The Global Financial Crisis (GFC) of 2008 wiped out millions of jobs worldwide. In the U.S., the ground zero for the crisis, companies laid off hundreds of thousands of workers. While the media, politicians, regulators, company executives and others hyped that the economy recovered in 2009, in recent weeks doubts have been raised if there was a recovery at all.

The U.S. economy entered a recession from December 2007 thru June 2009, according to National Bureau of Economic Research (NBER). The recession that lasted for 18 months was the longest since World War II. In addition to severe decline in private sector jobs, wages fell and duration of unemployment remained long as competition became intense for any job that was available.

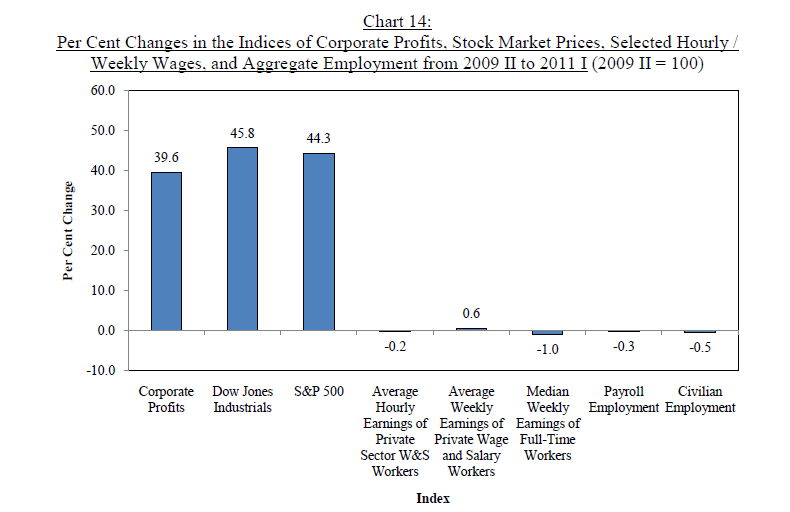

As of June this year, the official unemployment rate stood at 9.2% and the number of unemployed persons continued to remain high at 14.1 million. Unofficial figures are much higher. Meanwhile U.S. corporations hold over $1 Trillion of cash overseas and corporate profits have been increasing consistently since the second quarter of 2009. Corporate profits rose from $1,203 billion in 2Q, 2009 to $1,667 billion in 4Q, 2010. So in the first seven quarters of this “recovery” profits at U.S. companies surged by about $465 billion. Accordingly the Dow Jones Industrial Average rose from 8,447 at the end of 2Q, 2009 to 12,319 at the close of 1Q, 2011 for an increase of 46%. Similarly the S&P 500 gained 44% in the same period.

While corporate profits and stock markets have soared, growth in wages and jobs have been virtually non-existent as shown in the horrendous chart below:

Click to enlarge

Source:

The “Jobless and Wageless” Recovery from the Great Recession of 2007-2009: The Magnitude and Sources of Economic Growth Through 2011 I and Their Impacts on Workers, Profits, and Stock Values

by Andrew Sum, Ishwar Khatiwada, Joseph McLaughlin and Sheila Palma

Center for Labor Market Studies, Northeastern University, Boston, Massachusetts

Some key takeaways from the research report:

- “The absence of any positive share of national income growth due to wages and salaries received by American workers during the current economic recovery is historically unprecedented.

- Pre-tax corporate profits by themselves had increased by $464 billion while aggregate real wages and salaries rose by only $7 billion or only .1%.

- To date, through the first quarter of 2011, the nation’s recovery from the 2007-2009 recession is both a jobless and a wageless recovery.”

So in summary there is no real economic recovery – meaning no growth in jobs, wages, consumption, etc. Instead we have had a tremendous recovery in equity markets and corporate profits which only benefit the wealthy and elite of this nation. The rest of the public faces a long and uncertain future unless some bold and sensible policy changes occur which seems unlikely under the “Change We Can Believe In” Obama administration.