China used to be known as the “factory floor” of the world a few years ago as the country’s manufacturing industry was attractive to companies from the developed world due to cheap labor costs. However that is no longer the case. Wages in China have been steadily increasing making some manufacturers look for alternative cheaper locations. For example, in 2016 I wrote an article on the comparative wages in the automotive industry for select countries. At that time, the average hourly wage was $5.19 in China compared to $3.29 in Mexico and nearly $24 in the US.

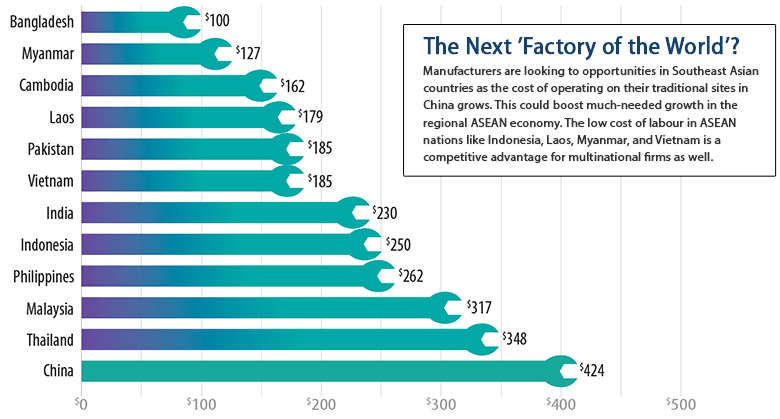

According to research by CLSA, the average monthly salary in the manufacturing industry in China is $424. Many Asian countries have lower monthly salaries than in China as shown in the chart below:

Click to enlarge

Source:How ASEAN’s 3Rs Can Overcome Trade Wars, Nikko AM

Asian economies such as Indonesia, Vietnam, etc. have competitive advantages over China in the manufacturing industry. Rising wages in China may lead some firms moving their facilities to these low wage countries to remain competitive in the global marketplace.