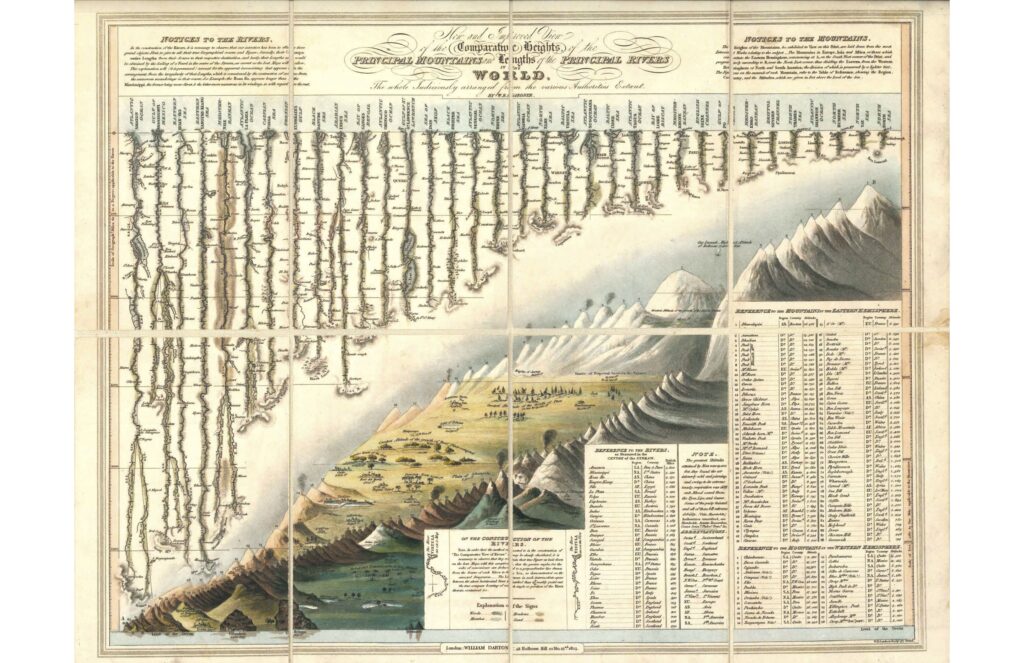

Infographics have become popular in recent years. In one page an infographic is able to show a ton of information in a clear and precise way. However infographics are not a new invention. I recently came across a fascinating infographic from the 1800s that shows the comparative height of mountains and lengths of rivers in the world. This single page also shows the data in a table in addition to the visual presentation.

For example, it shows the major rivers of the world such as the Amazon, Mississippi, Yangtse, Nile, etc. from their sources to their final destination including their length in miles. It also shows the top mountains of the world such as the peaks in the Himalayas, Mt. Blanc in the Alps, etc. with their country location and the altitude.

Click to enlarge

Credit:

Title: New and Improved View of the Comparative Heights of the Principal Mountains and Lengths of the Principal Rivers in the World

Author: W. R. Gardner & William Darton

Location: London, England

Year: 1823

Via Datavis.ca