One of the beneficiaries of the phenomenon of “friendshoring” since the covid-19 pandemic has been our Southern Neighbor Mexico. Friendshoring is the concept of growing trade with friendly countries. When supply-chain issues became a major problem for companies recently many opted to try friendshoring by locating plants closer to home in nearby countries as opposed to all the way across the globe in China.

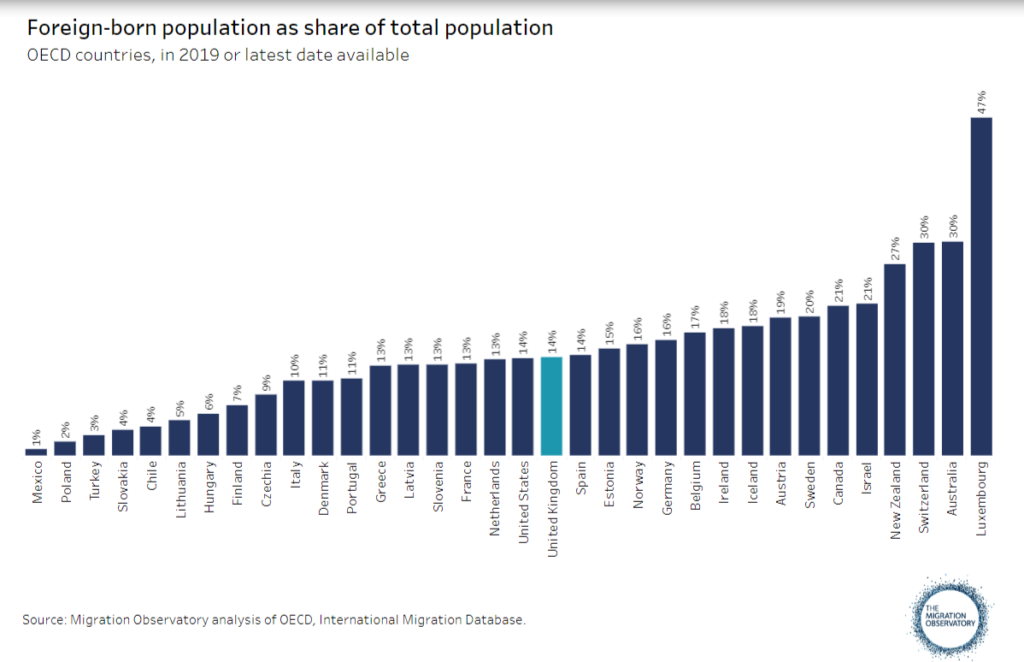

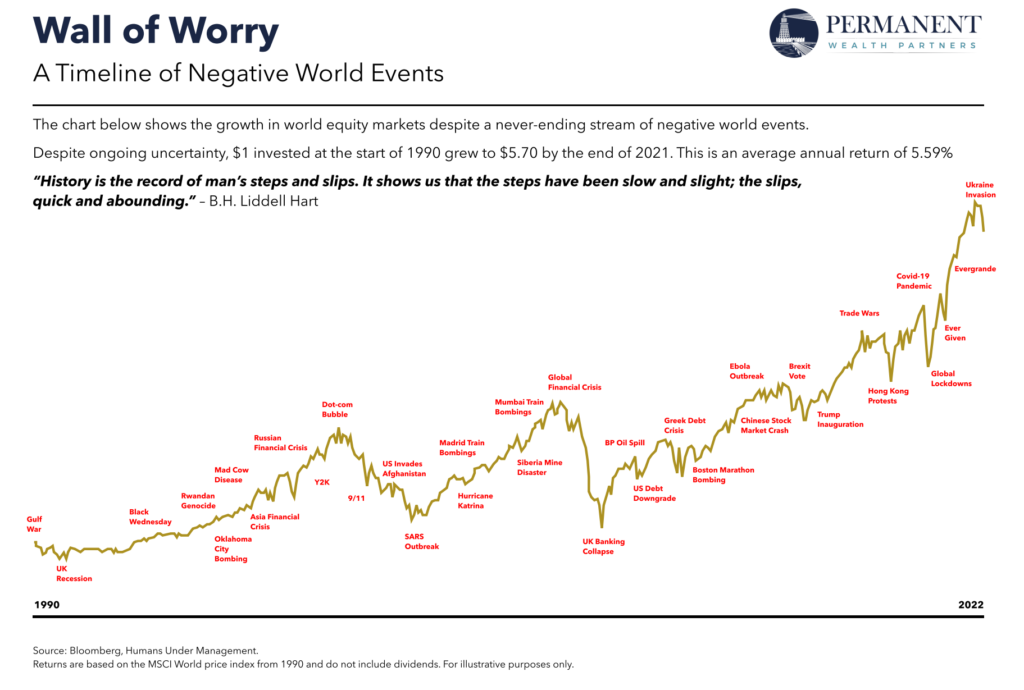

Mexico has traditionally been one of the major trade partners of the US due to its location. For years China was the top trading partner with Canada and Mexico always behind. That changed in 2023 when Mexico was the top trade partner of the US as shown in the chart below:

Click to enlarge

Source: Friendshoring brings industrial-sized investment opportunity, Capital Group

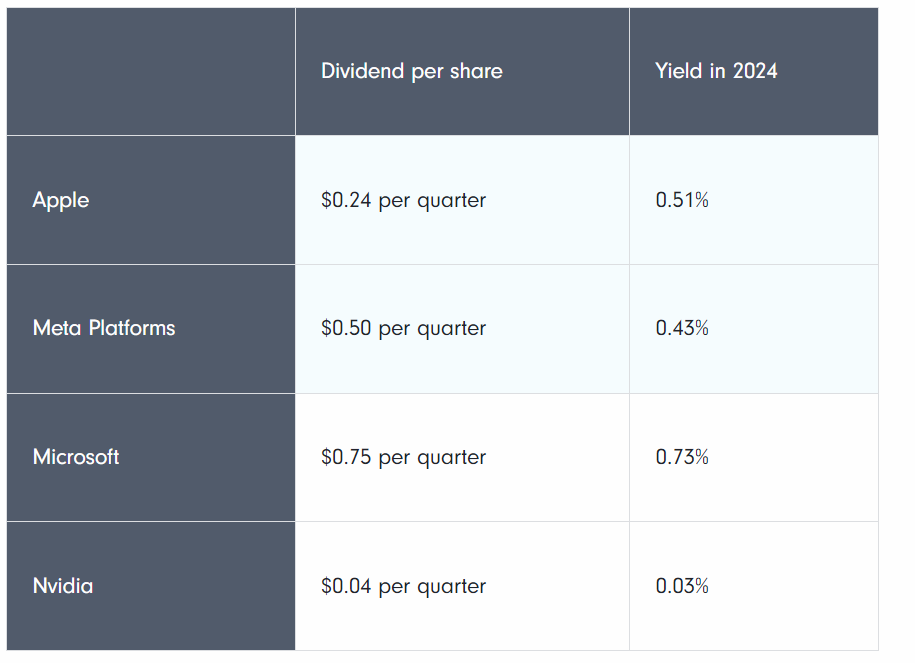

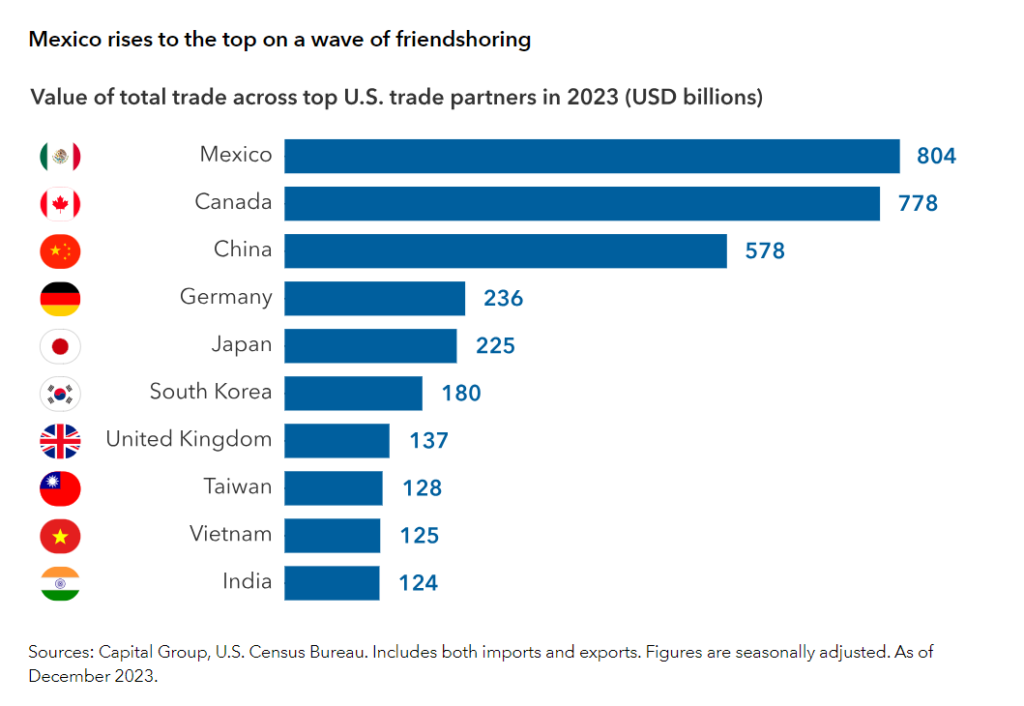

In terms of products exported by Mexico the US, most are finished goods. For instance 75% of all autos assembled in the country are exported to the USA. World’s major auto makers such as Ford(F), General Motors(GM), BMW, Daimler, Toyota(TM) and Honda(HMC) have operations there. Recently EV-champion Tesla (TSLA) announced its plan to open a plant in Santa Catarina, near Monterrey in Mexico. The chart below the top export products from Mexico the US and vice versa:

Click to enlarge

Source: Friendshoring brings industrial-sized investment opportunity, Capital Group

Manufacturing industry labor costs are lower in Mexico than China and Auto workers in Mexico also earn less those their counterparts in China. Hence the wage factor in addition to location and others are a big advantage to Mexico. As the chart above shows, Mexico is also a big exporter of other goods such as computers and appliances as well.

From an investment perspective, Mexico is an excellent choice for investors looking to profit from its booming economy. Currently about a dozen Mexican firms are listed on the US exchanges and a few trade on the OTC market.

Disclosure: No positions