One of the main reasons to invest in foreign stocks is for portfolio diversification. In the past, the correlation U.S. markets and foreign markets were very low which lead to foreign stocks going higher when US stocks went down and vice versa. However in recent decades the benefits due to international diversification are declining.

According to a research study by Vanguard, one reason for the decline in benefits is that individual markets across the world have become more synchronized with the US markets. Accordingly correlations between countries have increased significantly from 0.35 in 1980s to 0.75 as of 2010. Hence investors who invest in non-US stocks for diversification are unable to escape losses when U.S. stocks decline.

This theory is evident in the current performance of global equity markets. For example, the S&P 500 is off 6.4%% YTD. Similarly other developed markets and emerging markets are also down in tandem as shown in the returns of a few sample indices:

- France – CAC 40: -18.8%

- UK – FTSE 100 : -13.1%

- Germany – DAX: -19.9%

- Brazil – Bovespa: -23.0%

- China – Shanghai Composite: -7.0%

- India – Bombay Sensex : -22.7%

- Chile – Santiago IPSA: -16.4%

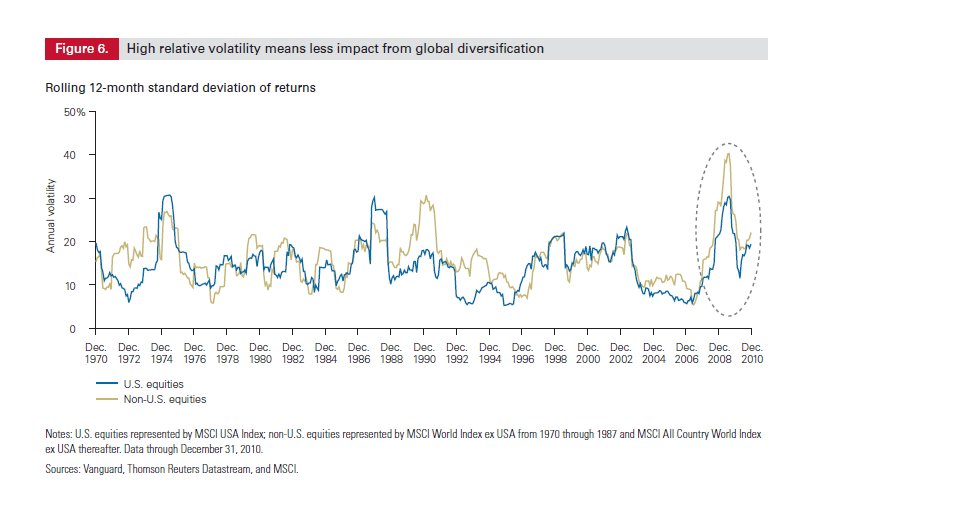

Another reason for the decline in diversification benefits is the spike in volatility in non-US stocks since 2007. The chart below shows the trailing 12-month standard deviation of returns for both U.S. and non-U.S. stocks:

Click to enlarge

Source: Consideration for investing in non-U.S. equities, Vanguard

The spike in volatility has increased the long-term average volatility of non-US markets by one full percentage point from 16.47% to 17.53%.

Hence the higher volatility combined with rising correlation between countries have attriuted to the reduction in international diversification benefits.

Related ETFs:

iShares MSCI Emerging Markets Indx (EEM)

Vanguard Emerging Markets ETF (VWO)

SPDR S&P 500 ETF (SPY)

SPDR STOXX Europe 50 ETF (FEU)

iShares MSCI Brazil Index (EWZ)

iShares FTSE/Xinhua China 25 Index Fund (FXI)

iShares MSCI Germany Index Fund (EWG)

Disclosure: No positions