The weapons industry is one of the major industries in the world. In some countries the industry accounts for a significant portion of the economy in terms of revenue, jobs and so forth. In the U.S. for example, defense companies are a source of employment for hundreds and thousands of workers. Similarly in developed Europe, thousands of workers are employed by defense firms. In addition to the need to fight terrorism, the onset of the Russia-Ukraine war in 2022 have made these firms even more critical to countries around the world.

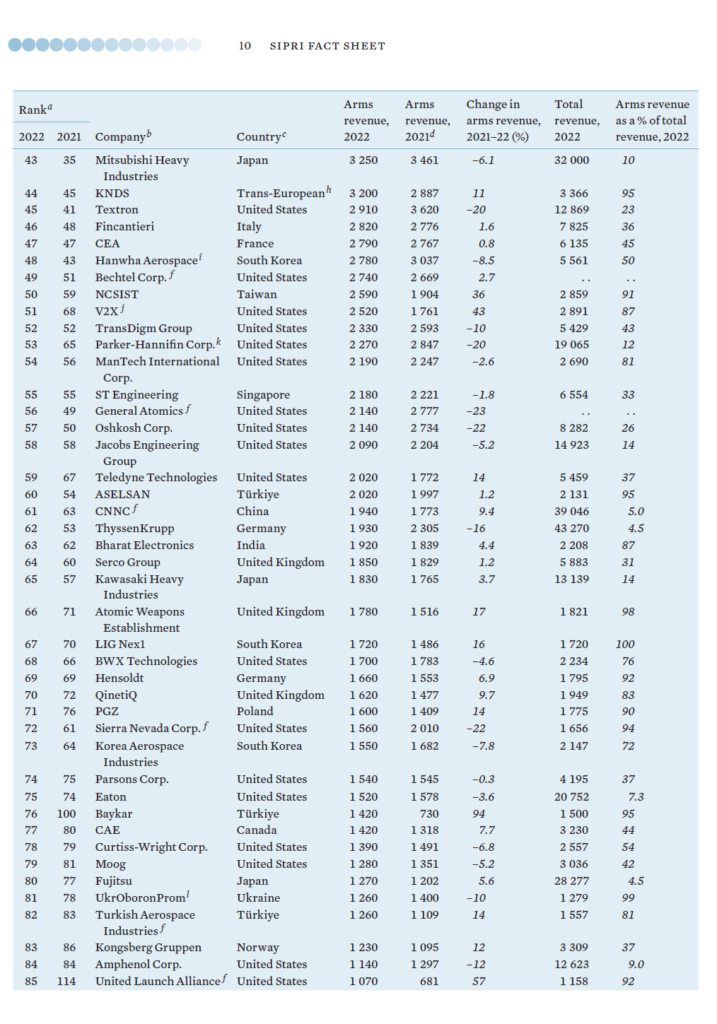

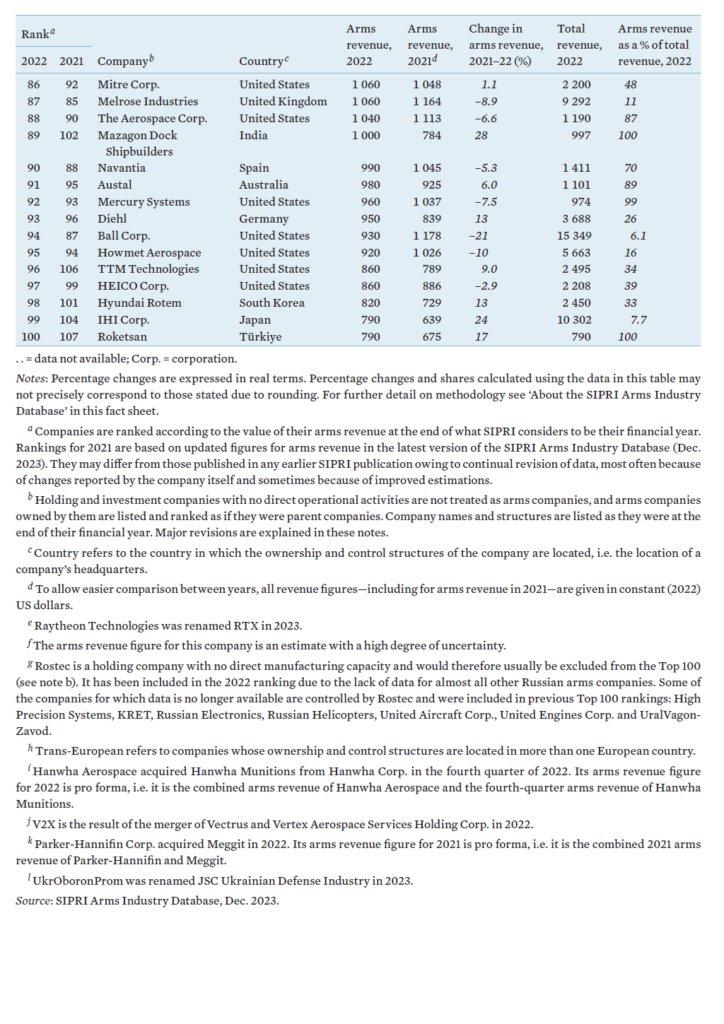

From an investment perspective, many defense stocks offer steady growth and decent dividends. One way to identify firms in this sector is to review the top 100 companies in the world published Sweden-based SIPRI each year and identify potential firms to research. The 2023 report was release late last year with data from 2022.

The following are some key excerpts from the report:

- The arms-revenue from the top 100 companies totaled $597 billion in 2022, a decrease of 3.5% in real terms from 2021.

- Though the Russia-Ukraine war increased he demand for the products produced by these firms, supply chain issues, labor shortages, cost of materials and other factors adversely impacted their production capacity.

- The total arms revenue of the 42 US companies in the list was $302 billion.

- Only two companies from Russia are in the list since many don’t publish data.

The Top 100 Arms-Producing and Military Service Companies, 2022:

Source: SIPRI

Some of the firms listed in the above list include:

- Lockheed Martin Corporation (LMT)

- Boeing Co (BA)

- Northrop Grumman Corporation (NOC)

- General Dynamics Corporation (GD)

- L3Harris Technologies, Inc. (LHX)

- Raytheon Technologies Corporation (RTX)

- BAE Systems PLC (BAESY)

- Airbus Group SE (EADSY)

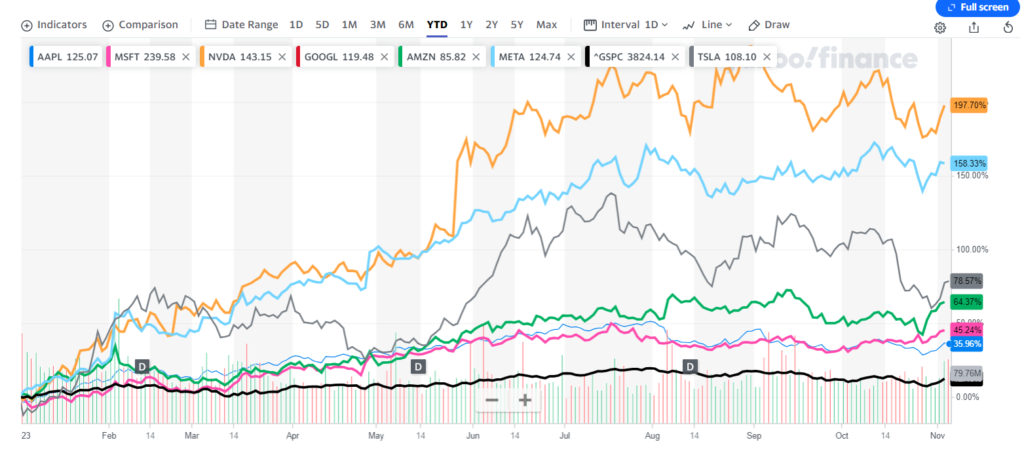

It remains to be seen if defense stocks would have another great run this year. As with the overall market, defense stocks are also richly valued now. So investors may want to wait for pullbacks and add in a phased manner.

Disclosure: No positions