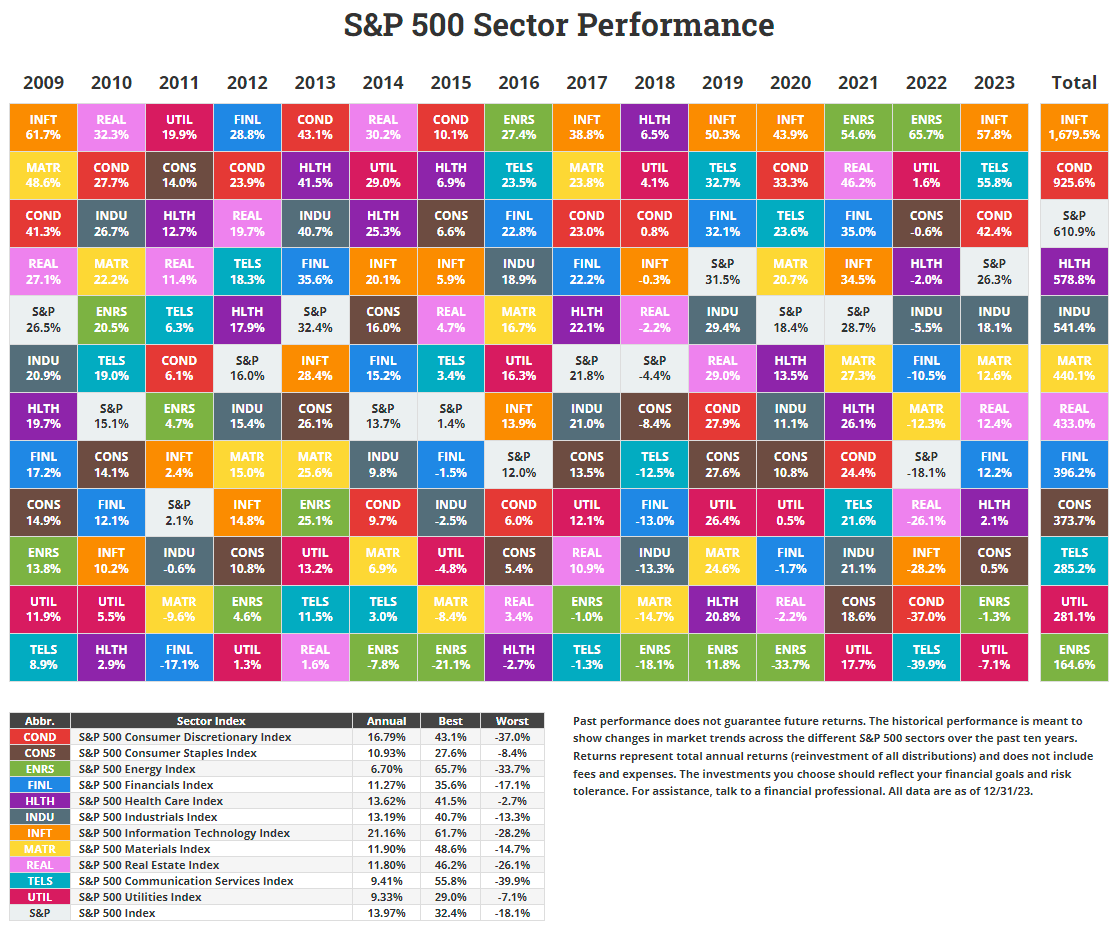

The latest edition of the annual S&P sector performance chart for the S&P 500 was published by Novel Investor this week. In 2023, the best performing sector was the tech sector as represented by INFT, the S&P 500 Information Sector Index. The sector annual return’s was over as astonishing 57%. The next top performers were communication services and consumer discretionary index. The strong returns of consumer discretionary sector shows consumers for the most part did not reduce spending with high inflation levels.

The worst performing sectors were utilities, energy and consumer staples in that order. Utility stocks have not received much love from investors lately since as income stocks they have sever competition from CDs, bonds and other asset classes that pay comparable rates or even better returns. For instance, a 1-year CD paying 5% is irresistible to an investor that might have put the money in utility stocks in the past.

Note: The returns shown below are based on Total Returns which includes dividends reinvested.

Click to enlarge

Source: novelinvestor.com

Source: novelinvestor.com

Source: Novel Investor

Related ETFs:

- SPDR S&P 500 ETF (SPY)

- iShares Core S&P 500 ETF (IVV)

- Vanguard S&P 500 ETF (VOO)

- SPDR Portfolio S&P 500 ETF (SPLG)

The Complete List of stocks in the S&P 500 Index as of Jan, 2024 can be found here.

Disclosure: No positions