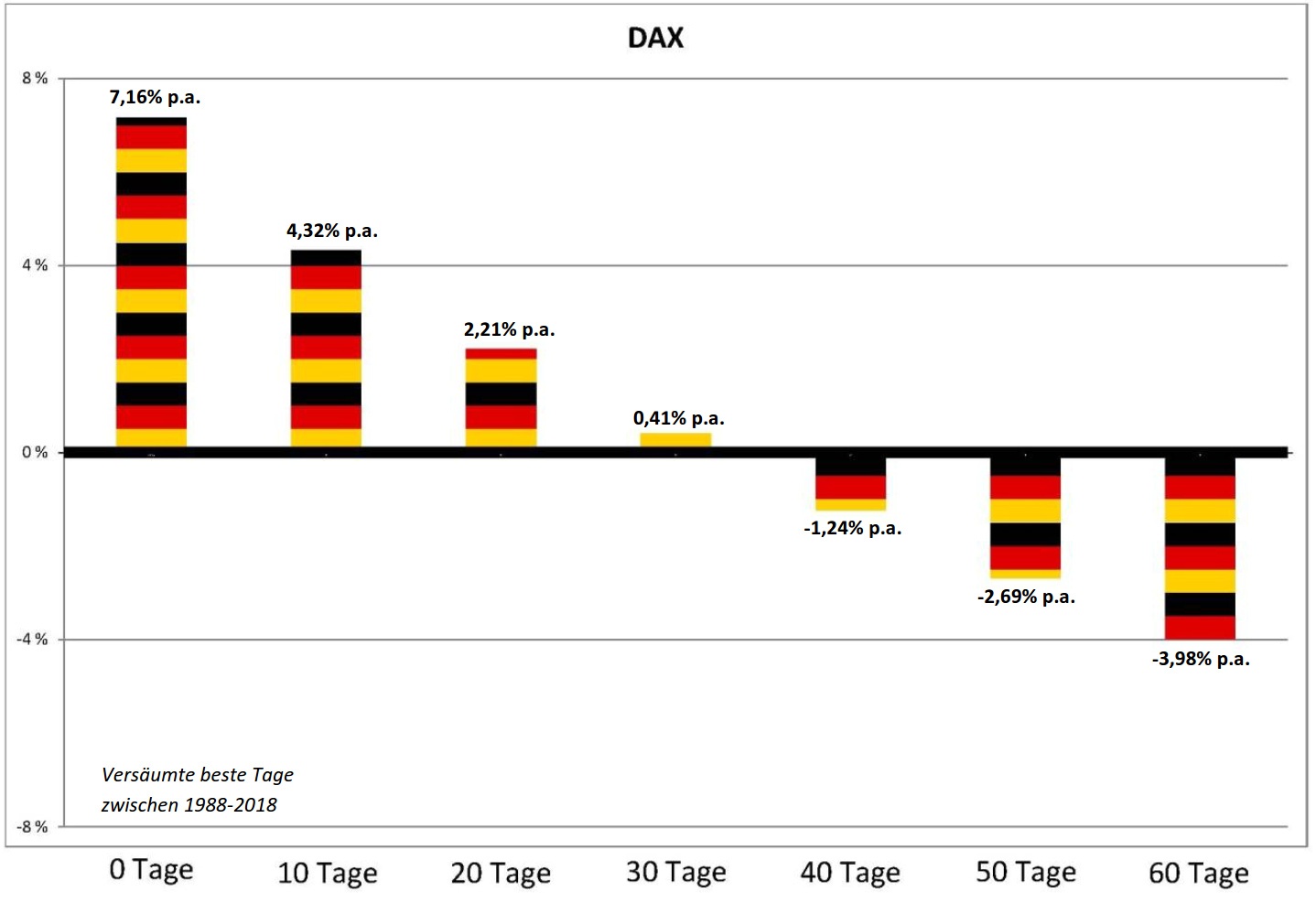

One of the critical factors that determines success with equity investing is the ability to stay invested not only during bull markets but also during bear markets. As the saying goes time in the market is important than timing the market This is because bear markets are followed by bull markets and vice versa, More specifically spectacular market crashes are often followed by violent up moves. If an investor misses these days then return on an investment can get reduced substantially. In a research study done by Sutor Bank of Germany it was observed that the DAX returned an average of 7.2% per year for the 31 year period from 1988 to 2018. But if an investor missed just the 13 best days in that period then the return was halved. This is indeed shocking!. As I mentioned earlier catching the violent up wave is important to boost returns.

From the study:

DAX: invested for 31 years = 7.2% per year; without 13 best days = return halved

Since it was founded on December 31, 1987, the Deutsche Aktien-Index (DAX) has brought investors an average return of 7.2 percent year after year – if you have invested a good 8,000 days continuously. Even temporary slumps in the course of crisis situations such as the bursting of the Dot.com bubble, Lehman, Fukushima or Greece are already taken into account.

“The history of the stock market teaches us that in six out of ten cases, the best stock market days followed within two weeks of the worst. That is noticeable, but again not a rule, otherwise you could bet on it, ”explains Lutz Neumann, Head of Asset Management at Sutor Bank. “It becomes critical if you sell for fear of a stock market low, then don’t go back into the market in time, and then miss the best trading days. Because that has dramatic effects. ”

Chart 1: DAX (invested every day) vs. DAX with no best 10/20/30/40/50/60 days

Source: Sutor Bank; Observation period: 1.1.1988-31.12.2018The analysis of the Sutor Bank showed: for an investor who missed the best 13 days in the DAX between 1988 and 2018, the return shrinks by half. If he missed the best 33 days, he would even have lost money. To put it even more pointedly: Anyone who did not invest only 0.4125 percent of the decisive trading days in the 31-year period under review has earned a negative return.

Chart 2: DAX in detail: return on investment if you missed the best days on the stock market.

Period: 1988-2018

Note: The returns are in Euros. Please use Google Translator to translate German in the charts. “Tage” in German means Days.

Source: Sutor Bank

Hap Tip: Tim Schaefer

The main takeaway is to have patience and remain calm during market declines. Simply selling our at market bottoms to get back in later won’t work. This is true in any equity market. The dramatic decline in March this year is a classic example.

Related ETF:

- iShares MSCI Germany ETF (EWG)

Disclosure: No Positions