Dividends play a critical role in the long-term returns of equities. Stocks that pay dividends are ideal investment vehicles for building wealth over many years or decades. Generally dividend payers tend to raise dividends occasionally if not consistently each year. So dividend yields of even 2% as a starting point can lead to substantial growth in the long run due to the power of compounding. The magic of compounding comes from the additional shares purchased in small increments each quarter. In bear markets dividends may offer the only return on an equity investment. It is possible to earn a decent dividend income with a well diversified portfolio even when the market goes south.

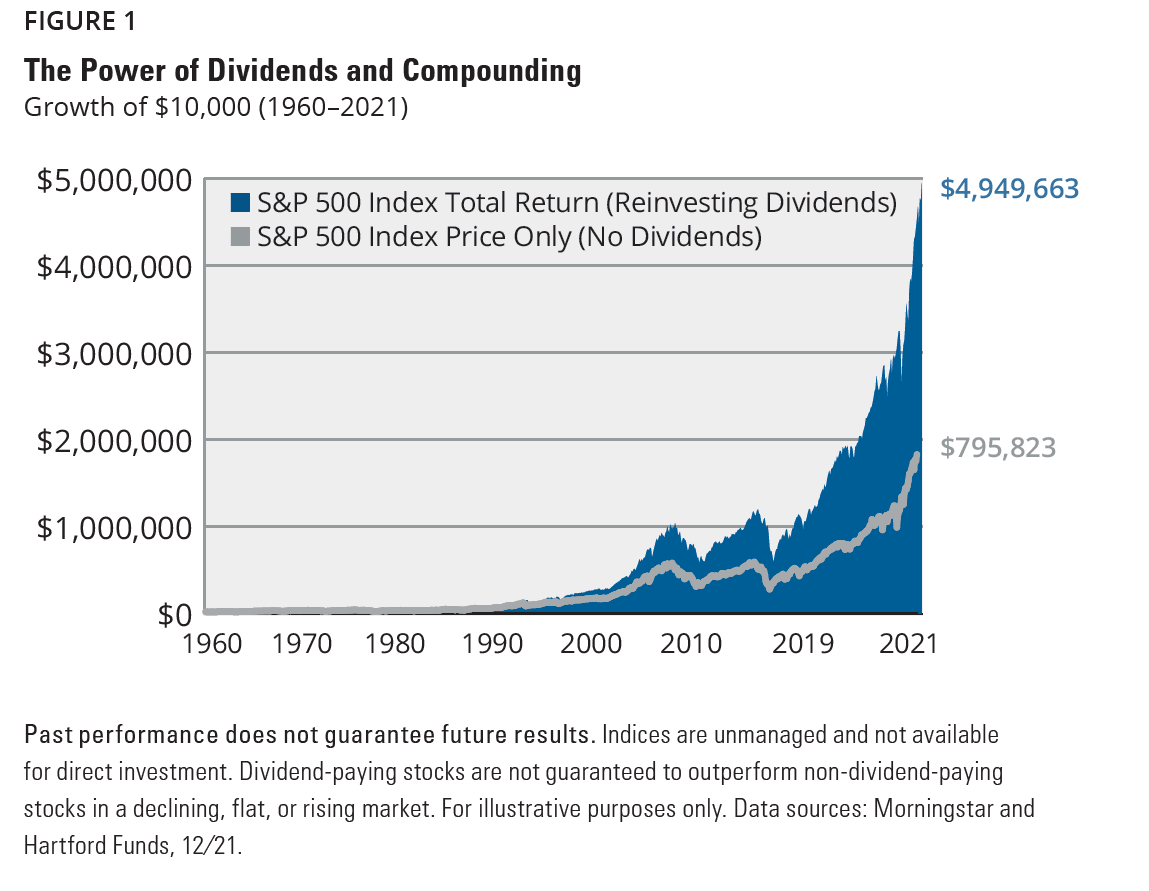

The power of dividends and compounding is vividly illustrated below using the S&P 500 index returns from 1960 to 2021. A $10K investment would have grown to over $4.9 million with the S&P 500 Total Return which includes dividend reinvested compared to just under $800K with the S&P 500 Price Index during the period noted above. The wide gap in returns is indeed astonishing.

Click to enlarge

Source: The Power of Dividends: Past, Present, and Future, Hartford Funds

So the key takeaway is that investors should not ignore dividends. According to the above research report from Hartford Funds, 84% of the total return of the S&P 500 from 1960 to 2021 came from reinvested dividends.

Related ETFs:

Disclosure: No positions