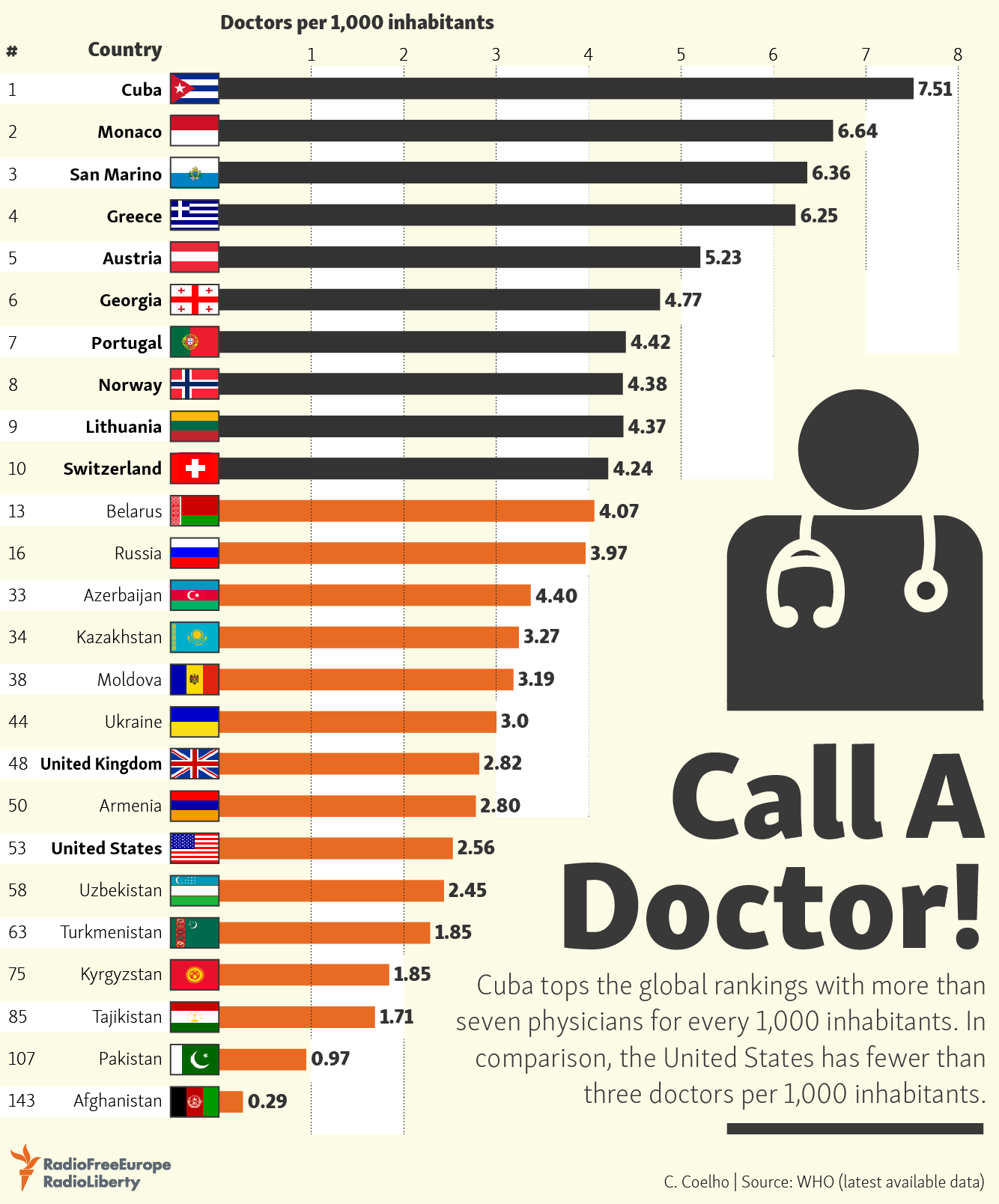

In the US, Cuba is often derided as a communist hell-hole where nothing works and its basically a disaster.Though most Americans tend to believe this oft-repeated propaganda one needs to dig into the details to find the truth. One area where Cuba beats the US hands down by global metrics is the field of medicine – more specifically in the number of doctors available per person in the country.

There are 7 doctors per 1,000 people in Cuba taking the number one spot in the world as shown in the chart below. The US ranks at 53, below Armenia but ahead of Uzbekistan. The US has less than 3 doctors per 1,000 people. No wonder getting a medical appointment especially with a specialist is like trying to get an appointment with the God !

Click to enlarge

Source: Call A Doctor!, RFE/RL