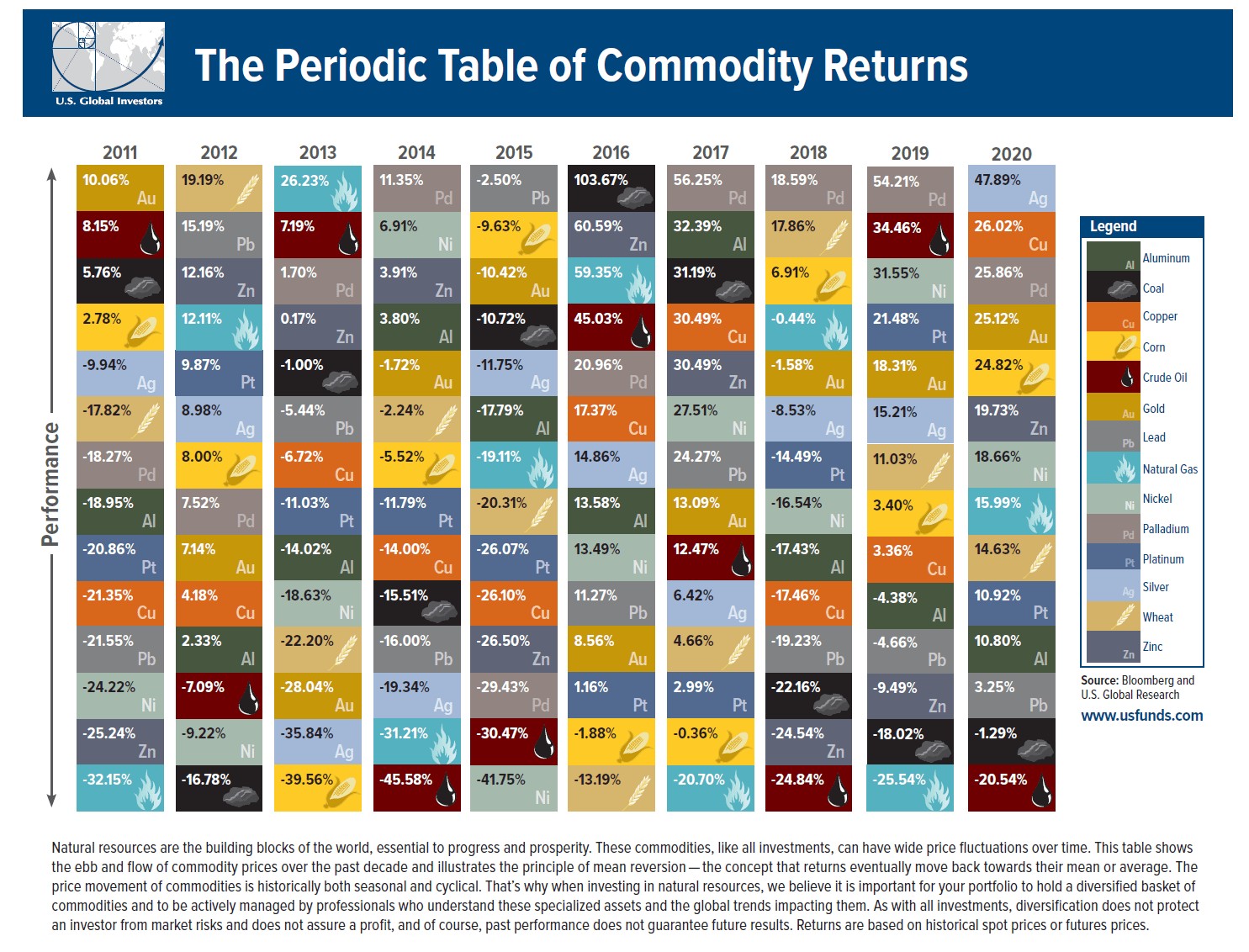

The Periodic Table of Commodity Returns published yearly by US Funds is an excellent tool for commodity investors similar to The Callan Periodic Table of Investment Returns for US equity investors. Silver was the best performing commodity return last year with a return of about 48%. The next top returns came from Copper and Palladium, which was the best performer in 2019. Soaring copper prices in later part of 2020 was a boon to the Chilean equity market as Chile as the world’s biggest copper producers. Accordingly Chilean equities including ADRs shot up in late 2020. As expected, Crude Oil ended up as the worst commodity due to the effects of the pandemic. Gold rose a decent 25% last year.

Click to enlarge

Source: U.S. Global Investors

Related ETFs:

Disclosure: No Positions