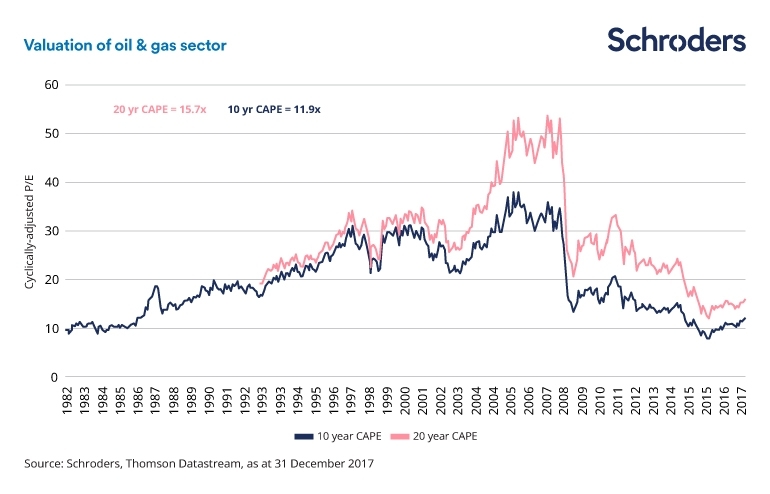

Oil prices have soared in the past year with prices currently hovering around the $80 mark for Brent crude. Rising oil prices have triggered a mini bull market in energy stocks that have barely moved higher in the past few years. Global investors are turning attention to this sector after many years and are trying to identify potential winners.Despite the rise in energy stock prices, the sector remains cheap according to a piece by Schroders.

From the article:

Valuations suggest the sector looks cheap

Another very important point to mention is that in our view the oil companies appear to be cheap.

Four years of declining oil prices have weighed on the sector, especially as some companies have been forced to cut their dividends or pay them in scrip (shares) instead of cash. The sector as a whole is out of favour with the market.

However, those firms that continued with disciplined investments through the downturn may find themselves in a good position with demand still strong and oil prices back on the rise once more.

In short, we see opportunities in the sector, both among producers and services firms. While global growth may be peaking, and worries abound over trade and geopolitics, the energy sector has a cycle of its own, driven by long-term supply and demand dynamics.

Moreover, we see oil stocks as beneficiaries of inflation which, as we have discussed before (here and here), could be on the way back.

Source: Why the oil & gas sector is energising investors by James Sym, Schroders