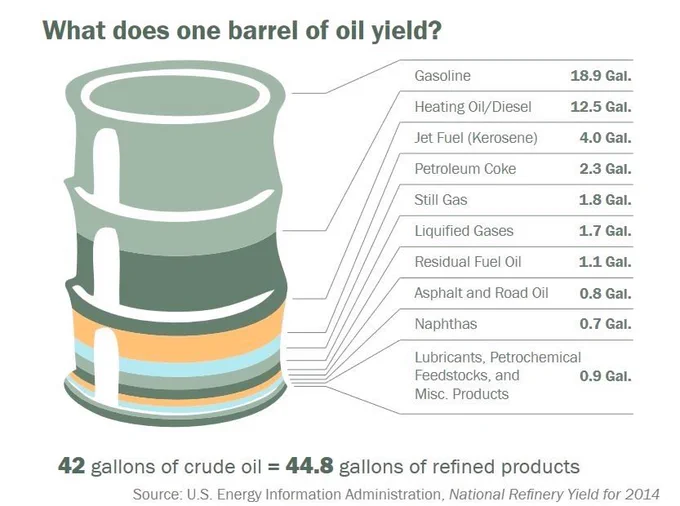

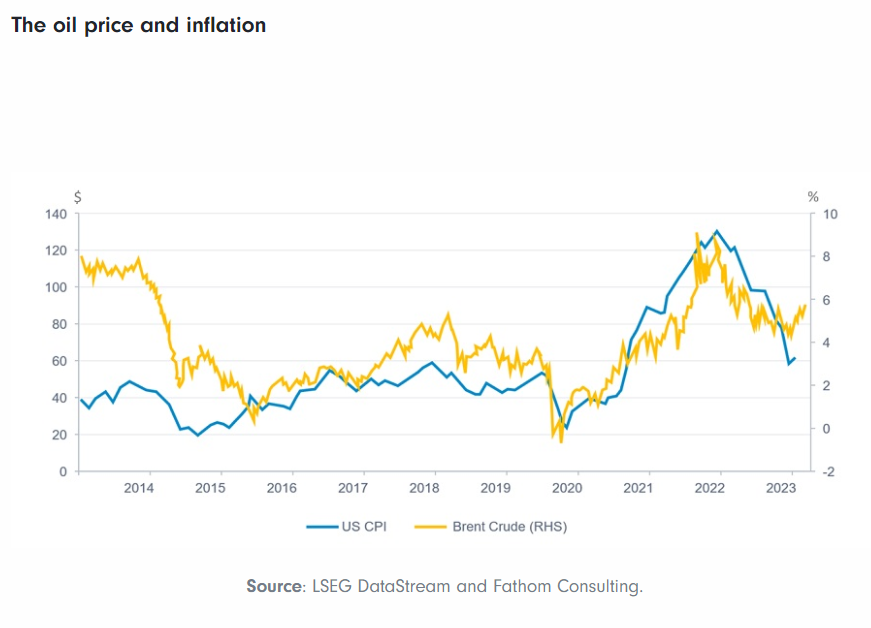

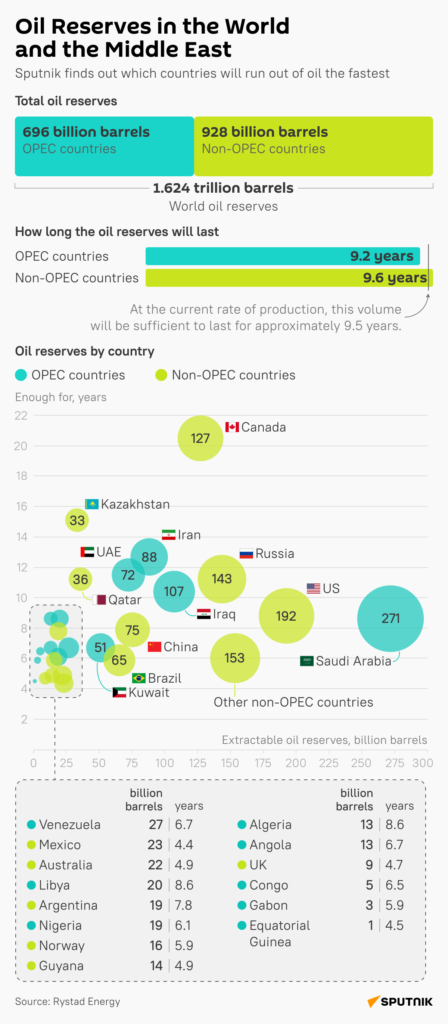

Oil prices have fallen from over $68 per barrel earlier in January to around $43 now as measured by Brent Crude. In April when Coronavirus lockdowns were imposed in most countries price plunged to around $20 a barrel. Though prices have recovered as economies have slowly opened up, it is still a far cry from over $68. Not to mention demand may decline again as new restrictions are imposed again in Europe. The US may not be far behind either since the US was lagging Europe by a few months from the start of the pandemic. Travel restrictions not only curtail gasoline usage but also other derivatives of oil such as jet fuel for example.

As oil prices declined so do the stock prices of oil producers. Many of the foreign oil company stocks have seen declines ranging from 38% to 71%. With prices so low, some investors especially contrarian investors may see a bargain. I have been keeping an eye on this industry as well since March. On Friday, John Stepek at MoneyWeek published an interesting article on this very topic. From the article:

The oil sector is staggeringly cheap

Louis-Vincent Gave at research group Gavekal has just put out a piece on oil prices. As ever with Gave, it’s extremely interesting. His core point – one we’ll return to in the future – is that oil, the US dollar, and US government debt have all been trading in a tight range since March. Those are all really important prices. If they start to trend properly in one direction or another, then we’ll have a very different investment environment on our hands.

But in this piece he focuses on oil. He looks at both the bearish and the bullish case, but I really just wanted to highlight some of the incredible statistics that are in his piece. He points out that energy stocks are now the smallest sector in the MSCI World index, with a weighting of just 2.48%. That compares to Apple, with a weighting of 4.46%. In other words, Apple by itself is almost twice as significant as the entire listed energy complex.

OK, Apple is the virtual, shiny, ultra-hygienic future into which we are being propelled, while oil is the real-world, gritty, dirty present day that we are apparently leaving behind. But we don’t all run on batteries yet, and even in lockdown some of us need to get from A to B and sometimes even to C. And the latter requires cars and occasionally planes.

So does that disparity in valuation make sense on the fundamentals? Or is it being driven more by an environment that puts little value on the present relative to the future, because of ultra-low interest rates? Is it all part of the “long duration” bubble? I’m guessing it’s the latter.

Meanwhile, for the first time ever, says Gave, “the broad energy industry is trading at below book value.” In other words, companies are trading for less than the value of the assets on their balance sheets.

That’s fascinating and it’s genuinely unprecedented. It’s also only happened this year. For roughly the decade after the financial crisis, the MSCI World energy index traded at around 1.5 to two times book value. Prior to that it was a lot higher – from 1996 to the financial crisis the low was about two and the high above 3.5.

Source: Oil shares have never been this cheap – but will they just get even cheaper? by John Stepek, MoneyWeek

The table below shows the year-to-date price returns of major foreign oil companies trading on the US exchanges:

| S.No. | Company Name | Ticker | Stock Price (as of Oct 16, 2020) | Year-to-date Change(%) | Country |

|---|---|---|---|---|---|

| 1 | Equinor | EQNR | $14.17 | -28.83% | Norway |

| 2 | Transportadora de Gas del Sur | TGS | $4.75 | -33.75% | Argentina |

| 3 | China Petroleum & Chemical | SNP | $38.83 | -35.44% | China |

| 4 | TOTAL | TOT | $33.00 | -40.33% | France |

| 5 | PetroChina | PTR | $28.32 | -43.73% | China |

| 6 | China National Offshore Oil-CNOOC | CEO | $93.57 | -43.86% | China |

| 7 | Eni | E | $15.21 | -50.87% | Italy |

| 8 | Ecopetrol | EC | $9.66 | -51.60% | Colombia |

| 9 | Petroleo Brasileiro-Petrobras | PBR | $6.85 | -54.09% | Brazil |

| 10 | BP | BP | $16.25 | -56.94% | United Kingdom |

| 11 | Royal Dutch Shell - A Shares | RDS.A | $25.27 | -57.15% | United Kingdom |

| 12 | Royal Dutch Shell - B Shares | RDS.B | $24.29 | -59.50% | United Kingdom |

| 13 | YPF | YPF | $3.56 | -69.26% | Argentina |

| 14 | Sasol | SSL | $6.25 | -71.08% | South Africa |

| 15 | Vista Oil & Gas | VIST | $2.25 | -71.34% | Argentina |

Source: BNY Mellon

Norwegian oil major Equinor (EQNR), formerly known as Statoil, has held up well relative to others. Though the three Chinese oil giants have lost over 40%, the Chinese economy is growing strongly and hence the oil stocks may outperform others. Global investors punished Shell and BP a few months ago when they slashed dividend payments.

While predicting the future price of oil or the demand is a futile exercise, wise investors can nibble at these record low stock prices.

You many also want to checkout Oil stocks: share prices in this hated sector are back at their Covid-19 lows – time to buy? by John as well.

Disclosure: Long EC