One of the important factors that investors are advised to consider when selecting a country for investment is the economic growth of that country. Generally higher economic growth leads to higher equity market returns. However this is not always the case.I have written many articles on this topic before which can be found here and here and here and here and here.

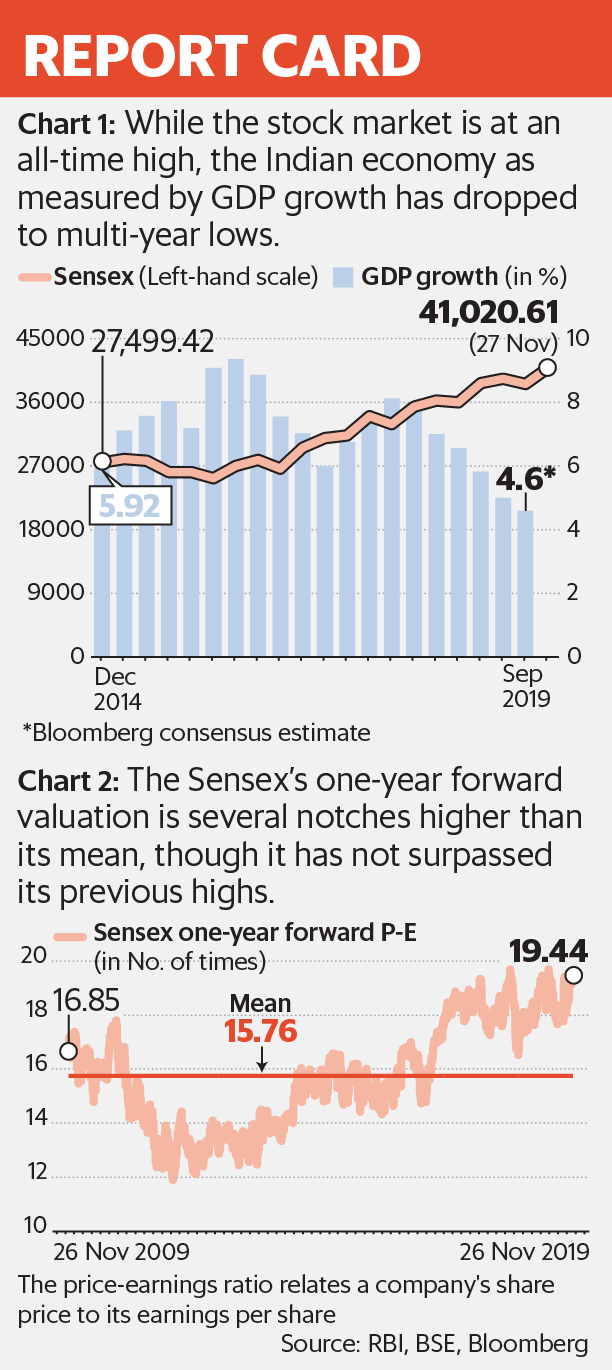

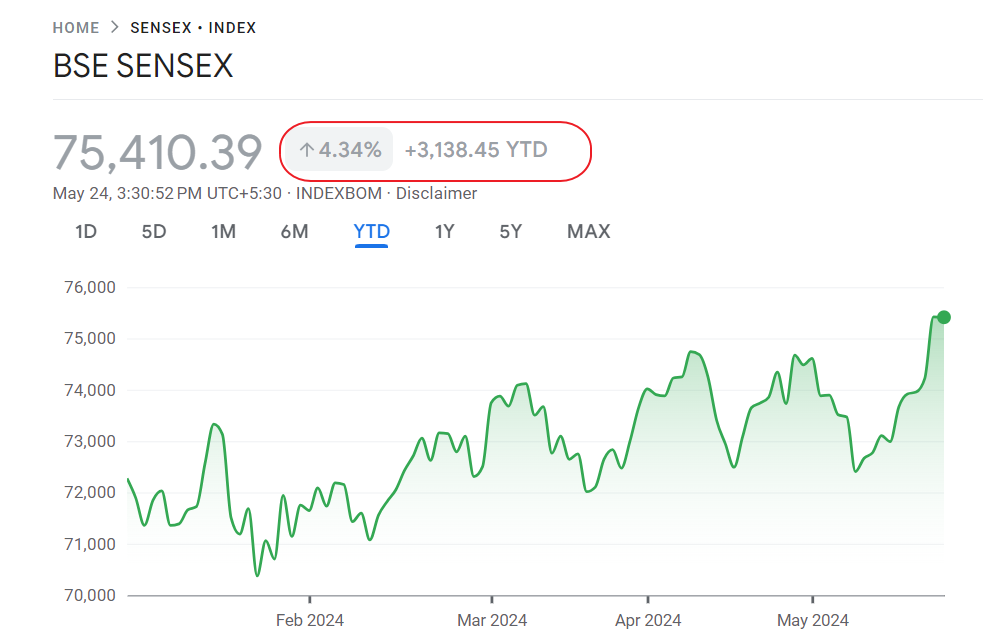

The relationship between equity returns and economic growth is weak especially in the context of emerging markets. Let’s take the example of Indian equity markets. Indian stocks are soaring and the Sensex crossed the 41,000 mark recently. However economic growth has been on the decline for a few quarters. As forecasted, the GDP fell to 4.5% for the quarter ending September today. From a journal article:

NEW DELHI—India’s economy slowed for the sixth quarter in a row during the past period, with gross-domestic-product growth dipping to a six-and-a-half-year low as concerned companies and consumers continued to hold back on spending.

The slowdown—which has been particularly tough on the rural regions where most Indians live—is emerging as the biggest challenge for Prime Minister Narendra Modi, who was voted back into office this year pledging better days.

Gross domestic product in Asia’s third-largest economy slowed to 4.5% growth in the three months ended September, according to government data released Friday. That was down from 5% in the previous quarter and its worst performance since the quarter through March 2013.

While New Delhi has launched multiple measures to boost lending, investment and consumption in recent months, it maintains that the downturn is only temporary.

Source: India’s GDP Growth Slows to More Than 6-Year Low of 4.5%, WSJ

A recent article at Live Mint discussed the reasons for market rising when economy is slowing down. One of the points analyzed in the piece was the disconnect between economic growth and equity market growth. From the article:

Simply put, the markets are up purely on the hope of a better future. And this dissonance between the markets and economic numbers naturally causes confusion in the minds of observers.

It’s another matter that there is nothing on the ground to support the optimism. Jefferies India, for instance, points out that its economic activity index slipped to a 15-year low in September. The broker’s Activity Index is based on 36 indicators including credit growth, automobile sales and electricity demand.

The latest reason for hope is the number of measures the government has taken to bolster the economy. Among other things, the Centre announced a massive cut in corporate tax rate. But analysts worry that the impact of these measures will take a long time to benefit the economy.

“We remain fairly sceptical about any imminent recovery in the Indian economy,” say Kotak’s analysts, citing multiple reasons. The current slowdown is because of structural factors such as low household income and poor job creation. Besides, the government’s finances are stretched and there is hardly any room for it to boost the economy by increasing spends. And while the Reserve Bank of India (RBI) is trying its best to bring interest rates down, the high borrowing needs of the government have kept real interest rates from falling meaningfully.

Source: Why markets are rising in times of slowdown, Live Mint, Nov 28, 2019

As I mentioned in the beginning of the post, the disconnect between equity markets and GDP is not surprising. Markets can continue to rise even economic growth is anemic. This is because stock prices are driven by a multiple of factors including optimism on the future, fundamentals of a firm, foreign portfolio investors, rumors, short-covering and many others. So the key to remember is that investors should not simply assume higher economic growth will lead to higher equity prices and vice versa.