The tiny city state of Singapore is one of the best run countries in the world. Singapore is the world’s top saving country.Both the government and citizens take pride in responsibility and act accordingly. One of the areas that other countries can emulate from Singapore is saving for retirement.Unlike other developed countries including those in Europe and North America, the state acts in the best interests of the country and its citizens. For example, while the west focuses on the trivial issues like the ban on bubble gums it fails to pay attention to important policies such as saving for retirement. According to a recent article at U.S. Global Investors Singapore is a masterclass in fiscal responsibility. From the article by Frank Holmes at U.S. Global Investors:

Brown’s idea is incredibly similar to what Singapore already does, starting with the Central Provident Fund (CPF)—a sort of Social Security-401(k) hybrid that all Singaporeans are required to participate in. The CPF not only provides participants with retirement earnings but can also be withdrawn before retirement for specific housing and medical expenses. Both employees and employers are responsible for making contributions—20 percent of income on average for the former, 17 percent for the later—which are then invested to earn about 5 percent annually.

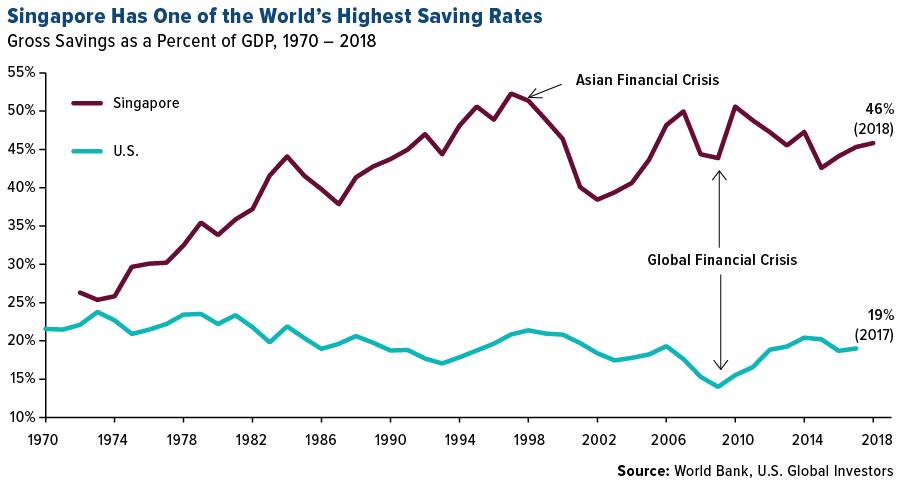

The CPF program, launched in the mid-1950s, is often cited for helping residents of the Asian city-state become among the world’s most fiscally responsible. Compared to people in most other developed countries, Singaporeans save a much larger portion of their earnings as a percent of GDP.

A recent study, in fact, found that six in 10 Singapore millennials—those aged 25 to 34—currently save over 20 percent of their salary. Most are not just adequately prepared for retirement, but they’re even more prepared for retirement than their middle-aged counterparts, according to the study.

Again, Singapore has managed to do this without levying huge taxes to support entitlements.

Personal income is taxed progressively between 2 percent and 22 percent, and because there’s no capital gains tax, dividends paid by Singapore-resident companies are completely tax-free.

Corporations pay a reasonable 17 percent on average, and there’s no payroll tax.

What this means is that Singapore’s tax revenue as a percent of gross domestic product (GDP) stands at only 14.1 percent, about two and a half times lower than the OECD average of 34.2 percent.

Some might initially think that lower taxes would result in a lower standard of living, with crumbling infrastructure and services, and yet Singapore’s infrastructure is regularly regarded as the best in the world, with the World Economic Forum (WEF) ranking it first in quality of roads, railroad density and efficiency of air transport and seaport services. The city-state came in first overall in the WEF’s Global Competitiveness Report 2019, followed by the U.S. Hong Kong, the Netherlands and Switzerland rounded out the top five.

Source: Expecting a Market Downturn? Make Sure You’re Following the “Noah Rule”, U.S. Global Investors

Though Singapore is also a developed country on par with developed Europe and the US, the high saving rate is indeed surprising. In addition to state policies that encourage savings, cultural and other factors may also be a factor that drive Singaporeans to save a high portion of their household income.

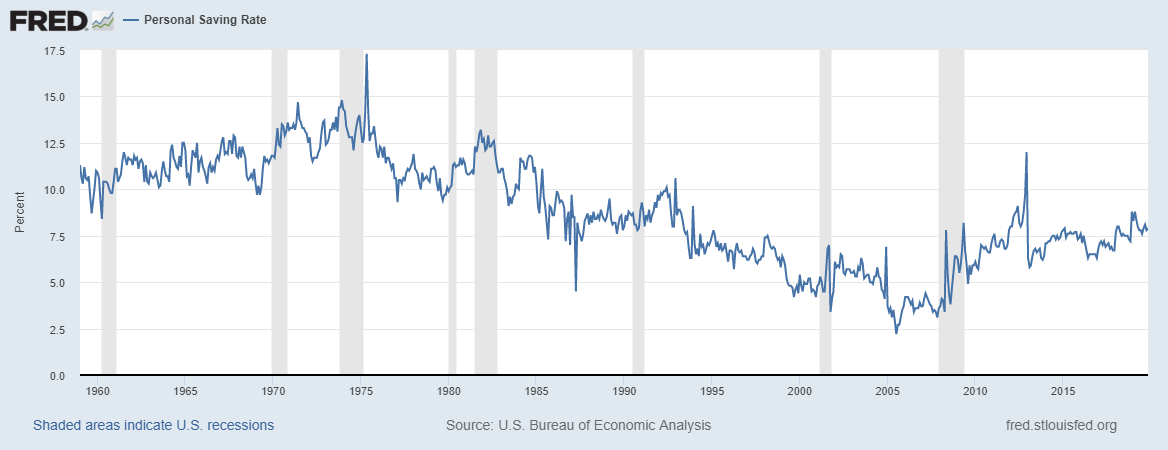

To put things in perspective, the current personal saving rate in the US is just 7.9% of disposable income. The following chart shows the rate since the 1960s:

Click to enlarge

Source: St. Louis Fed