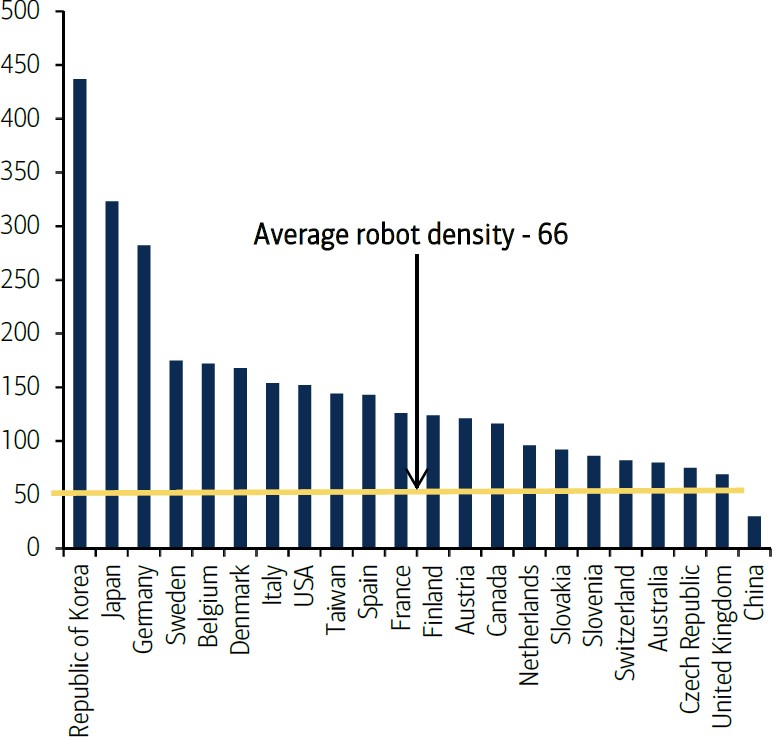

Robots are increasingly replacing human workers in many industries. The manufacturing industry including the auto industry is one of the few industries that has embraced the use of robotics in operations. Despite the cost benefits some countries have higher penetration rate for robots than others. According to one research report published in 2014, countries like South Korea, Japan and Germany have higher number of robots relative to workers in the manufacturing industry.

The chart below shows the number of multi-purpose industrial robots per 10,000 employees in the manufacturing industry:

Click to enlarge

Source: Are Robots Disruptive? … or could they be the saving grace for ageing societies?, July 2017, The Absolute Return Letter, Absolute Return Partners

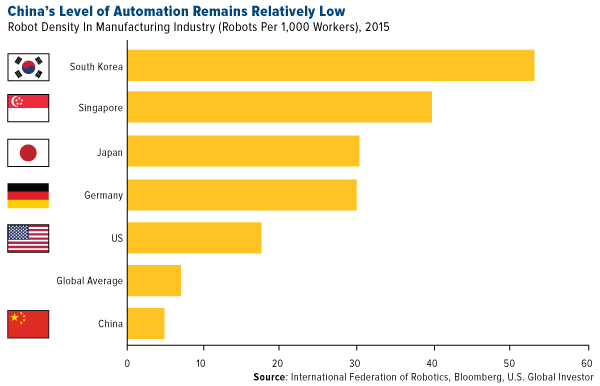

Update 99/11/17):

Robot Density in Select Countries

Click to enlarge

Source: US Funds