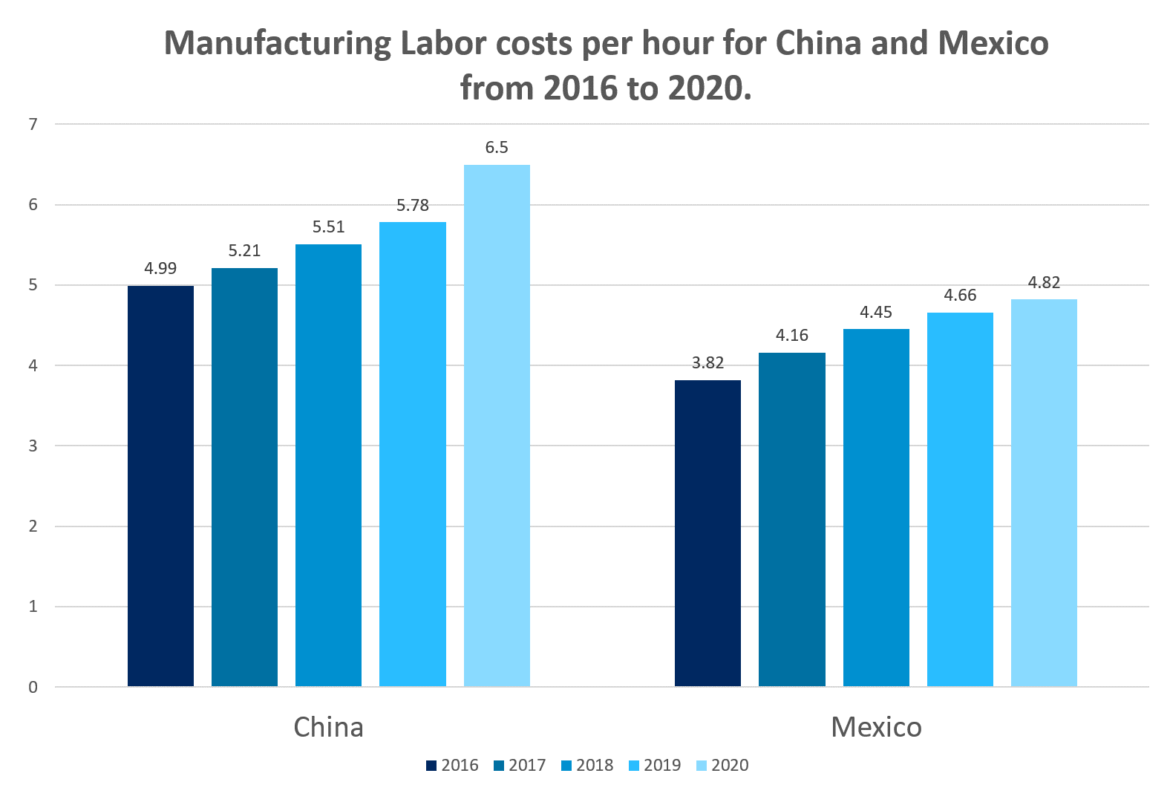

Wage growth for the average workers in the US has been artificially suppressed over the past few decades due to a variety of reasons. However worker productivity has continued to rise year after year. According to EPI, the average worker would be earning $10 more per hour if wage growth kept up with productivity. Since the late 1970s, the wage growth has been unequal between worker categories thru 2019.

For the bottom workforce category wages have increased 26%. But for the top 1% wages have increased by 160% during the same period as shown in the chart below.

Click to enlarge

Source: EPI