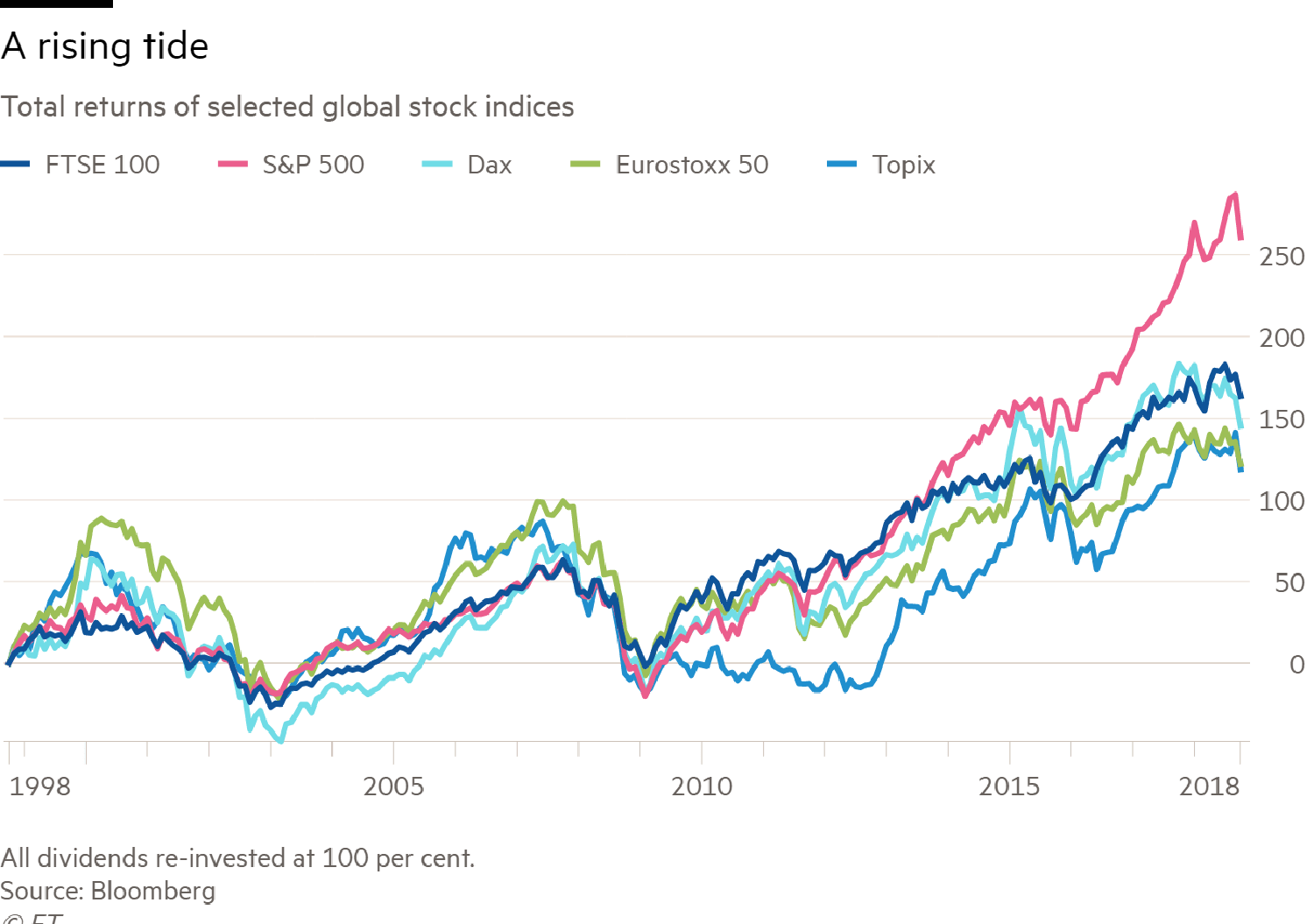

The Total Return(which includes price returns and dividend reinvested) of some of the major indices are shown in the chart below. The US market was the best performer as shown by the S&P 500 in red color.

Click to enlarge

Source: The future of the FTSE 100, FT Alphaville

UK’s FTSE 100 was the second best performing index with a return of 163% in the past two decades.It is interesting to note that Germany’s DAX under-performed not only the US but also the UK.