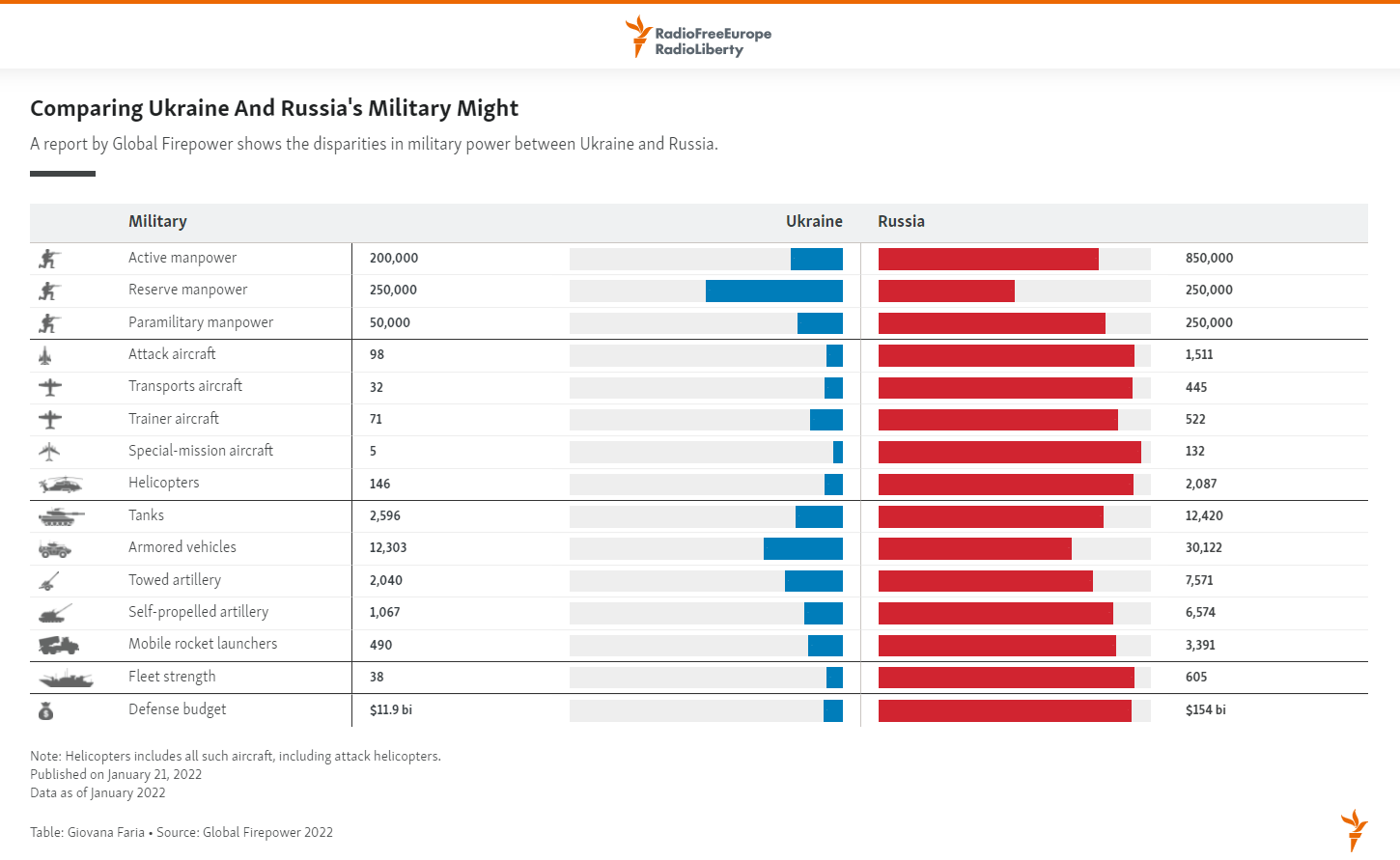

The Russian invasion of Ukraine is now on Day 5. Though it is too early to conclude anything, it appears the war is not going as planned for Russia. An article at The Guardian discusses a few of the early mistakes by Russia particularly the limited use of air force. With that said, the military forces of Ukraine is much smaller than of Russia. The following infographic from Radio Free Europe/Radio Liberty shows a comparison of the military might of the two countries:

Click to enlarge

Source: RFE/RL Infographic