The MSCI Emerging Markets Index allocates about 25% to the banking sector because this sector forms an significant part of these growing economies. However some investors including professional fund managers tend to avoid banks in the emerging countries for many reasons including their high exposure to the real estate industry, worries about adverse impacts to earnings due to rising interest rates, etc.

UK-based Jonathan Asante of First State Global Emerging Markets Leaders Fund stated the following as the reason for being underweight in emerging markets banking:

“We are suspicious of banks in a number of GEMs because they are generally arms of the government. They are forced to lend to the people in times of crisis. Though that is great news for the people it does not help minority shareholders like ourselves.”

Note: GEM – Global Emerging Markets

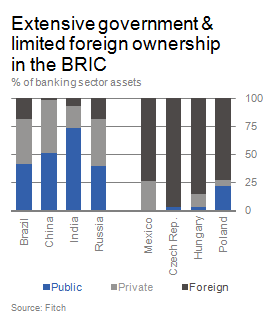

The banking sector is highly controlled by states in the BRIC countries. Accordingly the majority of the banking assets are held by the state-owned banks as shown in the chart below:

Source: BRIC banking systems after the crisis, Deutsche Bank Research

About 75% of banking sector assets in India is under the state control. China’s public-sector banking ownership is just over 50%. In Brazil and Russia also a high portion of this sector remains under state control. In all these countries, the government considers banking as a strategic industry and hence plays an active role in lending credit to the economy by using state-controlled banks. During the credit crunch of 2008-09, public-sector banks in BRIC increased lending and helped maintain the stability of the economy. As a result of the high government role in this sector, real credit growth averaged almost 25% in China in 2009-10, while public-sector banks in Brazil doubled lending from 10% of GDP in 2008 to 20% of GDP in 2010.

According to Markus Jaeger, author of the DB Report, state-led economic development including lending by state-controlled banks is appropriate during the early “catch-up” phase of economic growth “when per-capita income is low and growth is significantly driven by large-scale investment in physical infrastructure and the introduction of “off-the-shelf” technologies.” However as per-capita income rises, private-sector banking and market-based credit allocation will lead to superior economic growth. As all the BRIC countries are still in the “catch-up” phase, large public-sector ownership of the banking sector is not highly negative.

Private-sector banks in BRIC countries are also performing extremely well despite exponential growth in assets in the past few years. Unlike banks of the developed world, private-sector banks in BRIC have recovered strongly from the credit crisis and their balance-sheets are in a much healthier position. One reason for their success is that most of these banks follow traditional lending practices and maintain strict discipline in reducing risks.

Hence investors should not avoid bank stocks in BRIC. Instead they can add them selectively at current or lower prices.

Some of the banking stocks from Brazil, Russia, China and India are listed below with their current yields:

1.Bank: Banco Santander Brasil SA (BSBR)

Current Dividend Yield: 4.34%

Country: Brazil

2.Bank: Banco do Brasil SA (OTC:BDORY)

Current Dividend Yield: 6.12%

Country: Brazil

3.Bank: Itau Unibanco Holding SA (ITUB)

Current Dividend Yield: 2.17%

Country: Brazil

4.Bank: Bank of China Ltd (OTC:BACHY)

Current Dividend Yield: 4.68%

Country: China

5.Bank: China Construction Bank Corp (OTC:CICHY)

Current Dividend Yield: 4.07%

Country: China

6.Bank: ICICI Bank Ltd (IBN)

Current Dividend Yield: 1.33%

Country: India

7.Bank: HDFC Bank Ltd (HDB)

Current Dividend Yield: 0.64%

Country: India

Disclosure: Long BBD, ITUB