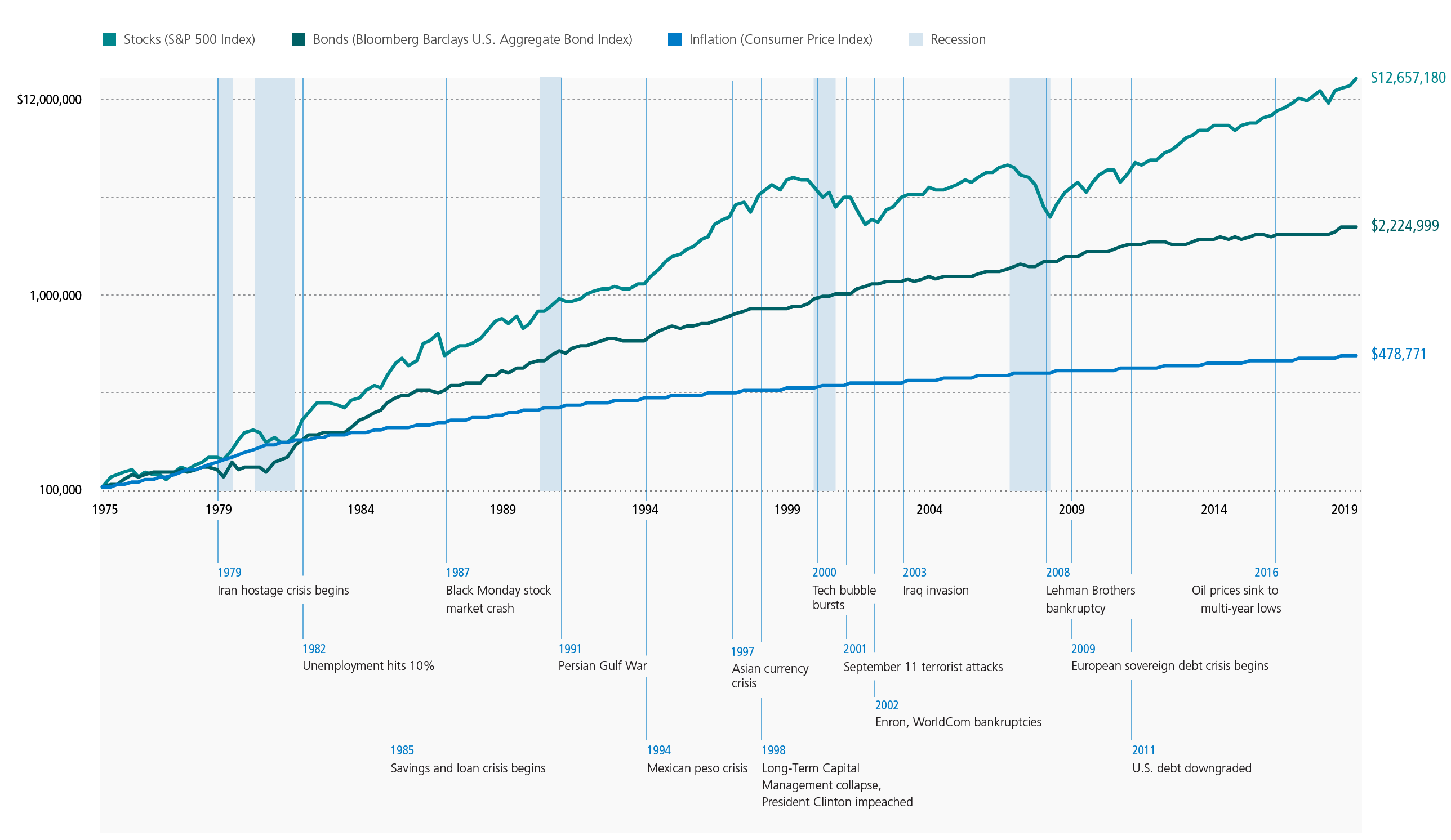

A picture is worth a thousand words the saying goes. The respected Der Spiegel of Germany is known for its excellent graphics. While doing some research I came across the below cover illustration:

Click to enlarge

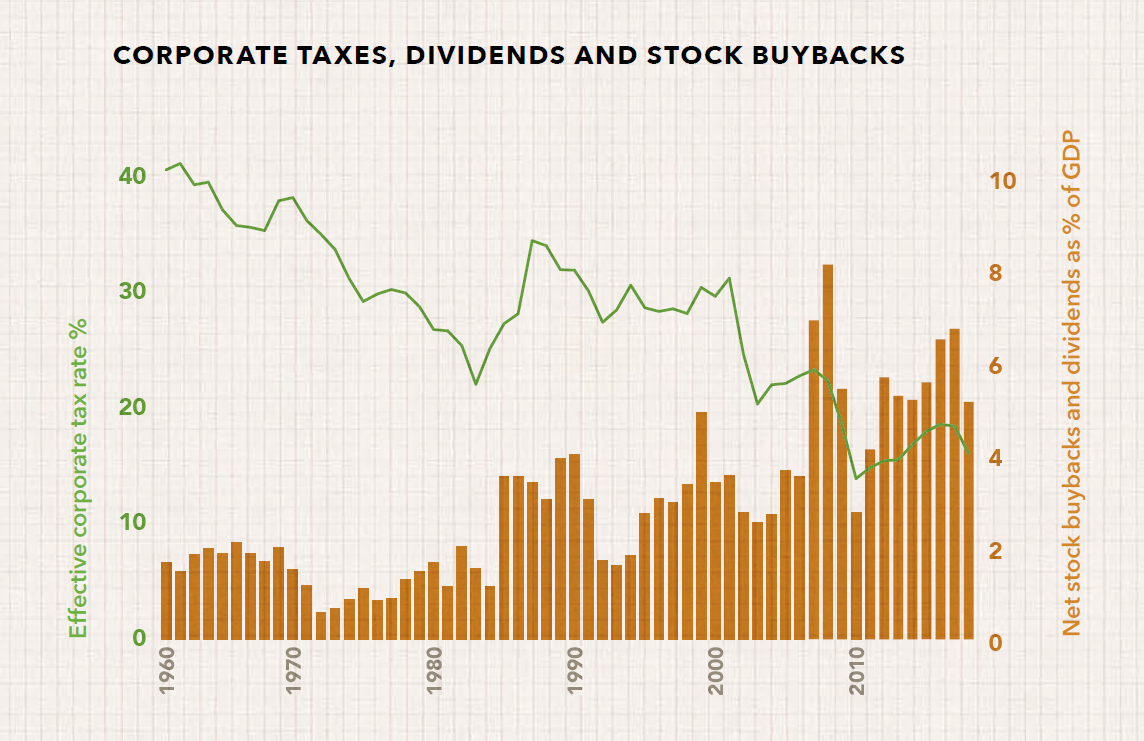

Source: Joe Biden’s Almost Impossible Task, Der Spiegel