The defense sector has been one of the stable and strongest growing sectors since the 9/11 attacks. Firms in this sector were the biggest beneficiaries of rising defense budgets especially in the US. For example, Lockheed Martin (LMT) is up about 46% year-to-date. Despite excellent performance in the past, a recent journal article cautions investors on this industry. From the WSJ article:

Investors in defense companies have spent years uncorking Champagne bottles because the world couldn’t be going any better for them. But that may be their biggest problem as well.

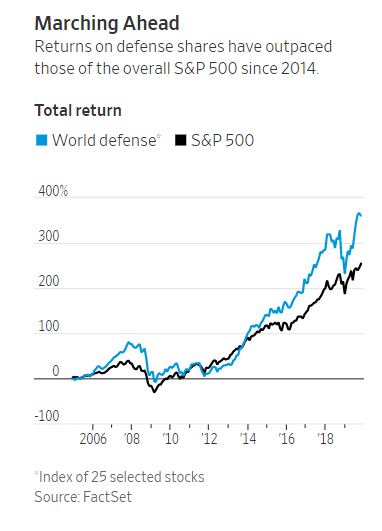

Defense shares have returned 130% since 2014—based on a constructed index of 25 firms—compared with 89% for the S&P 500. This year has been particularly buoyant because investors were eager to buy stocks but also hedge against a slowing economy, so they piled into “safe” income-paying assets.

Military contractors have also ridden the coattails of unprecedented Congressional defense spending, which has pushed net-profit margins to records. This is part of a broad effort to retire the last Cold War defense technology in favor of a new generation of weapons such as hypersonics—an area where China and Russia are racing ahead.

The deck appears stacked in their favor: U.S. military spending is set to rise for a fifth consecutive year to a near-record $738 billion, the number of bidders for government contracts keeps shrinking, and geopolitical tensions are mounting—including escalating tension with North Korea over the country’s nuclear program and with Iran over alleged attacks on oil tankers.

Under the surface of all these astronomical numbers, however, there may be too many assumptions baked in by investors.

Political spats involving defense are escalating ahead of next year’s presidential election. Some voices within the Democratic Party argue for military spending to be slashed, including presidential candidate Sen. Elizabeth Warren. While most Democratic lawmakers don’t plan to follow, it is now likely that Congress won’t agree on a full defense bill before year-end for the first time in 58 years amid controversy over such projects as Mr. Trump’s border wall and new nuclear weapons.

Source: How Long Can the Defense Party Last?, WSJ, Nov 9-10, 2019

The Top 10 Defense Companies in the world for 2019 are shown in the graphic below:

Click to enlarge

Source: Defense News

Some of the major US-based defense firms are:

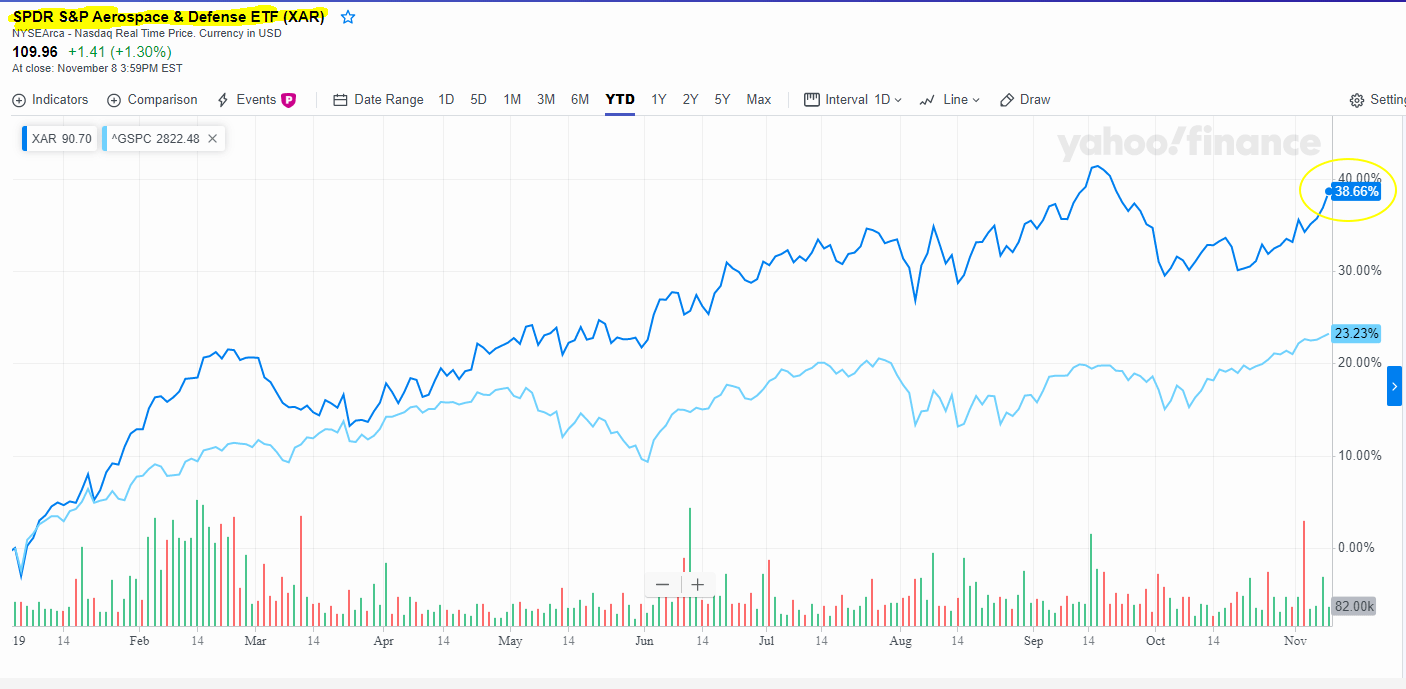

The SPDR S&P Aerospace & Defense ETF (XAR) has soared 39% compared to S&P 500’s return of 23% year-to-date:

Source: Yahoo Finance

Takeaway:

Investors looking to add defense stocks may want to wait for pullbacks. Even if you have to deploy some cash soon it is wise to add in a phased manner.

Related:

- Why Invest in European Aerospace & Defense Stocks, TFS

- 11 Defense Numbers to Consider on Veterans Day, Barrons, Nov 11, 2019

Disclosure: No Positions