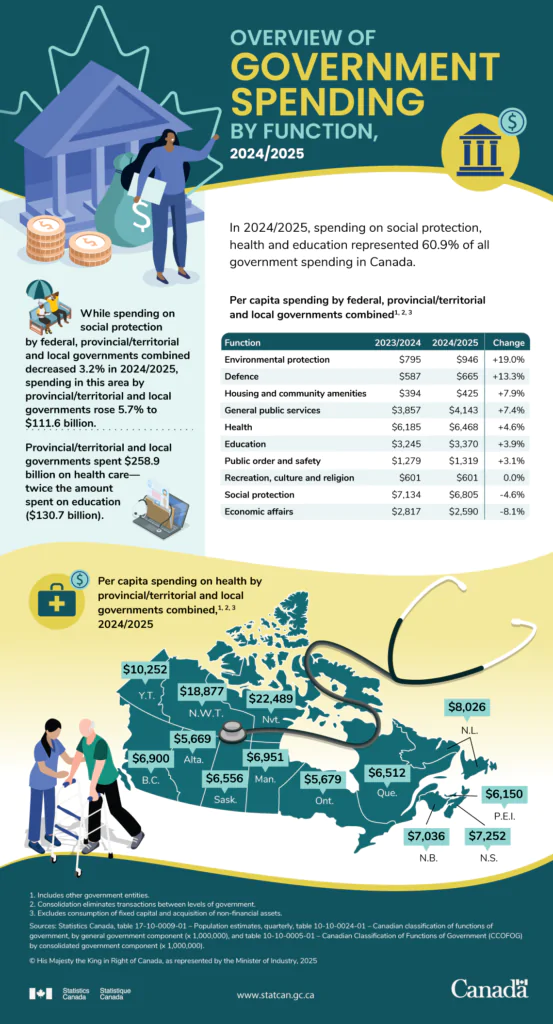

The US debt mountain continues to grow. The Gross Federal debt has crossed $38 Trillion (or)$38,000,000,000,000 according to an article at the Peter G. Peterson Foundation. Since this is a such huge amount, the following infographic puts the number in perspective in a few ways. While most this debt is held by the general public it still needs to be serviced. Hence interest payments amount to an astonishing $3.0 billion per day.

Click to enlarge

Source: Infographic: The National Debt Is Now More than $38 Trillion. What Does That Mean?, Peter G. Peterson Foundation