Gold is widely known as a safe haven asset by most investors. During the credit crisis gold prices reached record high levels. Last year gold prices hit an all-time high on the heels of the U.S. debt downgrade by Standard & Poor’s and the European debt crisis. As the hype over gold continued many experts predicted that prices would fly past $2,000 an ounce. But that hasn’t happened yet and today gold futures for Februray delivery settled at $1,620.10 on the New York Mercantile Exchange.

Instead of blindly seeking shelter in gold during economic distress, investors may want to ask themselves if gold as an asset class has delivered positive real returns over longer periods and if the performance of gold is better than stocks and bonds. A research report by Alliance Bernstein last year noted that gold is not a better performer compared to stocks and bonds.

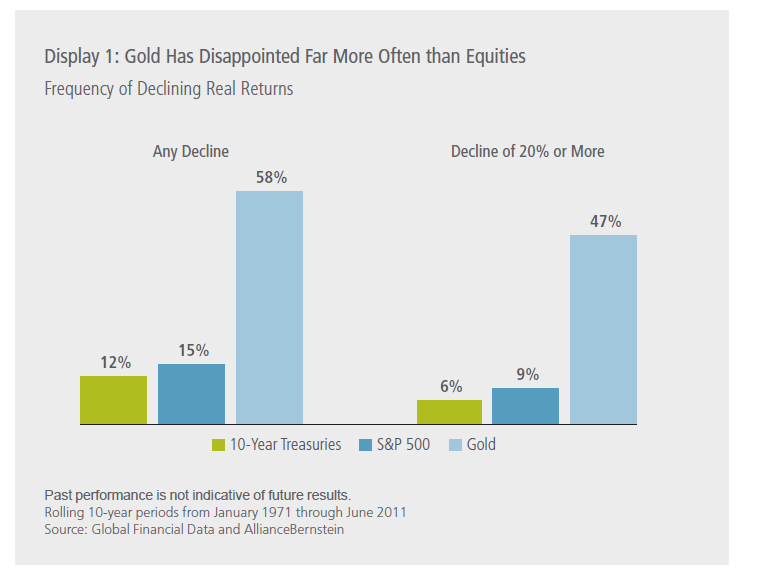

Click to enlarge

Source: What’s Safe?, Alliance Bernstein

From the report:

Looking at the longer-term safety track record of various asset classes reveals some big surprises (Display 1). After adjusting for inflation, gold has delivered negative real returns in 58% of all rolling 10-year periods since 1971, far worse than stocks or bonds. Even more astonishing, gold’s purchasing power declined 20% or more in 47% (nearly half!) of all rolling 10-year periods.

Meanwhile, 10-year Treasuries have lost purchasing power in 12% of the 10-year periods since 1971, and in half of those cases, the loss in purchasing power was 20% or more.

Maintaining a balanced mix of stocks and bonds has provided somewhat better protection against drops in purchasing power over the long term than Treasuries, and far more protection than gold. Adding additional asset classes can provide even more protection.

Related ETFs:

SPDR Gold Shares ETF (GLD)

iShares COMEX Gold Trust (IAU)

Global X Gold Explorers ETF (GLDX)

Market Vectors TR Gold Miners ETF (GDX)

Disclosure: No Positions