Gold prices continue to remain stagnant with December futures for the precious metal ending at $1,187.70 an ounce last Friday. The price struggles to maintain levels above $1,200 per ounce. However investors looking to gain from a rebound in gold prices may find gold miners attractive at current levels. In an article last week Frank Holmes of U.S. Global Investors noted that gold mining stocks are attractive relative the S&P 500.

From the article:

Get ready, gold bulls: The precious metal could be close to finding a bottom.

The price of gold fell back below $1,200 an ounce again this week as the U.S. dollar advanced following another federal funds rate hike. It’s now set to log its sixth straight month of declines, its longest losing streak since 1989.

That gold’s not trading below $1,150 is, I believe, remarkable. There’s a lot motivating the bears right now. Besides a stronger dollar and higher interest rate, stocks are still going strong, buoyed by record buybacks and massive inflows into passive investment products. In the week ended September 20, investors poured as much as $34.3 billion into ETFs, taking year-to-date inflows to nearly $215 billion, according to FactSet data.

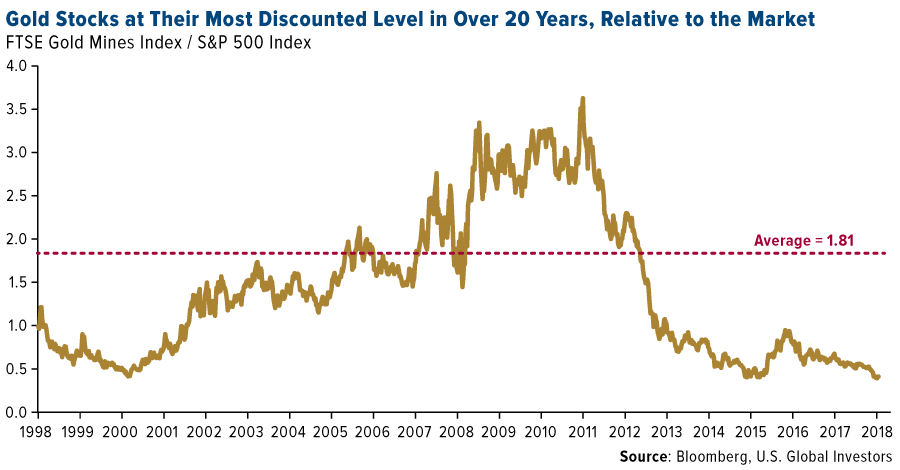

This makes gold mining stocks look especially attractive by comparison. Relative to U.S. blue chips, the FTSE Gold Mines Index is now at its most discounted level in over 20 years.

Source: Gold’s Bottom Could Be Investors’ Lost Treasure, U.S. Global Investors

On a related note, last week NASDAQ-listed Randgold Resources(GOLD) announced plans to merge with NYSE-listed Barrick Gold Corp (ABX) to create the world’s largest gold mining company.

I am not a fan of gold mining stocks. However investors interested in gold miners can consider the stocks trading on the NASDAQ and NYSE for further research.

Related ETF:

- SPDR Gold Trust ETF (GLD)

Disclosure: No Positions