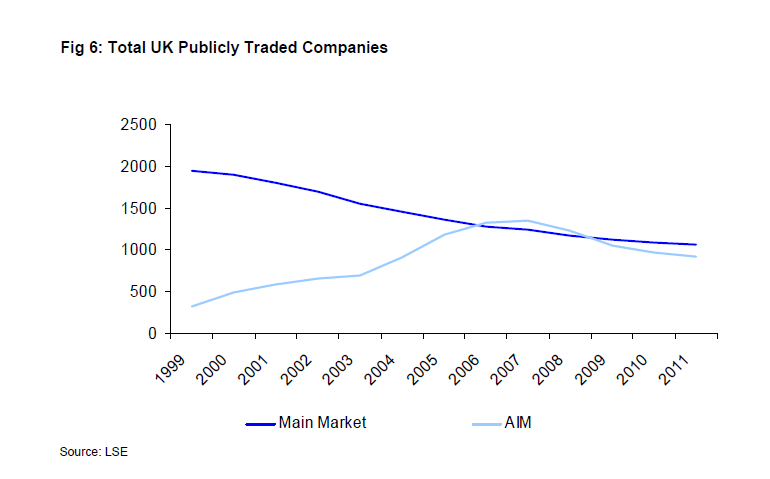

The total number of British companies traded publicly on the equity markets continue to decline for many years due to many reasons. Unlike in the past, many companies do not find a compelling need to go public. In addition, companies are able to fund their capital requirements through internal funding and issuing debt. The explosive growth of the private equity industry is also averse impacting the number of listings. Rise in M&A activity also leads to fewer publicly listed firms.

The U.S. market also fewer listings today due to the reasons mentioned above.Most of the high tech companies going public accumulate most of their funding before they list their shares on the market. In fact, the prospectus of Facebook IPO stated “we do not currently have any specific uses for the net proceeds planned”.

The total number of publicly traded companies on the London Stock Exchange’s all markets at the end of September, 2012 is 2,500 compared to 2,938 in 2011. Currently less than 1,000 companies trade on the Main market.

Click to enlarge

Source: THE KAY REVIEW OF UK EQUITY MARKETS AND LONG-TERM DECISION MAKING, Final Report, June 2012, The Department for Business, Innovation and Skills, UK

Hence it can be argued that a public listing is no longer considered a prestigious event or a natural progression of business growth for most companies. While there has a been a flood of IPOs on the market, it should be noted that most of these are worthless companies hyped up by Wall Street to earn investment fees and greedy Silicon Valley venture capital firms waiting to unload shares on the unsuspecting public and move to the next big fad. The disastrous stock performance of recent IPOs such as Facebook(FB), Zynga Inc (ZNGA), Pandora Media (P), Groupon Inc (GRPN) and Angie’s List Inc. (ANGI) are some examples.

Related ETF:

iShares MSCI United Kingdom Index (EWU)

Disclosure: No Positions