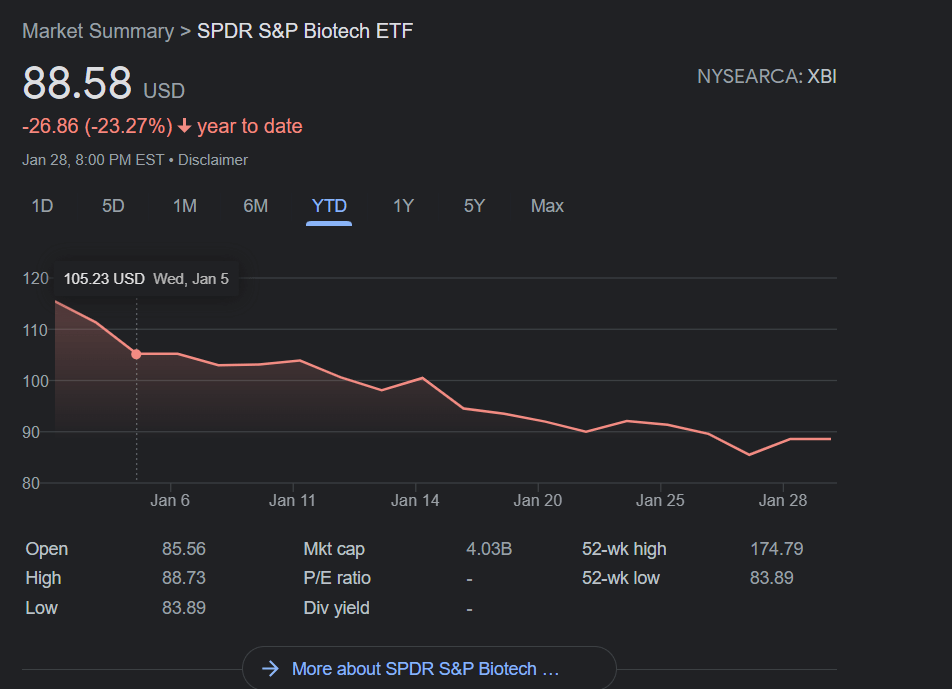

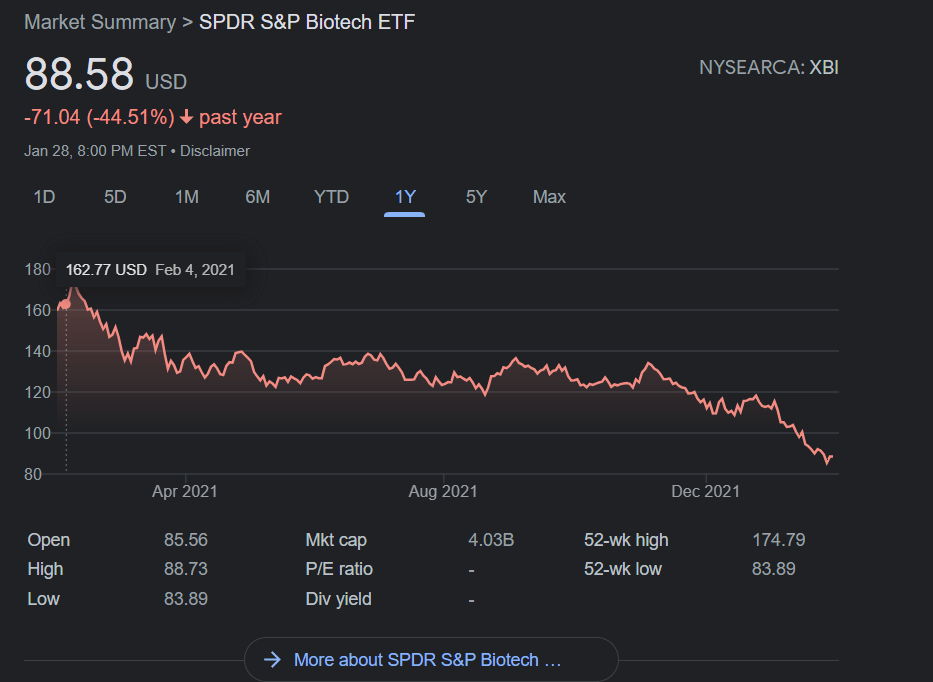

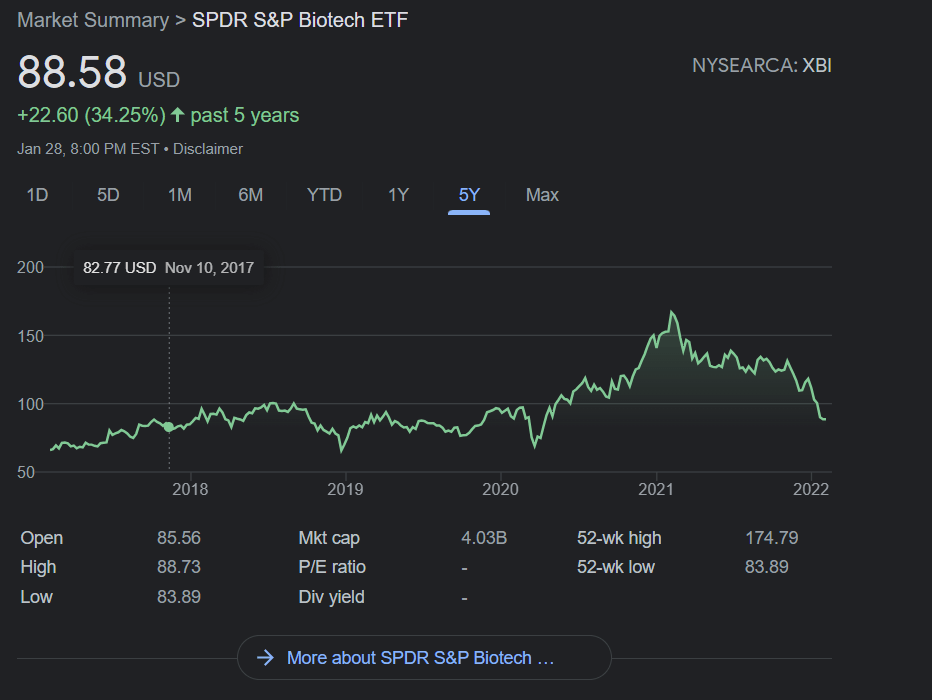

Biotech stocks are not performing well at least so far this year. In the past two years or so the sector was hot due to a variety of factors including discovery of vaccines for Covid-19, M&A, investors’ interest, etc. However none of that seems to be in favor of biotechs now. The following charts of the SPDR S&P Biotech ETF (XBI) show the dramatic decline in the sector YTD.

SPDR S&P Biotech ETF – Year-To-Date Return:

Click to enlarge

SPDR S&P Biotech ETF – 1 Year Return:

SPDR S&P Biotech ETF – 5 Years Return:

Source: Google Finance

It remains to be seen if a catalyst emerges to help biotechs in the reminder of the year. Other ETFs like the iShares Biotechnology ETF (IBB) is down 16% and 21% YTD and 1 year respectively.

Related:

- The Complete List of Biotech Stocks Trading on the NASDAQ

- The Complete List of Biotechnology Stocks Trading on the NYSE

Disclosure: No positions