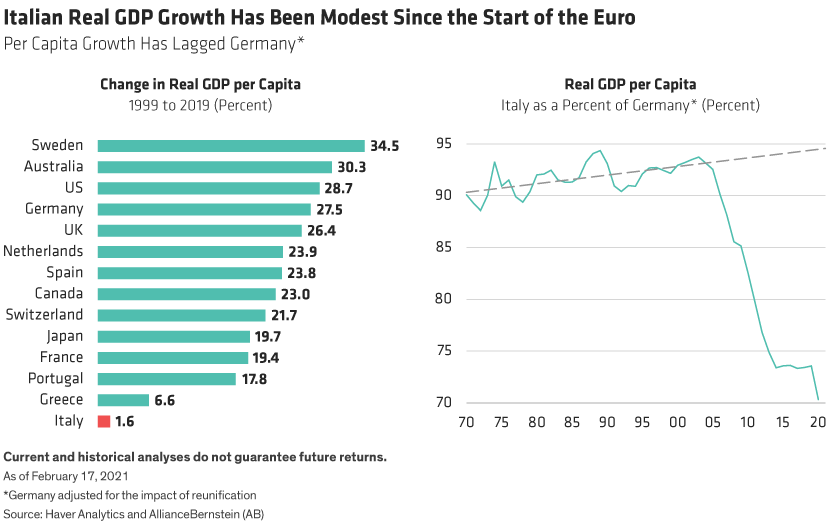

Italy used to be called “The Sick Man of Europe”. More recently a few years ago during the European Sovereign Debt Crisis Italy was part of the PIIGS countries which represented Portugal, Ireland, Italy , Greece and Spain. Over the long term also, Real Italian GDP Growth has been the slowest among the developed world as shown in the chart below. Sine early February, former ECB President Mario Draghi has become the Prime Minister of Italy. It would be interesting to see if Mr.Draghi can help the country finally get out of the long doldrums.

Click to enlarge

Source: Can Mario Draghi Recharge Italy’s Economy?, Alliance Bernstein Blog