The ADR of Australian Bank Westpac ADR used to trade on the NYSE under the ticker WBK. Westpac voluntarily delisted its ADRs from the NYSE effective January 31, 2022. Hence the last day WBK traded on the NYSE was Friday, Jan 28, 2022. Below is the delisting announcement from the bank’s site:

10 January 2022

WESTPAC BANKING CORPORATION NOTIFIES NYSE OF INTENTION TO DELIST AMERICAN DEPOSITARY SHARESNEW YORK—Westpac Banking Corporation (NYSE: WBK) (“Westpac,” “we” or the “Company”) announced today that it notified The New York Stock Exchange (the “NYSE”) of its intent to voluntarily delist its American depositary shares, each representing the right to receive one ordinary share of the Company (the “ADSs”), from the NYSE. The Company intends to file a Form 25 with the Securities and Exchange Commission (the “SEC”) on January 21, 2022 to delist the ADSs immediately thereafter. The Company expects that the delisting will occur ten calendar days after the filing of the Form 25 so that trading will be suspended on January 31, 2022 prior to the market opening. The Company has not arranged for listing or registration on another U.S. national securities exchange or for quotation of the ADSs in a quotation medium. In line with the Westpac strategy, Westpac has chosen to simplify its share listings to Westpac ordinary shares. In light of this, it is withdrawing the listing of Westpac sponsored ADSs.

Source: Westpac Banking Corporation notifies NYSE of intention to delist American depositary shares, Westpac

The following is the ADR termination notice from the depository BNY Mellon:

NOTICE TO HOLDERS OF AMERICAN DEPOSITARY SHARES (“ADSs”) EVIDENCED BY AMERICAN DEPOSITARY RECEIPTS (“ADRs”) REPRESENTING DEPOSITED ORDINARY SHARES OF: WESTPAC BANKING CORPORATION ONE ADS REPRESENTS ONE ORDINARYSHARE CUSIP: 961214301 AND UNDERLYING ISIN: US9612143019

As owners and beneficial owners of the above ADRs, you are hereby notified that The Bank of New York Mellon, as depositary (the “Depositary”), will terminate the Deposit Agreement, dated May 13, 2013 among Westpac Banking Corporation (“Westpac”), the Depositary, and Owners and Holders of ADRs, the (“Deposit Agreement”).

As a result, the existing ADR facility will be terminated effective Monday, January 31, 2022 Under the terms of the Deposit Agreement, you have until at least June 2, 2022 to surrender your Westpac ADRs for delivery of the underlying shares. If you surrender ADRs for delivery of the underlying shares, you must pay a cable fee of $17.50, a cancellation fee of up to $0.05 per ADRs surrendered and any applicable U.S. or local taxes or governmental charges. Payment should be made payable to The Bank of New York Mellon.

Subsequent to June 2, 2022 under the terms of the Deposit Agreement, the Depositary may attempt to sell the underlying shares. If the Depositary has sold such shares, you must surrender your ADRs to obtain payment of the sale proceeds, net of the expenses of sale, any applicable U.S. or local taxes or government charges and a cancellation fee of up to $0.05 per ADRs.

To surrender your ADRs, the address of the Depositary is: The Bank of New York Mellon, 240 Greenwich Street, Depositary Receipts Division – 8th Floor, Attention: Cancellation Desk, New York, NY 10286. Registered or overnight mail is the suggested method of delivering DRs to the Depositary.

Source: BNY Mellon

Investors holding Westpac ADR may have many questions on what happens next. The following post may provide some answers:

Below are answers to some common questions:

1.Will WBK move to the OTC market and trade there?

I contacted their investor relations. They confirmed the Board of Directors does not plan to move it to OTC. But BNY Mellon or other depositories may create OTC shares with the ordinary shares they own and let them trade there.

2.Can you sell WBK now?

Nope. WBK stopped trading on the NYSE on Jan 28th. So you cannot sell it on the market anymore.

3.So what should you do if you own Westpac ADR?

It does not look like WBK will move to the OTC markets like other stocks in the past. You may want to contact BNY Mellon and confirm this. So your only other options are:

a) To redeem the ADR and receive the underlying ordinary share (or)

b) Receive cash proceeds after June 2nd by surrendering ADRs to BNY Mellon.

“Subsequent to June 2, 2022 under the terms of the Deposit Agreement, the Depositary may attempt to sell the underlying shares. If the Depositary has sold such shares, you must surrender your ADRs to obtain payment of the sale proceeds, net of the expenses of sale, any applicable U.S. or local taxes or government charges and a cancellation fee of up to $0.05 per ADRs.”

To do either of the options, follow the process mentioned in the Termination Notice above.

Once you covert your ADRs to ordinaries then there is nothing to do. You will directly own Westpac shares that trade on the domestic market in Australia. You will have the same rights like any other investor in Australia. You will automatically receive dividends as usual and will be qualified for all corporate actions such as rights offering, voting, etc.

4.Is there a deadline to convert to ordinary?

Yes. You have to surrender your ADRs before June 2, 2022 and receive the ordinary shares.

5.What if you want to cash out the ADRs?

Yes you can. But its possible only after June 2nd. As noted above, once your surrender the ADRs to BNY Mellon and request them for cash payment, they will send the corresponding ordinary shares and send you the sale proceeds less any fees and taxes.

6.What is the ticker of Westpac ordinary?

Once converted you will receive Westpac ordinaries that trade on the Australian Stock Exchange with ticker WBC. In Yahoo Finance, enter WBC.AX.

7.What about the share price and average trading volume for WBC?

The current share price of WBC is A$21.52. As one of the top banks, the stocks is very liquid with average trading volume of 9.2 million shares, per Yahoo Finance.

8.What if you want to sell Westpac ordinary and get out?

If you do not want to own Westpac ordinary shares any longer you can sell it on the Australian market just like any other stock and cash out. Of course, you will pay a commission to execute this transaction on the domestic market in Australia. Other fees and foreign exchange will also impact your proceeds.

9.How many Westpac Ordinary shares (WBC) will you get for each Westpac ADR?

Each ADR represented one ordinary share. So for each ADR you own(WBK) you will receive one Westpac ordinary share(WBC).

Updated (4/24/22):

10.If I decide to convert Westpac ordinary shares, are there are any tax consequences?

No. The conversion to ordinary shares will NOT have any tax impacts. The conversion will not be a taxable event. So a gain or loss will not be realized.

11.Could Westpac a depository program on the OTC markets?

Probably. But that is unlikely to happen in the near future. Their competitor Bank for Australia and New Zealand Banking Group (ANZBY) delisted from NYSE in July 2007. They re-started a DR program on the OTC markets only in December, 2018.

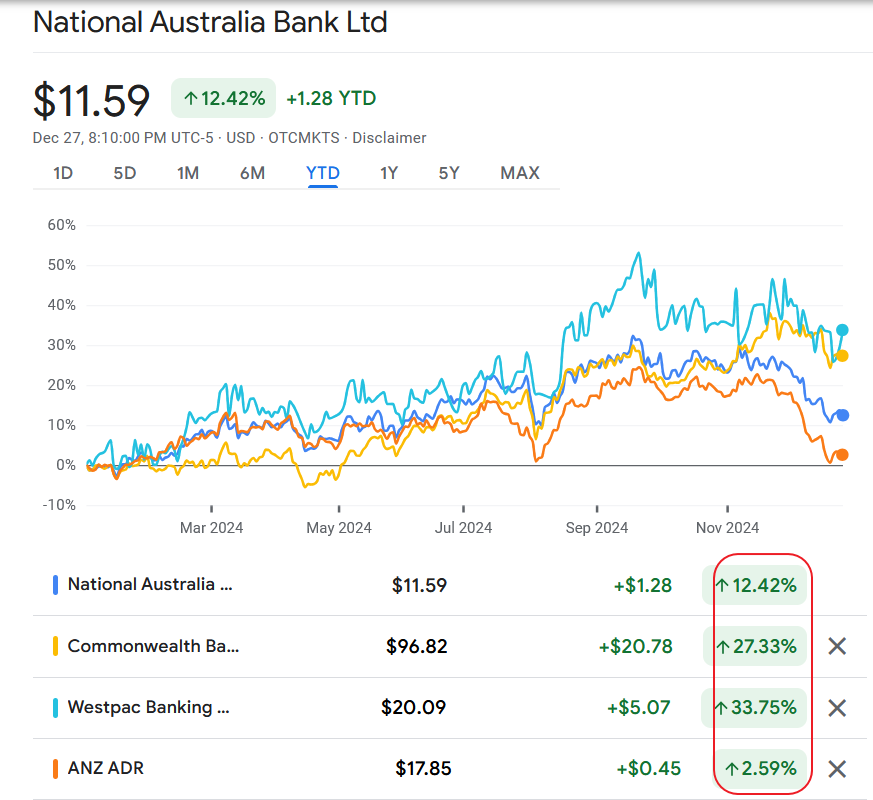

12.Do competitors of Westpac trade on the OTC markets?

Yes. Bank for Australia and New Zealand Banking Group (ANZBY), The National Australia Bank Limited (NABZY), Commonwealth Bank Of Australia Sponsored Australia (CMWAY) and Bank of Queensland (BKQNY) all trade on the OTC markets.

13.Does Westpac trade on the OTC market?

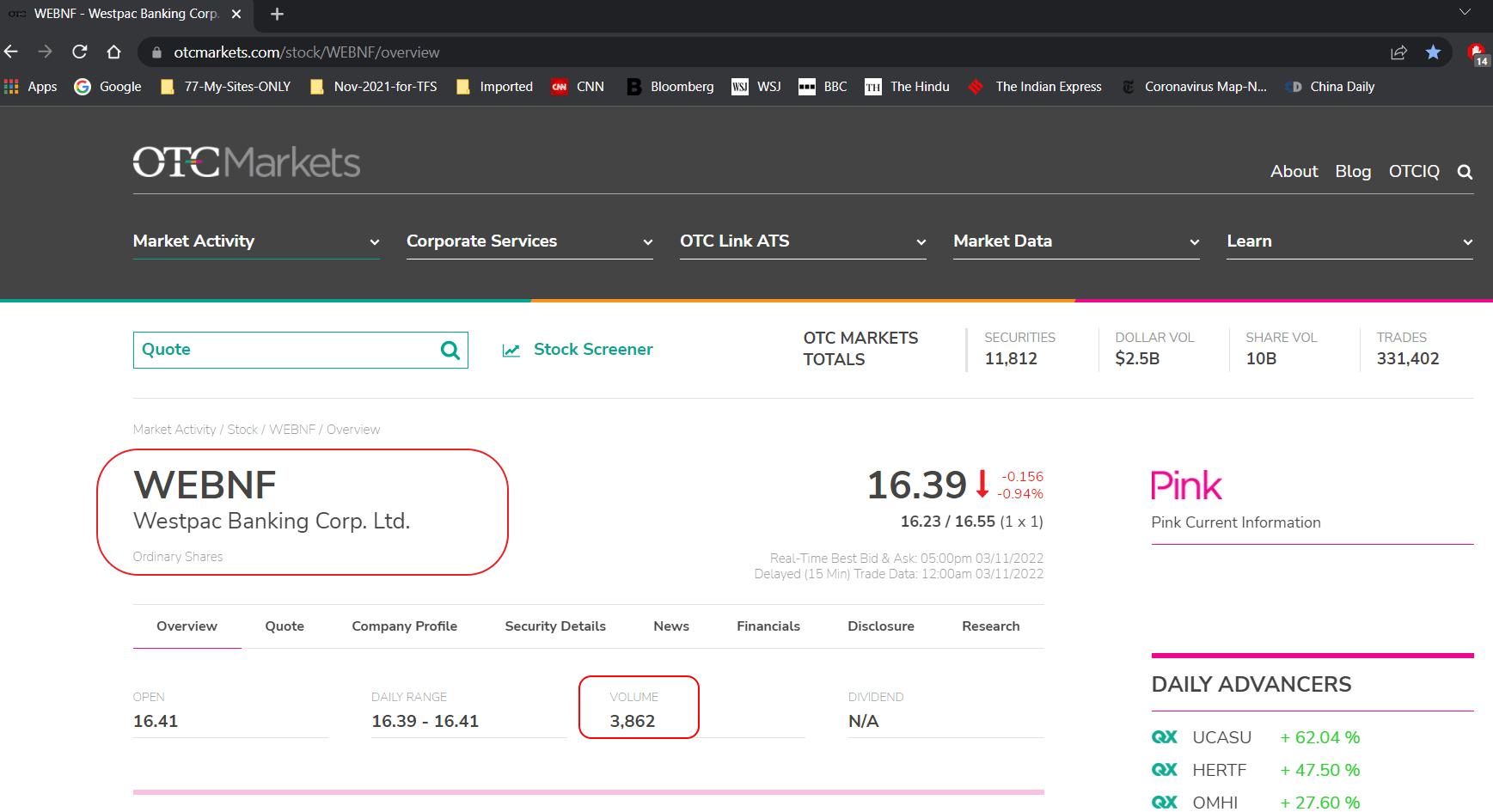

Yes. But with very thin volume under the ticker WEBNF.

14.When I convert to ordinary shares will I get the ordinary on the Australian market (WBC.AX) or the ordinary trading on the OTC market (WEBNF) ?

That depends on the broker. For US investors, Fidelity converted the ADRs to WEBNF per one reader.

15.Will WEBNF pay dividends just like WBK when it traded?

Yes. Absolutely. Your dividend in US $ should be credited by your broker. As of Mar 11, 2022 the dividend yield for WEBNF is 7.61% for a dividend amount of $1.25. The recent dividend payments are below:

11/05/21

Westpac Banking Corp Dividend for WEBNF – $0.4441

05/13/21

Westpac Banking Corp Dividend for WEBNF – $0.4483

16.Where does WEBNF trade and how do I find out the details:

Westpac ordinary on the US markets has the ticker WEBNF. It trades on the OTC market. You can find all the other details at this link:

https://www.otcmarkets.com/stock/WEBNF/overview

Note: Dividend is marked as “N/A” in the screenshot below. But that is incorrect. Dividends will be paid as applicable.

17.How do foreign ordinary shares trade on the OTC market?

Watch this YourTube video to understand the process:

18. Which US brokers allow conversion of WBK to Westpac Ordinary Shares?

- Fidelity Investments – Yes. Contact them directly for fees and other details. Their fee for this service is under $100 and it takes about a week for the conversion to go through.

- TD Ameritrade – No. In order to convert to ordinary shares you have to transfer your ADRs to another broker by opening an account with them. Or surrender the ADRs to the depository before the deadline and receive cash proceeds. TD Ameritrade made a business decision not to perform the conversion to ordinary shares.

- Charles Schwab – Yes. Schwab will be do the conversion to ordinary shares. There is no extra fee for the conversion. But you have to pay the below fees per account. Contact them directly for full details. Schwab Fees for conversion of WBK ADR to WEBNF trading on the US OTC markets:

S.No. Item Amount 1 DR Cancellation Fee $0.05 per DR 2 Schwab Reorganization Fee $39 So for 100 WBK ADRs the total fees will be $69. The conversion process will take 2 to 4 weeks.

- Etrade – Contact the broker directly for details

- Robinhood – Contact the broker directly for details

- Interactive Brokers – Contact the broker directly for details

- Merrill Edge – Contact the broker directly for details

____________________________________________________________________________

Useful Links:

- ADR Conversion Process, Interactive Brokers

- ADR Conversions, Interactive Brokers

- How to Convert ADR to Ordinary Shares, Zacks

- How to Convert ADR to Ordinary Shares, PocketSense

- ADRs, Foreign Ordinaries, & Canadian Stocks, Schwab

Disclosure: Long Westpac

Hi there, just thought I would point out that it appears that cash will be given in lieu of ordinary shares. The Corporate Action Notice I received had this statement ‘HOLDERS WHO DO NOT WISH TO EXCHANGE THEIR ADRS WILL RECEIVE CASH AND NEED NOT SUBMIT INSTRUCTIONS.’ Mind you it will be after June 2, 2022.

Yep that is correct I missed to note that part. I will update the post.

Thanks for pointing it out.

So much for that trip to Australia. That’s $700. Crookery,i tell you. Shenanigans.

I purchased WBK only a short time ago ( 12/27/2021 ) in my taxable US brokerage account, so was very surprised when I learned Westpac was discontinuing their sponsored ADR. On 01/27/2022 I instructed my broker to tender my shares for conversion to the underlying foreign ordinaries. I much prefer to receive shares in WBC:AU than WEBNF. WEBNF seems to have very thin volume, and the dividend was discontinued a few years ago. Because I anticipate holding long term, higher foreign trading costs aren’t a dealbreaker, the higher trading volume on the Australian exchange should make for better bid/ask spread, and the currency conversion of the generous dividend and foreign tax would have been baked into holding the ADR anyway. Your article was very informative and reassuring.

Wow. That’s a lot of money. Its incredible how much they charge for this.

Thanks Thomas for the kind words. Glad you found it useful.

Yes that’s a good point. I did not research much into WEBNF. My broker’s site shows the dividend yield for WEBNF but I am not sure if it will be paid automatically.

I also plan to convert my shares to the foreign ordinaries (WBC:AU) and hold it for the long-term. The dividend rate is excellent and I can’t get that rate with any of the US banks or even Canadian ones. Hopefully my broker won’t charge too much for the conversion.

I also owned WBK. After June 2nd, how many underlying shares will hit the ASX and what will that do to the market price I wonder. Do ADR programs have a set number of underlying shares or is that dynamic based on trading needs? So in this instance, I wonder how many total shares of Westpac was in the ADR program.

I am in Canada and my broker informed me that it will cost me $250 per trade for any trade outside Nasdaq, NYSE and TSX. But like many of you, should I opt to convert to WBC on the AXS, It will be a long term hold.

I also wonder if the local US & Canadian brokers will charge a fee to deliver dividends. I will be calling my broker to find out about this.

David Hunkar: my update—on 02/07/22, my conversion finalized in my account, and, to my chagrin, I received WEBNF, not WBC. AX. I talked with a trading specialist at Fidelity today and he insisted that the shares I received are identical to the Australian-denominated ordinaries, and that they are/will paying/pay a dividend. I decided to stand down because I didn’t perceive a willingness on Fidelity’s part to provide a do-over, and maybe owning the otc F shares will be more convenient and cheaper than the Australian ordinaries. Fingers are crossed.

I came across this YouTube presentation by OTCMarkets Group which answered a lot of my questions about foreign ordinaries ( identifiable by a five letter symbol which ends in F ), who creates them , why, how they increase the pool of interested investors in foreign companies from a home market into the American investor pool by making foreign shares more conveniently traded on US platforms via the NASDAQ otc market.

https://youtu.be/qXP_81BOVhY

The number of Westpac shares in ADR programs is dynamic – can change based on trading needs. You can find out how many shares were held for the ADR program last by reaching to BNY Mellon.

Yes trading in foreign markets is expensive. I think they may not charge a fee to deliver dividends but may earn some fees in foreign exchange conversions.

Good Luck !

Hi Thomas

Thanks for the update. Glad you were able to complete the conversion. I am not surprised that you received WEBNF and not WBC.AX. I saw in my broker’s site dividends will be paid as usual on the WEBNF shares. I would not worry too much about owning WEBNF shares. You still own Westpac stock and as long as you are not trying to sell thousands of shares instantly one day you are ok. Who owns volume may pick up more as months roll by.

And thanks for the Youtube video link. I will add it to my post soon.

I am yet to start the process. Have reached out to my broker.

Happy Investing !

Hi Thomas

QQ. How much did Fidelity charge you for the conversion? Just curious.

How did you convert these WBK ADR’s? I am not too sure on what I need to do in this regard and its starting to stress me out!

I haven’t converted my ADRs yet. Found out my broker would not do it. So I am looking for another to open an account and transfer them there for conversion. Check out the post again since I updated with a few more questions.

No need to stress out. Reach out to your broker and then go from there.

Good luck !

I own 100 shares of wbk adr If I were to do nothing, would I eventually receive a cash payout after June 2. Am I required to send my adr shares to Bny Mellon? THIS HAS BEEN A LESSON IN BUYING ADR’s!!!!

Yes. You must surrender the ADRs to BNY Mellon to receive the cash proceeds. But you cannot do it yourself. Your broker has to do that. So contact your broker and ask them to surrender your ADRs.

“Subsequent to June 2, 2022 under the terms of the Deposit Agreement, the Depositary may attempt to sell the underlying shares. If the Depositary has sold such shares, you must surrender your ADRs to obtain payment of the sale proceeds, net of the expenses of sale, any applicable U.S. or local taxes or government charges and a cancellation fee of up to $0.05 per ADRs.”

I know its a pain with ADRs. But this was totally unexpected from Westpac. They could have easily moved to the OTC and made it smooth for investors. Apparently they don’t care about investors especially US-based ones !! Very unprofessional and pathetic. Especially since other Aussie trade on the OTC markets.

I have Westpack ADRs on a dividend reinvestment program with BNY. How to I convert these to the underlying shares? Thanks.

You have to contact them directly to convert to the underlying shares. Since they are the depository they should be able to do this easily for you. Hope this helps.

I contacted BNY and they say I need a broker to do it. Do you know a broker that can do it? Thanks

Oh ok. Fidelity and Schwab would do it. Contact them. Yw.

Thanks for all of the info. I had no idea Westpac WBC was an ADR when I made the purchase and the information from Fidelity in their Corporate Action section was of little value. I had to call and talk to them at the International trading desk for better insight. This forum is still better than anything they said. It sounds like taking the one for one conversion is the best route. If we wait till Melon disposes of the share, we could lose even more money.

Thanks. Glad you find the info on this site useful. Yes its better to take the conversion now than wait. This delisting was totally unexpected.

I had my WBK shares on robinhood and I’ve tried moving them to another broker to try to convert shares but it seems like no one is willing to transfer the shares, does anyone have any insite or advice on this?

Sorry for the delay. Yes there are a couple of brokers – Schwab and Fidelity – that will do the conversion. See one of the questions below for more details. Good luck!

I found this site useful for info on Westpac delisted ADR’s

Does anyone have any info on conversion and or selling of CNOOC Adr’s?

CNOOC ADR was delisted in March 21 from the NYSE. Its too to do the conversion. Selling also is not possible since it is not trading.

https://www.cnn.com/2021/03/01/investing/cnooc-nyse-delisting-intl-hnk/index.html

https://topforeignstocks.com/2021/02/27/chinese-oil-company-cnooc-to-be-delisted-by-nyse/

Anyone got they shares payed out yet? Or know how long it will take roughly after 2nd of June.

Your answer is greatly appreciated! 🙂

Hello, David Hunkar. I came across your question on how much Fidelity charged me long after you asked—I hadn’t been to your site for a while, and then work and exhaustion kept me from looking back for an answer. Sorry about that.

Fidelity charged me a total of $32.72 for the entire tender conversion process ( 650 shares ) from WBK to WEBNF. Very reasonable.

I was very happy with WEBNF’s price performance, until very recently it seems that the entire Aussie banking sector has swooned. Perhaps a recovery will ensue for patient holders. Fingers crossed.

Yesterday, 06/24/2022 was the payable date for Westpac’s first half dividend. As of yet, I haven’t seen it. And I am fully able to understand that there may be more time required for an F share dividend to appear in one’s brokerage account, given all the steps required, currency conversion, etc. I’m wondering if any WEBNF holders have seen this dividend yet. I’m keeping the faith that it will appear. Given the explanation that these F shares are in all important senses, ordinaries, it only makes sense that if the home exchange shares pay a dividend (WBC.AX), then the OTC Pink F ordinary shares should pay it also. Again, fingers crossed. Cheers!

Final update: I did receive the June 24th payable Westpac dividend into my Fidelity brokerage account yesterday ( the 27th ) and I’m very pleased. I can totally understand that processing it, given the process of currency translation and other cumbersome steps to get it from this large Australian bank into my US account would take a few days. I’m now a fully converted proponent of these OTC Pink ordinaries as a way of including some really fine, off-the-radar, foreign company shares into one’s investment mix. Given Westpac’s size and glorious financials, they are one investment that I can set it and forget it, and let their fat semi-annual dividend regularly sluice into my account.

Sorry for the delayed reply. I converted mine to the foreign ordinary. Looks like you should receive your cash proceeds after July 6th.

See BNY notice here:

https://www.adrbnymellon.com/files/ad1007007.pdf

Hi Thomas

Thanks for the update.

Sorry for my late reply as well. Yes Fidelity’s fee was indeed reasonable. Glad everything worked out smooth for you and you received the dividend also.

For me, Schwab charged $39 plus the $0.05 per ADR cancellation fee. This was not bad. Since I had multiple accounts I had to pay this for each. That is understandable. I also received the first dividends on these foreign ordinaries on June 27th. So I am happy about that.

I will look into other great firms that trade as foreign ordinaries.

Thanks and Good Luck !

Hi All,

I found this information very informative, THANK YOU.

QUESTION: Someone had WBK shares from the now defunct ADR program on the NYSE but converted these into ordinary shares held on the Australian Stock Exchange under the ticker WBC.AX, how can you locate the cost for this conversion? This would need to be known as someone would like to sell them at some point and would be required for tax purposes.

Do you go back to the broker for details of the conversion?

Is there a website one can go to for this information?

Kind Regards

Art

You are welcome.

Yes. We can find the cost for that conversion to the ordinary shares WBC.AX from the broker that performed the conversion. Fidelity, Schwab, etc. charge about $39 like I mentioned in the post and related fees. Reach out to the broker for all the details on the cost. There is no website to find this info since each broker charges different fees and some don’t even do the conversion.

You can also review the monthly statement for the month the conversion happened and that should have the details you are looking for.

Hope this helps.