Australian stocks have one of the highest dividend yields in the world. Many firms offer yields of over 5%. Over the long term rising equity prices together with high income,lead stocks to beat bank term deposits in terms of returns. With interest rates offered by banks at historical lows, the gap in return between the assets have further increased. The following excerpt from a recent article shows the superior performance of stocks over bank deposits in Australia:

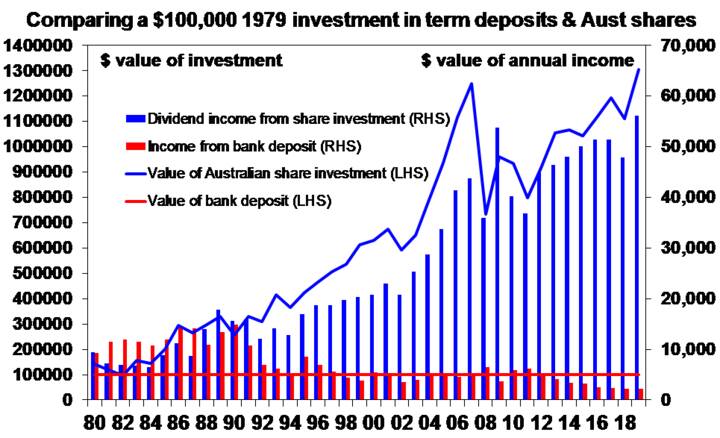

Chart #3 Shares can provide stronger growth in income with less volatility than bank deposits

Investing in shares entails the risk of capital loss, but can offer a higher and less volatile income flow over time. The next chart compares initial $100,000 investments in Australian shares (ASX 200) and one-year term deposits in December 1979 and the income they have provided over time (before franking credits are allowed for in the case of shares).

The term deposit would still be worth $100,000 (red line) and last year would have paid roughly $2200 in interest (red bars). By contrast the $100,000 invested in shares would have grown to $1.31 million (blue line) now and last year would have paid $47,792 in dividends before franking credits (blue bars). The point is that dividends tend to grow over time (because profits and hence an investment in shares tends to rise in value) and are relatively stable compared to income from bank deposits, which vary with interest rate settings. Over the period the worst decline in dividend income from shares was a 32% decline between 2009 and 2011, whereas the income from bank deposits plunged 68% between 1990 and 1994 and by 65% between 2011 and this year. And it’s set to plunge even more given the falls in term deposit rates since June. Once franking credits are allowed for, the comparison would become even more favourable towards shares.

Source: Five great charts on investing for income (or cash flow) by Dr Shane Oliver Head of Investment Strategy and Economics and Chief Economist, AMP Capital

Key Takeaway: Though stocks have the risk of losing entire investment (principal) of a company fails, the outsize returns they provide over the long term cannot be ignored. However diversification is important to reduce the risk of losing principal.

The entire article is worth a read as well.

Related ETF:

- iShares MSCI Australia Index Fund (EWA)

Disclosure: No Positions

__________________________________________________________________________________________________

Checkout also:

__________________________________________________________________________________________________